Still looks to me like it’s already rolled over: Less than expected indicating spending likely to be less than expected as well: Highlights Growth in consumer credit slowed in December, to .2 billion vs an upward revised .2 billion in November. Revolving credit showed less life in December than prior months, rising only .4 billion vs November’s .8 billion. Weakness here helps explain the general weakness in core shopping during December. Nonrevolving credit, reflecting demand for auto loans and especially student loans, rose an intrend .8 billion. When losses start to increase, banks tend to tighten credit: Credit conditions for most business lending unchanged in fourth quarter: Fed (Reuters) Loan officers at U.S. banks reported largely unchanged lending standards and slightly looser terms for business loans in the last three months of 2016, the Federal Reserve reported on Monday in a quarterly survey. About a third of the 69 institutions surveyed, however, said they had “tightened somewhat” the standards for commercial real estate construction and land development loans, and close to a fifth had tightened standards on loans secured by multifamily properties.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Still looks to me like it’s already rolled over:

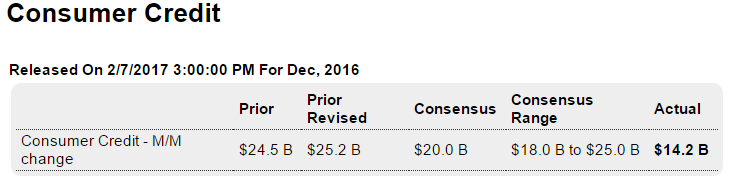

Less than expected indicating spending likely to be less than expected as well:

Highlights

Growth in consumer credit slowed in December, to $14.2 billion vs an upward revised $25.2 billion in November. Revolving credit showed less life in December than prior months, rising only $2.4 billion vs November’s $11.8 billion. Weakness here helps explain the general weakness in core shopping during December. Nonrevolving credit, reflecting demand for auto loans and especially student loans, rose an intrend $11.8 billion.

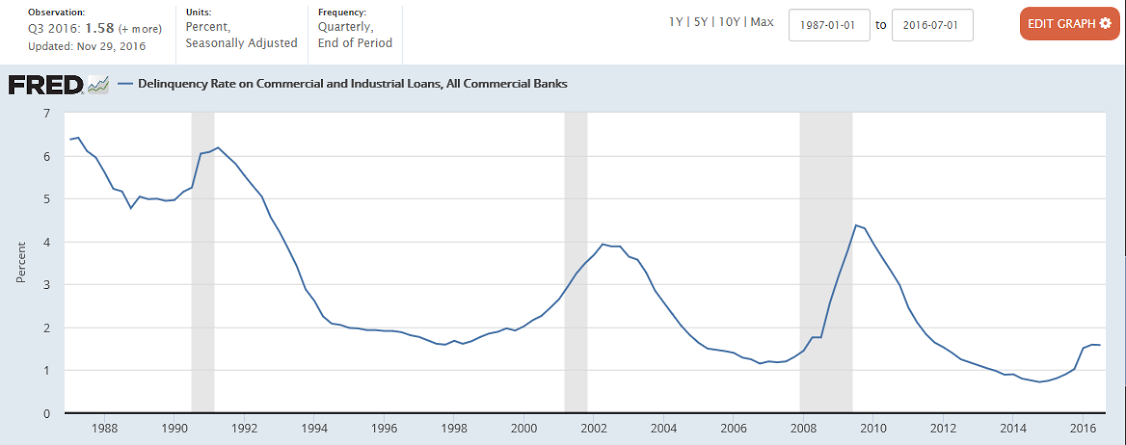

When losses start to increase, banks tend to tighten credit:

Credit conditions for most business lending unchanged in fourth quarter: Fed (Reuters) Loan officers at U.S. banks reported largely unchanged lending standards and slightly looser terms for business loans in the last three months of 2016, the Federal Reserve reported on Monday in a quarterly survey. About a third of the 69 institutions surveyed, however, said they had “tightened somewhat” the standards for commercial real estate construction and land development loans, and close to a fifth had tightened standards on loans secured by multifamily properties.

This was released Nov 29:

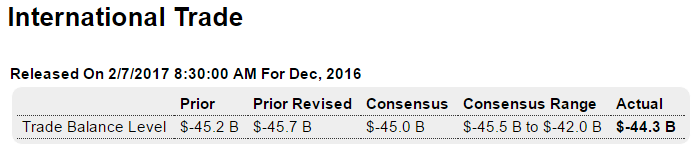

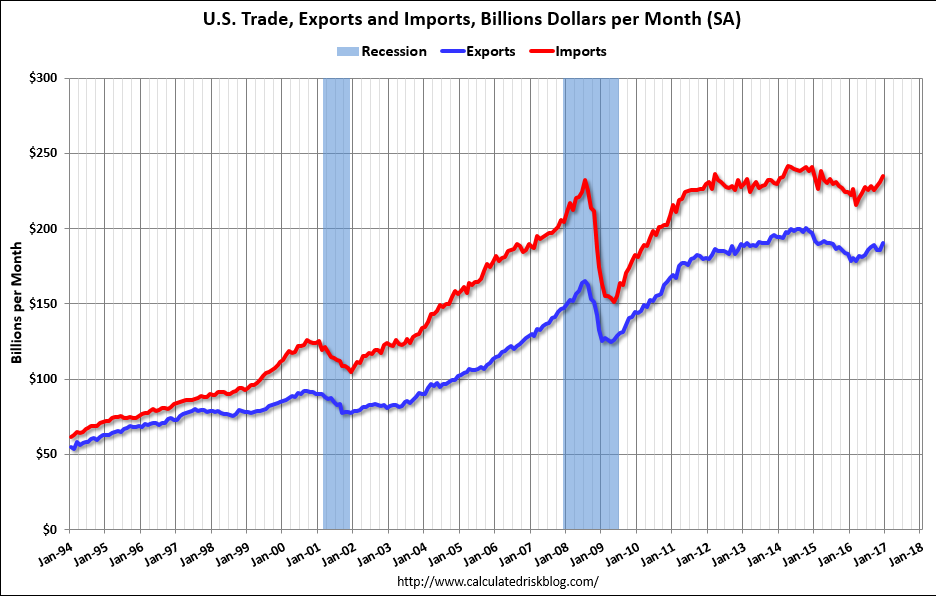

The higher crude oil prices look to be showing up in the next report:

Highlights

Strong exports of capital goods helped limit the nation’s trade deficit in December to a lower-than-expected $44.3 billion vs a revised $45.7 billion in November. Exports, also boosted by strong demand for U.S. services, rose a very solid 2.7 percent to $190.7 billion in the month, strength offset however by a 1.5 percent rise in imports to $235.0 billion that was swollen by heavy imports of vehicles.

Petroleum was not a factor in the December report with the related deficit unchanged from November at $6.1 billion. Details here show a 0.3 percent dip in imports to $14.3 billion in December and a 0.6 percent dip in exports to $8.2 billion. Month-to-month import volumes slipped slightly but were offset by a rise in the average barrel of crude to $41.45 which is the highest since September 2015.

Country data show a narrowing in the monthly gap with China to $27.8 billion from November’s $30.5 billion and a narrowing with Mexico to $4.4 billion from $5.8 billion. For full year 2016, the gap with China totaled $347.0 billion, down from $367.2 billion in 2015, and with Mexico at $63.2 billion vs $60.7 billion in 2015. Gaps in Canada narrowed in December to $2.2 billion for $11.2 billion in 2016 and narrowed to $12.2 billion with the EU for a 2016 total of $146.3 billion.

December exports were the highest since April 2015 though imports were the heaviest since March 2015. Still, the active two-way traffic points to strong cross-border trade and improved global demand.

Seems to be a shift in progress?

Most British voters now approve of May’s approach to Brexit (Reuters) A majority of Britons approve of the government’s approach to leaving the European Union. Prime Minister Theresa May set out her vision for Brexit in a speech in mid-January, outlining plans to leave the EU single market in a clean break with the bloc. The proportion of the public that approve of the government’s preparations for Brexit stood at 53 percent, ORB found, up 15 points from a poll last month when only 38 percent approved, with 62 percent disapproving. The poll also found that 47 percent agreed that May would get the right deal for Britain, with just 29 percent disagreeing.