As previously discussed, no homes are built without prior permits, which are going nowhere: Highlights Housing starts extended their wild ride of volatility in December, up 11.3 percent in the month to a 1.226 million annualized rate which beats the Econoday consensus for 1.200 million. But the rise is confined to multi-unit starts which jumped 57 percent to a 431,000 rate, a contrast to the 4.0 percent decline to 795,000 for single-family starts. Permits, which are subject to less volatility than starts, slipped 0.2 percent in December to a 1.210 million rate which is sizably below expectations for 1.230 million. Here, however, the details favor single-family homes where permits rose 4.7 percent to 817,000 vs a sharp 9.0 percent decline on the multi-unit side to 393,000. Single-family homes, which pack the most cost and price punch, are the focus of the housing market and today’s results are mixed, with permits a positive but starts a tangible negative. In sum, lack of available supply remains an obstacle to sales acceleration for housing.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As previously discussed, no homes are built without prior permits, which are going nowhere:

Highlights

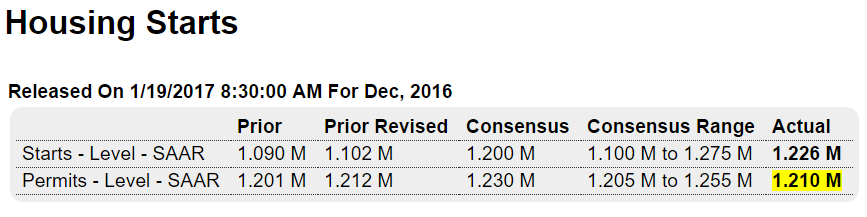

Housing starts extended their wild ride of volatility in December, up 11.3 percent in the month to a 1.226 million annualized rate which beats the Econoday consensus for 1.200 million. But the rise is confined to multi-unit starts which jumped 57 percent to a 431,000 rate, a contrast to the 4.0 percent decline to 795,000 for single-family starts.

Permits, which are subject to less volatility than starts, slipped 0.2 percent in December to a 1.210 million rate which is sizably below expectations for 1.230 million. Here, however, the details favor single-family homes where permits rose 4.7 percent to 817,000 vs a sharp 9.0 percent decline on the multi-unit side to 393,000.

Single-family homes, which pack the most cost and price punch, are the focus of the housing market and today’s results are mixed, with permits a positive but starts a tangible negative. In sum, lack of available supply remains an obstacle to sales acceleration for housing.

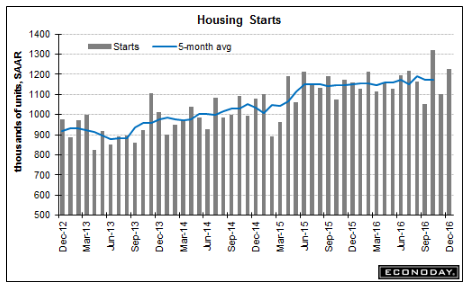

Note how flat the 5 month moving average is:

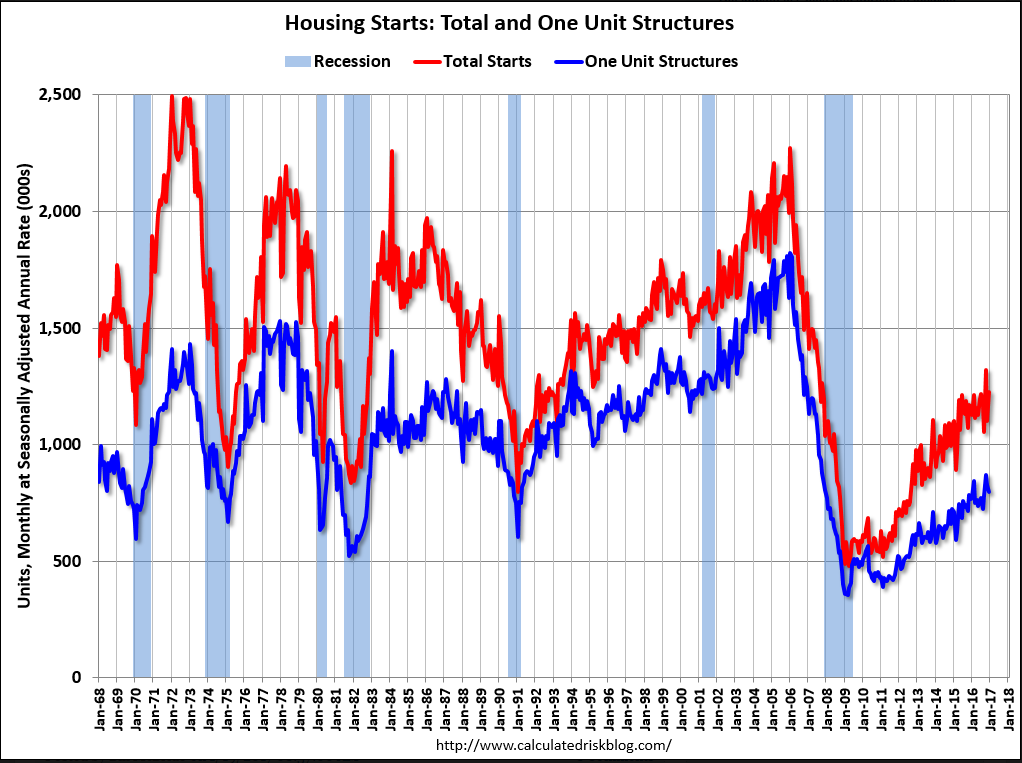

Housing remains a far lower portion of the economy than it was in past cycles, isn’t growing, and not likely to contribute to growth:

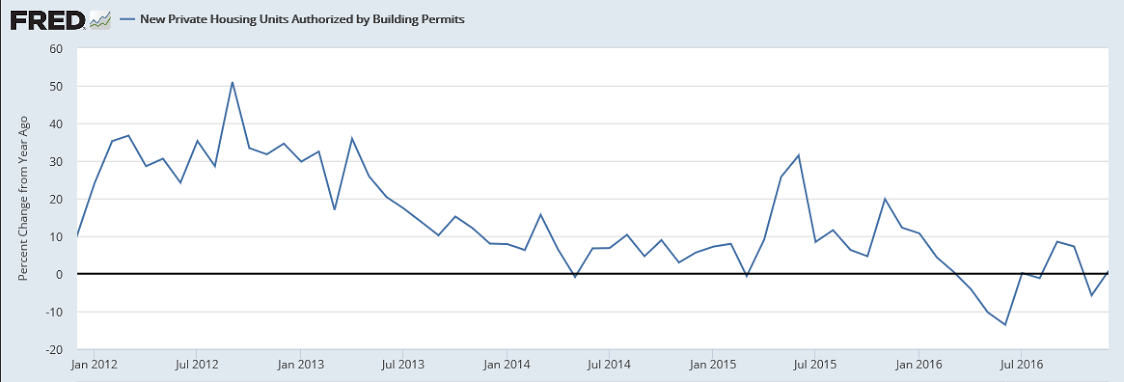

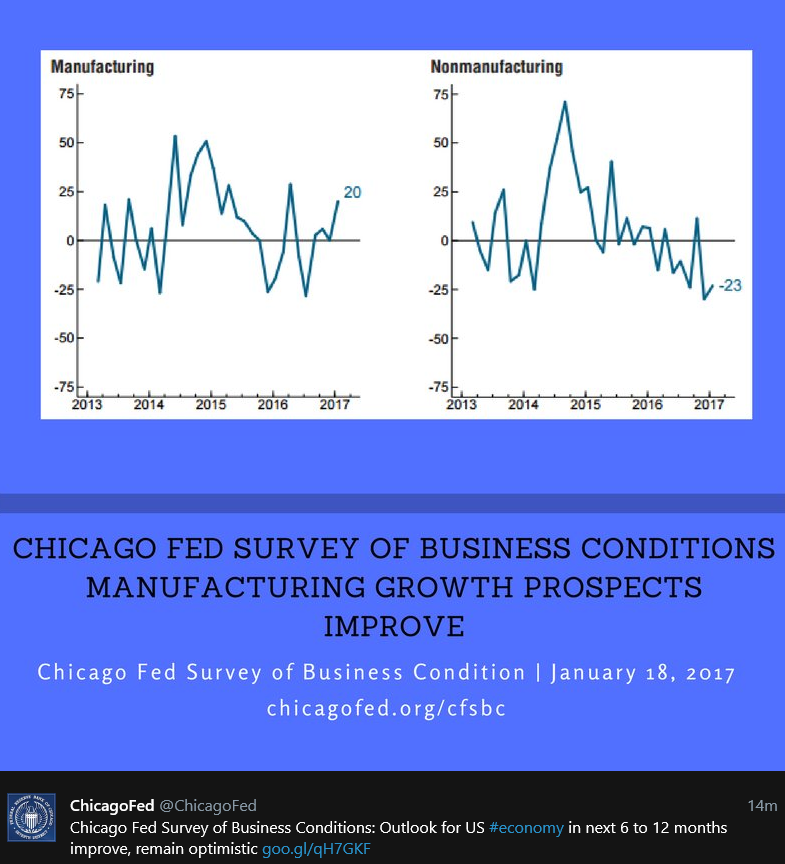

As previously discussed, the weakness that began a couple of years ago with the collapse in oil prices and capex has bled over into the much larger service sector:

This is highly deflationary stuff, even with matching tax cuts, as the tax cuts under discussion have much lower multiples:

Trump Team Seeking Deep Spending Cuts: The Hill

By Derek Wallbank

(Bloomberg) — President-elect Donald Trump’s team working blueprint would cut U.S. federal spending by $10.5t over 10 years, The Hill reports.

Plan similar to Heritage Foundation’s spending outline from last year, which also sought $10.5t in spending cuts; would be steeper than Republican Study Cmte’s FY2017 budget, which sought $8.6t in reductions over 10 yrs: The Hill The Hill reports Russ Vought and John Gray leading effort Trump team may release 175-200 page document with summary tables within 45 days and full budget by end of April