Very modest growth continues from the lows following the crash in oil capex, and note that the numbers are not inflation adjusted: The painfully slow recovery following the crash continues, and note the numbers are not population adjusted: Trumped up expectations fading: Forecasters Lower Growth Outlook as Hopes for Quick Stimulus Fade By Josh Zumbrun Apr 13 (WSJ) — Following the election, respondents to The Wall Street Journal’s monthly survey of forecasters significantly raised their estimates for growth, inflation and interest rates. In December, the average forecast called for 2.3% growth in the first quarter. That had fallen to 1.9% in March and dipped again to 1.4% in this month’s survey. In January, 71% of economists in the Journal’s survey were including significant fiscal policy changes in their forecasts. In April, that number was down to 44%. A majority now say “significant” changes are unlikely, although many said a small fiscal boost remains possible. Slowing loan growth finally making the news: Loan growth stalls despite profit, trading gains at some U.S. banks By David Henry Apr 14 (Reuters) — Big U.S. banks revealed more evidence of a slowdown in loan growth in their earnings reports on Thursday. JPMorgan’s core loan portfolio averaged 2 billion during the first quarter, up 9 percent on an annualized basis.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Very modest growth continues from the lows following the crash in oil capex, and note that the numbers are not inflation adjusted:

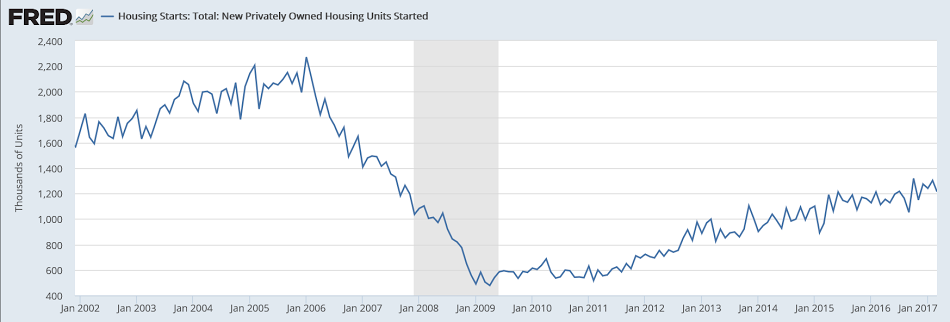

The painfully slow recovery following the crash continues, and note the numbers are not population adjusted:

Trumped up expectations fading:

Forecasters Lower Growth Outlook as Hopes for Quick Stimulus Fade

By Josh Zumbrun

Apr 13 (WSJ) — Following the election, respondents to The Wall Street Journal’s monthly survey of forecasters significantly raised their estimates for growth, inflation and interest rates. In December, the average forecast called for 2.3% growth in the first quarter. That had fallen to 1.9% in March and dipped again to 1.4% in this month’s survey. In January, 71% of economists in the Journal’s survey were including significant fiscal policy changes in their forecasts. In April, that number was down to 44%. A majority now say “significant” changes are unlikely, although many said a small fiscal boost remains possible.

Slowing loan growth finally making the news:

Loan growth stalls despite profit, trading gains at some U.S. banks

By David Henry

Apr 14 (Reuters) — Big U.S. banks revealed more evidence of a slowdown in loan growth in their earnings reports on Thursday. JPMorgan’s core loan portfolio averaged $812 billion during the first quarter, up 9 percent on an annualized basis. But that growth rate has ticked down from 12 percent in the previous quarter and 17 percent a year ago. Wells Fargo’s annual loan growth rate of 4 percent has also been slowing over the past year. Citigroup’s loan book has been skewed by divestitures and its acquisition of a credit-card portfolio. Adjusting for those matters, Citi’s core loan book grew 5 percent in the first quarter.