Interesting charts: Over 50 hedge funds attracting investors who want to go long bitcoin and the rest. Helps explain why the prices are going up even as there is no intrinsic or conversion value whatsoever, which, presuming that to be the case, also means that at some point the mania ends and the price goes all the way back to 0: Hedge funds are cashing in on bitcoin mania — there are now 50 dedicated to cryptocurrencies Digital currencies, such as Bitcoin, are powered by distributed ledger technology and are not controlled by a centralized authority. The market for such currencies has exploded with over 800 coins on the market with a combined marketcap of 6 billion. Autonomous NEXT, a fintech analytics firm, released a list of 55 cryptocurrency hedge funds on

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

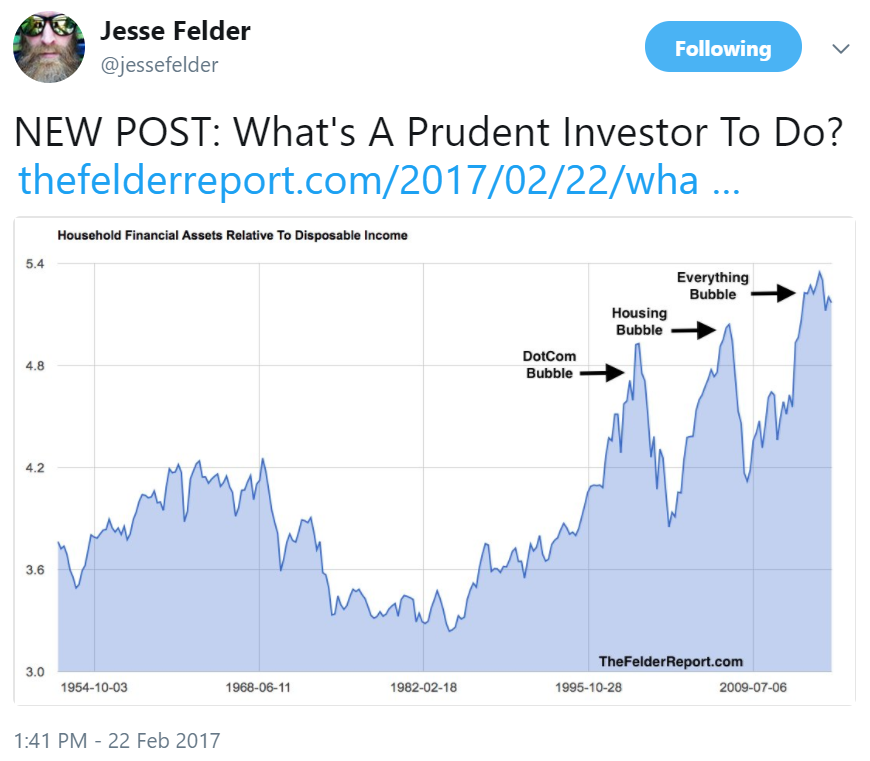

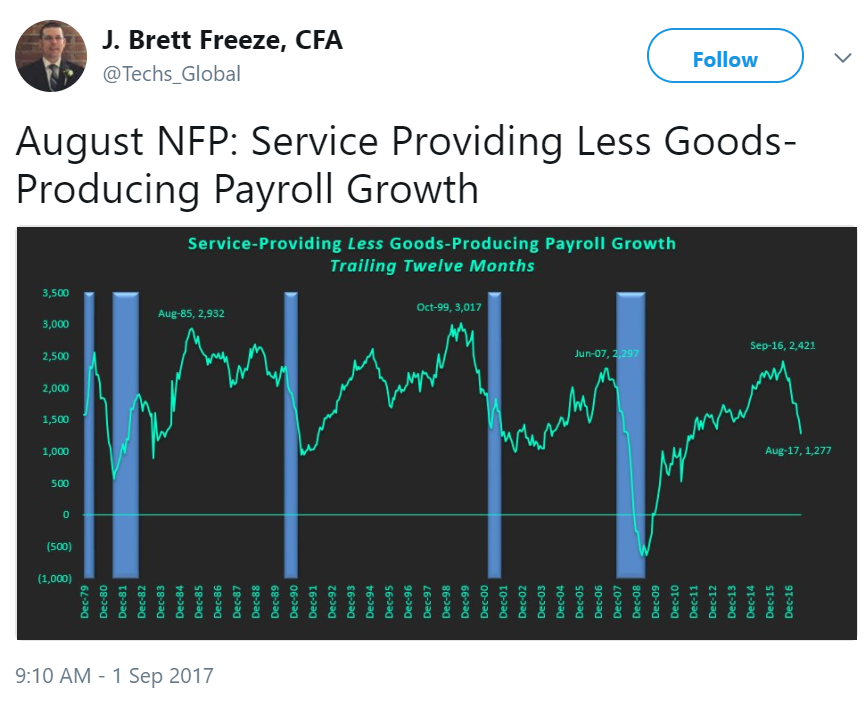

Interesting charts:

Over 50 hedge funds attracting investors who want to go long bitcoin and the rest. Helps explain why the prices are going up even as there is no intrinsic or conversion value whatsoever, which, presuming that to be the case, also means that at some point the mania ends and the price goes all the way back to 0:

Hedge funds are cashing in on bitcoin mania — there are now 50 dedicated to cryptocurrencies

Digital currencies, such as Bitcoin, are powered by distributed ledger technology and are not controlled by a centralized authority. The market for such currencies has exploded with over 800 coins on the market with a combined marketcap of $166 billion.Autonomous NEXT, a fintech analytics firm, released a list of 55 cryptocurrency hedge funds on Tuesday, illustrating the mounting interest in the space.

Protecting their investors…

;)

Bitcoin price drops $200 after new ruling from Chinese regulators

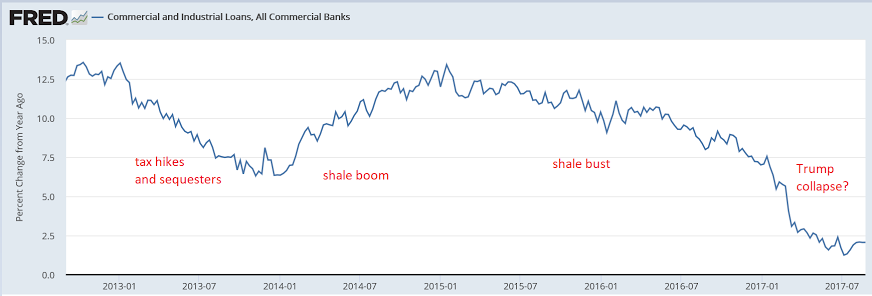

Another interesting chart:

Still no pick up in site: