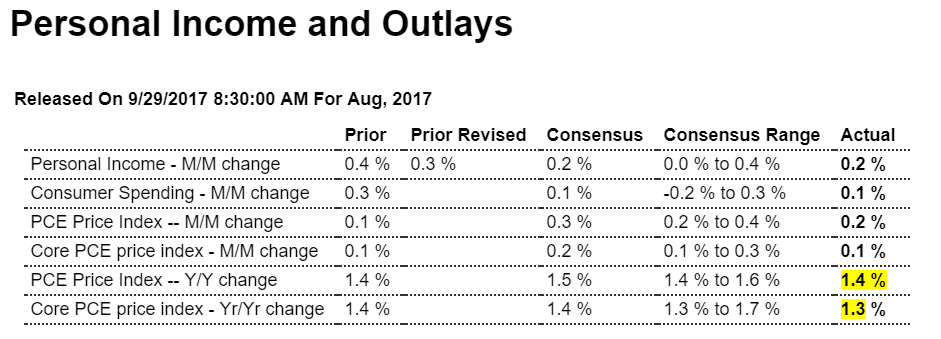

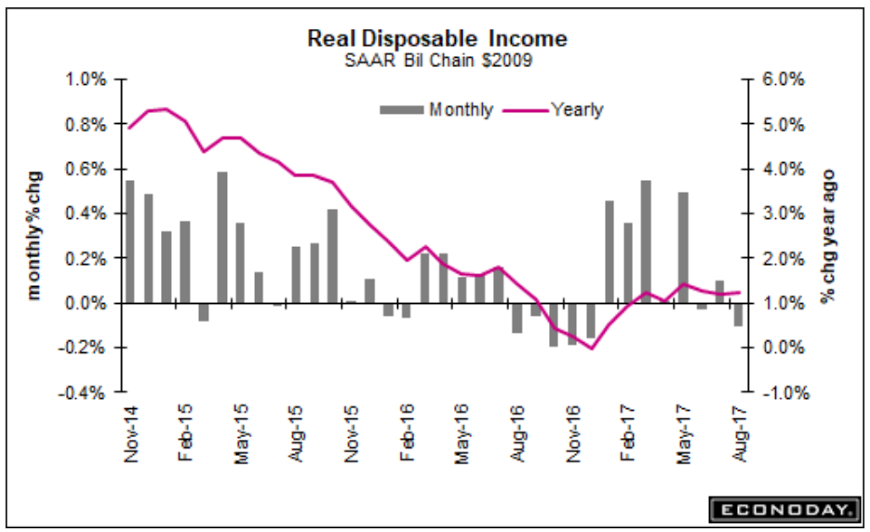

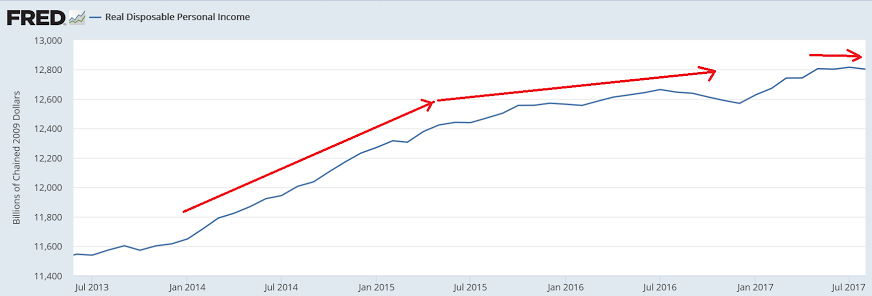

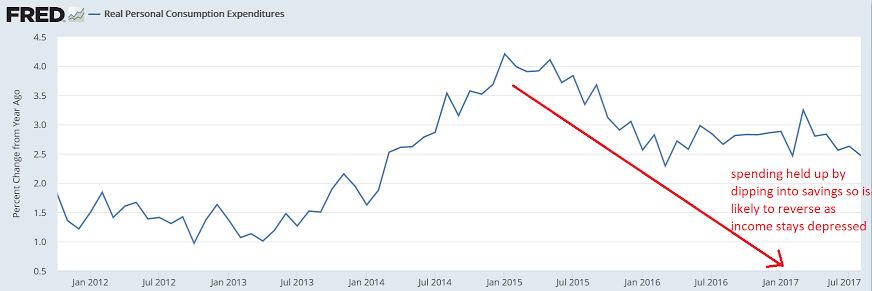

July Personal income revised down to .3 and August only .2 further confirms income growth- the driver of consumption- has slowed down in line with the deceleration in bank lending, and the same seems to be the case with spending, with weak price indicators further confirming the same weak demand narrative. And the very low savings rate tells me there’s a lot more weakness to come: Highlights The next Federal Reserve rate hike may not be in December after all, based on an unexpectedly weak personal income and spending report that includes very soft inflation readings. Income is the best news in the report as it managed the expected 0.2 percent August gain getting boosts from proprietor income, transfer receipts and also rent. Wages and salaries, in part reflecting a

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

July Personal income revised down to .3 and August only .2 further confirms income growth- the driver of consumption- has slowed down in line with the deceleration in bank lending, and the same seems to be the case with spending, with weak price indicators further confirming the same weak demand narrative. And the very low savings rate tells me there’s a lot more weakness to come:

Highlights

The next Federal Reserve rate hike may not be in December after all, based on an unexpectedly weak personal income and spending report that includes very soft inflation readings. Income is the best news in the report as it managed the expected 0.2 percent August gain getting boosts from proprietor income, transfer receipts and also rent. Wages and salaries, in part reflecting a decline in hours, came in unchanged though this follows strong growth in the prior 2 months. Another weakness in today’s report is a 1 tenth downward revision to overall July income which now stands at 0.3 percent. The savings rate held unchanged in August at a moderate 3.6 percent.

Now the bad news starts. Spending came in at only 0.1 percent as spending on durables, the likely result of Hurricane Harvey’s late month hit on Texas and related declines in auto sales, fell a very steep 1.1 percent to fully reverse strength in the prior month. Spending on both nondurables and services actually inched forward in August to 0.3 percent each.

The really bad news comes from inflation readings as the core PCE price index, which is the Federal Reserve’s central inflation gauge, inched only 0.1 percent ahead while the year-on-year rate fell backwards, down 1 tenth to 1.3 percent for the weakest result since November 2015. Overall prices, likely getting a small boost from a Harvey-related spike in gasoline prices, rose 0.2 percent with this yearly rate, however, also moving backwards, down 1 tenth to 1.5 percent. All these inflation readings, interestingly, came in no better than Econoday’s low estimates.

Data in this report, after inflation adjustments, are direct inputs into third-quarter GDP and the results will pull down estimates. Real spending fell 0.1 percent in August to cut in half July’s 0.2 percent gain. The Bureau of Economic Analysis which compiles the report could not quantify Harvey’s effect and had to make estimates for missing data. Yet the impact appears obvious and is the most tangible hurricane effect so far to hit the nation’s economic data. The next hurricane effects will be coming from Irma’s September strike on Florida.

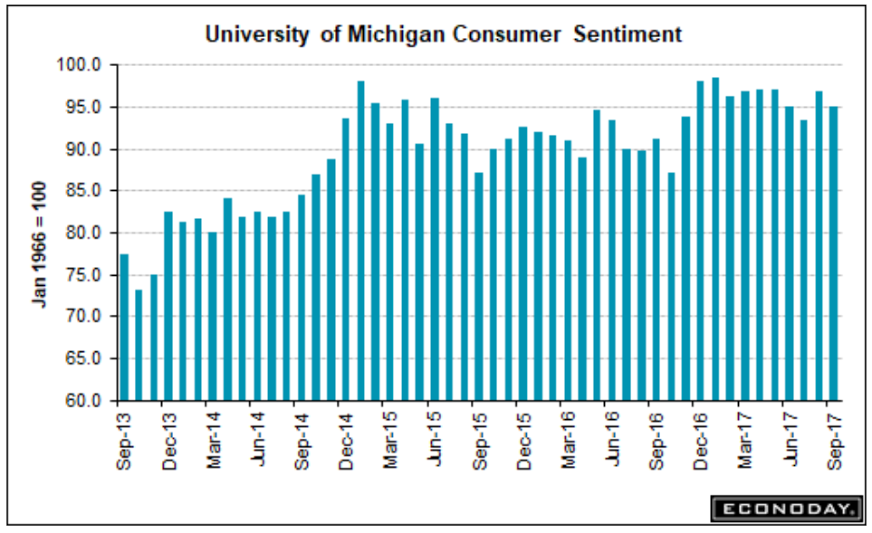

Trumped up expectations persist, but aren’t translating into spending: