No surprise here, after seeing what mortgage lending has been doing: Highlights A topping out from lower-than-indicated expansion highs is the news from the April housing starts report where levels, though still healthy, are disappointing. Starts fell 2.6 percent to a 1.172 million annualized rate that is well below Econoday’s low estimate for 1.215 million. Downward revisions are a factor in the report, totaling 27,000 in the prior two months. The strength in the report is in the key single-family component with starts up 0.4 percent to a rate of 835,000. Otherwise, however, the report is filled with minus signs. Permits for single-family homes fell 4.5 percent to a 789,000 rate with completions also down 4.5 percent, to 784,000. The sharpest weakness comes from

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

No surprise here, after seeing what mortgage lending has been doing:

Highlights

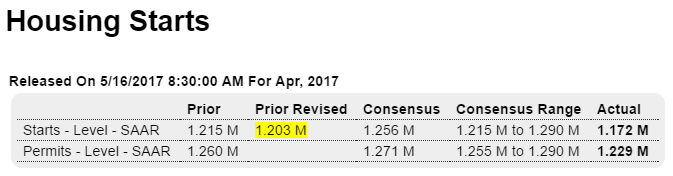

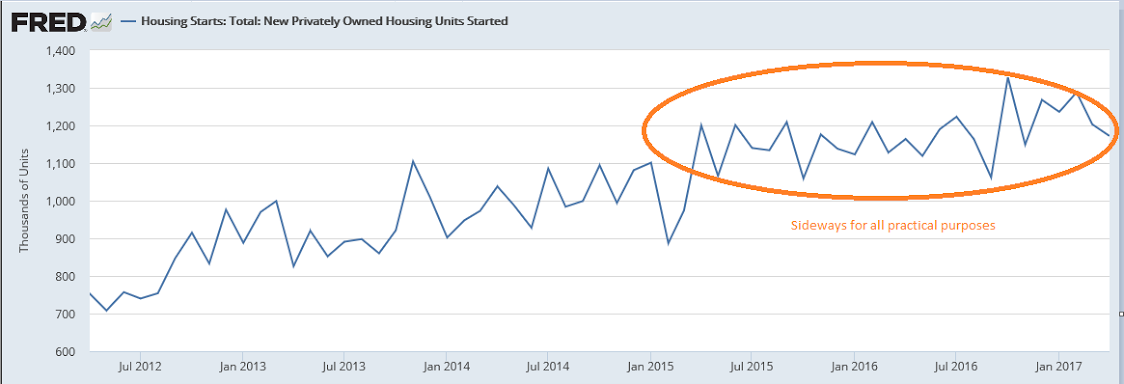

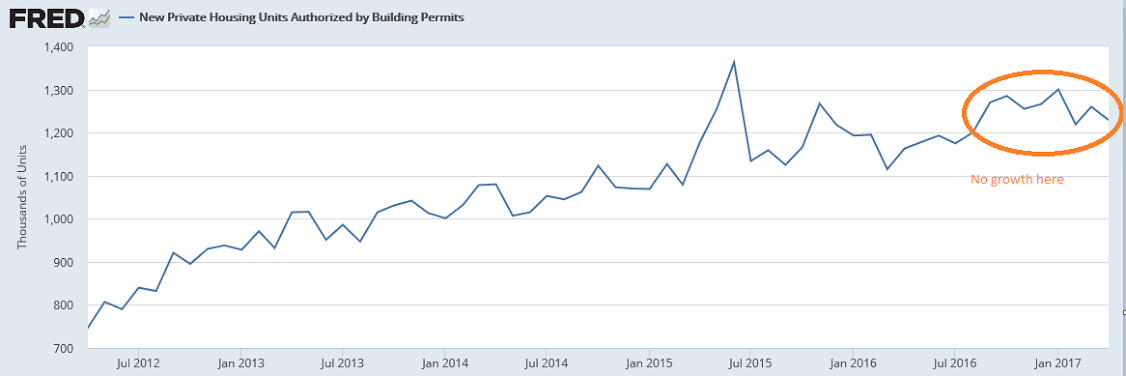

A topping out from lower-than-indicated expansion highs is the news from the April housing starts report where levels, though still healthy, are disappointing. Starts fell 2.6 percent to a 1.172 million annualized rate that is well below Econoday’s low estimate for 1.215 million. Downward revisions are a factor in the report, totaling 27,000 in the prior two months.

The strength in the report is in the key single-family component with starts up 0.4 percent to a rate of 835,000. Otherwise, however, the report is filled with minus signs. Permits for single-family homes fell 4.5 percent to a 789,000 rate with completions also down 4.5 percent, to 784,000.

The sharpest weakness comes from multi-family homes where starts fell 9.2 percent to a 337,000 rate. Permits did rise 1.4 percent to 440,000 but completions dropped 17.2 percent to a 322,000 rate.

April was supposed to be a rebound month for the economy. It was for the jobs report but bounces in last week’s retail sales and consumer price reports were minimal with today’s report an outright negative for the second quarter. Still most housing data, especially sales, have been showing significant strength going into the spring sales season.

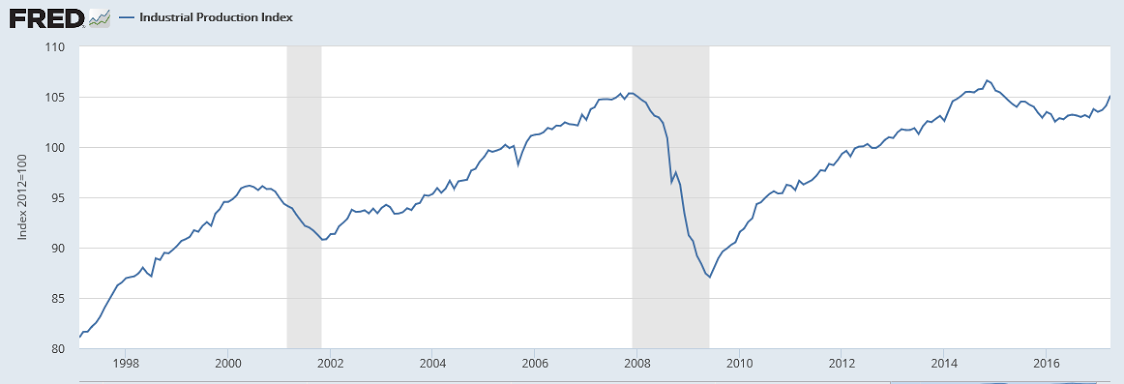

As previously discussed, industrial production is muddling through at modest levels with weakness spreading to the service sector. These numbers are not inflation adjusted, which means industrial production hasn’t even gotten back to the highs of the prior cycle:

Stalled at lows of prior cycle: