Trumped up expectations are fading a bit while ‘hard data’ continues to fade. And note the real disposable personal income chart which continues its deceleration that began when oil capex collapsed: Highlights A second month of weak spending on services pulled down on consumer spending which could only manage a 0.1 percent rise in February, one that follows a nearly as weak 0.2 percent gain in January. February’s result is below consensus and at the low end of the Econoday forecast range. Income data are more favorable headlined by an as-expected 0.4 percent gain and a very solid 0.5 percent increase in the wages & salaries component. And consumers moved money into the bank as the savings rate climbed 2 tenths for a second straight month to 5.6 percent. Increases in savings are a factor behind the weakness in spending. Inflation data are mixed as monthly rates are tame but year-on-year rates, reflecting low prices this time last year, are moving higher. For the first time in nearly 5 years, the PCE price index is over the Federal Reserve’s 2 percent target, up an expected 2 tenths to 2.1 percent. The monthly rate, however, rose only 0.1 percent which if extended into future months would point to easing pressure for the year-on-year as last year’s comparisons become harder. The PCE core rose a tame looking 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

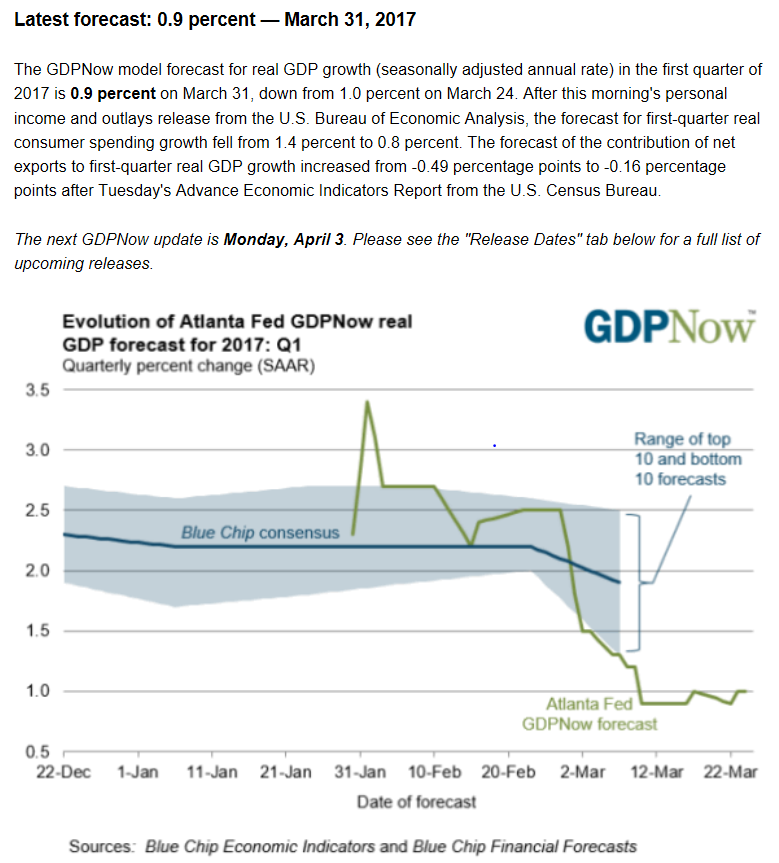

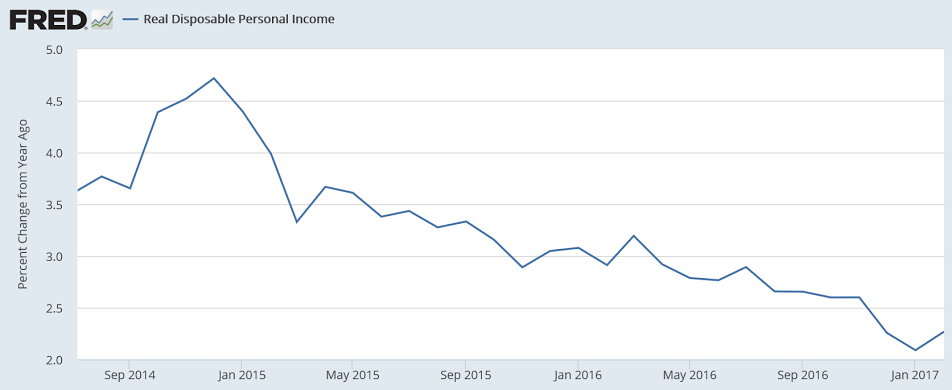

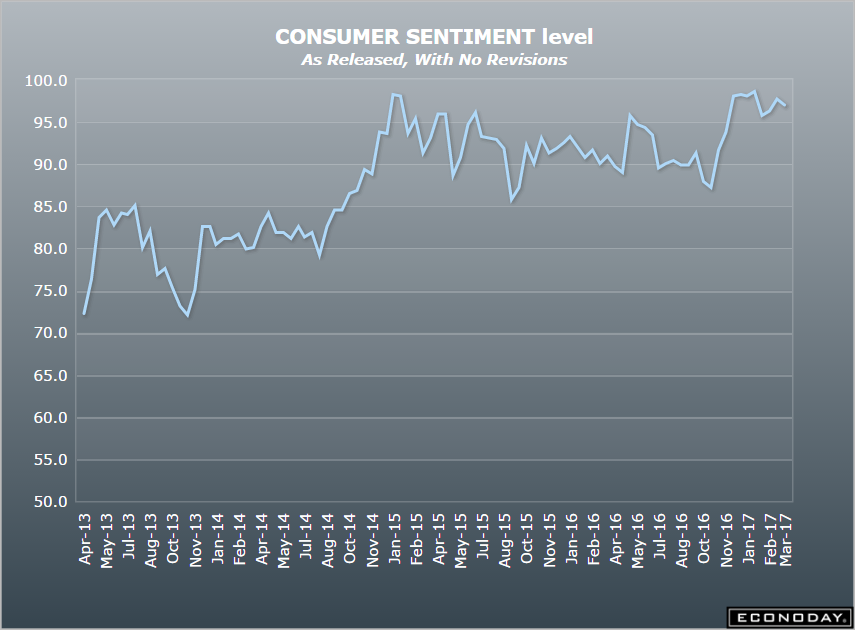

Trumped up expectations are fading a bit while ‘hard data’ continues to fade. And note the real disposable personal income chart which continues its deceleration that began when oil capex collapsed:

Highlights

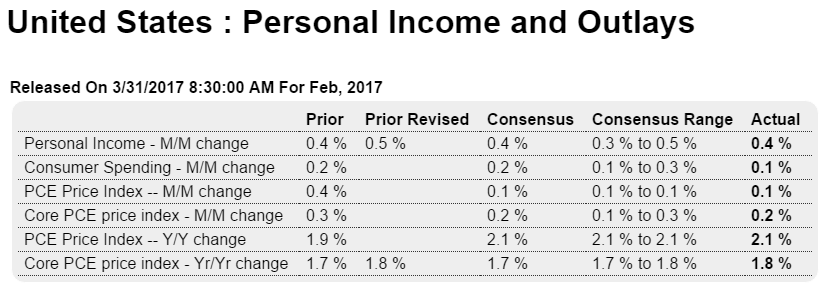

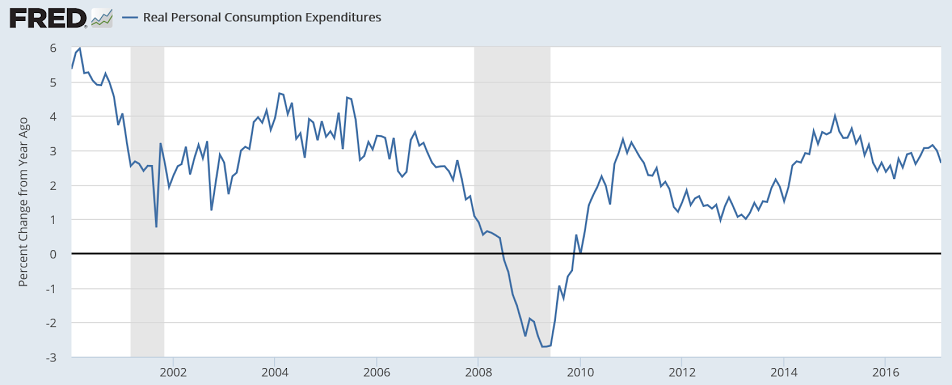

A second month of weak spending on services pulled down on consumer spending which could only manage a 0.1 percent rise in February, one that follows a nearly as weak 0.2 percent gain in January. February’s result is below consensus and at the low end of the Econoday forecast range.

Income data are more favorable headlined by an as-expected 0.4 percent gain and a very solid 0.5 percent increase in the wages & salaries component. And consumers moved money into the bank as the savings rate climbed 2 tenths for a second straight month to 5.6 percent. Increases in savings are a factor behind the weakness in spending.

Inflation data are mixed as monthly rates are tame but year-on-year rates, reflecting low prices this time last year, are moving higher. For the first time in nearly 5 years, the PCE price index is over the Federal Reserve’s 2 percent target, up an expected 2 tenths to 2.1 percent. The monthly rate, however, rose only 0.1 percent which if extended into future months would point to easing pressure for the year-on-year as last year’s comparisons become harder.

The PCE core rose a tame looking 0.2 percent on a monthly basis but here the year-on-year rate is 1 tenth higher at 1.8 percent which is also 1 tenth above Econoday’s consensus. And the rate for January is now revised 1 tenth higher and is also now at 1.8 percent.

The pressure on the core rate is very delicate for the Federal Reserve which does not expect this reading to accelerate, only stabilize quietly just under or just at the 2 percent line. The gain in income in this report hints at wages perhaps adding to inflationary pressures, a possibility that will be tested in the average hourly earnings reading in next week’s employment report.

Along with the risk of less-than-tame inflation is the risk of a less-than-excited consumer who, after a vehicle-buying spree in the fourth quarter, may be cutting back and putting money into the bank. This may be good for consumer health and the long-term outlook, but it won’t help first-quarter GDP which, after today’s report, now looks to be decidedly soft.

The chart hasn’t yet been updated for this latest forecast: