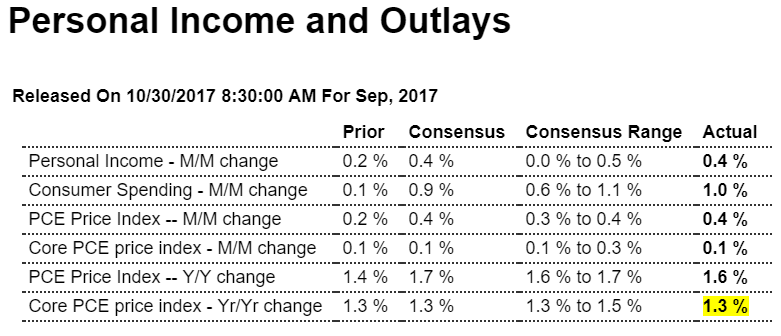

Personal income growth continues to be depressed, which tends to keep spending down as well over time, though this month it had a nice one time increase due to the hurricanes, and the drop in the personal savings rate tells me it’s entirely unsustainable. Also the low inflation readings also support the notion of a general lack of aggregate demand: Highlights Core inflation remains lifeless in an unwanted highlight of an otherwise solid income and spending report. Personal income rose 0.4 percent in September and was underpinned by wages & salaries which also rose 0.4 percent. Consumer spending jumped 1.0 percent driven by a 2.1 percent surge in durable goods that was tied to vehicle replacement following Hurricanes Harvey and Irma. But the rise in income and spending

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Personal income growth continues to be depressed, which tends to keep spending down as well over time, though this month it had a nice one time increase due to the hurricanes, and the drop in the personal savings rate tells me it’s entirely unsustainable. Also the low inflation readings also support the notion of a general lack of aggregate demand:

Highlights

Core inflation remains lifeless in an unwanted highlight of an otherwise solid income and spending report. Personal income rose 0.4 percent in September and was underpinned by wages & salaries which also rose 0.4 percent. Consumer spending jumped 1.0 percent driven by a 2.1 percent surge in durable goods that was tied to vehicle replacement following Hurricanes Harvey and Irma.

But the rise in income and spending didn’t heat up ex-food ex-gas core inflation which posted a marginal 0.1 percent gain. This is the 5th straight 0.1 percent gain for this key reading. The core’s year-on-year rate has been stuck at a rock bottom 1.3 percent for the last two months. Total inflation, reflecting a hurricane-related gain for energy prices, rose 0.4 percent with this year-on-year rate rising 2 tenths to 1.6 percent.

But the pressure on energy prices has already faded and unless wage pressures can extend their emerging gains, inflation readings are not going to be climbing in the direction of the Federal Reserve 2 percent goal. Also helping spending in September was a sharp 5 tenths decline in the savings rate to 3.1 percent and a 10-year low in what, however, is likely to be another hurricane effect that will be quickly reversed.

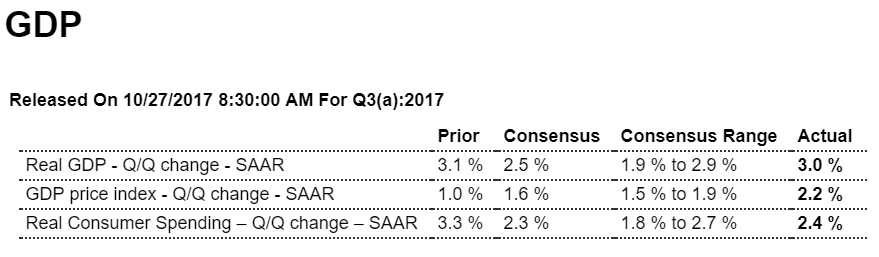

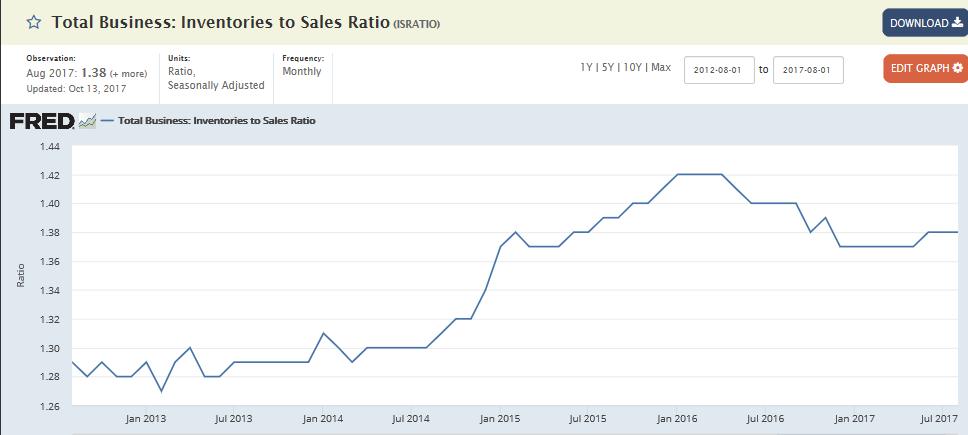

For me, the numbers still don’t ‘add up’. Yes, subtracting inventories, trade, etc. bring the number down closer to 2%, but that’s still at odds with the bank lending reports, depressed personal income, decelerating employment, and the large drop in the personal savings rate. I suspect something has to give, and very soon, and most likely a further and larger drop in consumption:

The changes from the prior quarter reflect a general weakening of consumer and commercial spending growth, nearly offset by increased inventories and reduced imports. The contribution from consumer spending on goods dropped -0.24%, while the contribution from spending on services dropped -0.38% (a combined -0.62%). The inventory contribution became significant, at +0.73%, roughly a quarter of the entire growth. The contribution from fixed commercial investment was halved to +0.25% (from +0.53%). Governmental spending remained in a very minor contraction (-0.02%). The contribution from exports dropped -0.14% to +0.28%, while the contribution from imports turned positive, at +0.12%.

The BEA’s “bottom line” (their “Real Final Sales of Domestic Product”, which excludes inventories) decreased to +2.25%, down -0.69% from the prior quarter.

Real annualized household disposable income dropped -$19 to $39,280 (in 2009 dollars). The household savings rate also dropped -0.4% to 3.4%, the lowest level since the fourth quarter of 2007.

For this revision the BEA assumed an effective annualized deflator of 2.16%. During the same quarter (July 2017 through September 2017) the inflation recorded by the Bureau of Labor Statistics (BLS) in their CPI-U index was 4.31%. Underestimating inflation results in optimistic growth rates, and if the BEA’s “nominal” data was deflated using CPI-U inflation information the headline growth number would have been materially lower at an +0.89% annualized growth rate.

Among the notable items in the report :

The headline contribution from consumer expenditures for goods was reported to be +0.92% (down -0.24% from the prior quarter). The contribution to the headline from consumer spending on services weakened to +0.70% (down -0.38% from the prior quarter). The combined consumer contribution to the headline number was +1.62%, down -0.62% from 2Q-2017. The headline contribution from commercial private fixed investments decreased to +0.25%, down more than half (-0.28%) from the prior quarter. That continued to reflect a contraction in residential construction. Inventory growth provided a material boost to the headline number (+0.73%). This was a +0.61% improvement from the prior quarter. It is important to remember that the BEA’s inventory numbers are exceptionally noisy (and susceptible to significant distortions/anomalies caused by commodity price or currency swings) while ultimately representing a zero reverting (and long term essentially zero sum) series. Governmental spending was reported to be contracting very slightly, at a -0.02% rate. This was a +0.01% improvement from the prior quarter. Exports contributed +0.28% to the headline number, down -0.14% from the prior quarter. Imports added +0.12% to the headline, which was up +0.34% from the prior quarter. In aggregate, foreign trade added +0.42% to the headline number. The “real final sales of domestic product” grew at an annualized 2.25%, down -0.69% from the prior quarter. This is the BEA’s “bottom line” measurement of the economy and it excludes the inventory data. As mentioned above, real per-capita annual disposable income reportedly dropped -$19 per annum. At the same time the household savings rate was reported to have dropped to 3.4% (down -0.4% from the prior quarter). It is important to keep this line item in perspective: real per-capita annual disposable income is up only +7.10% in aggregate since the second quarter of 2008 — a meager annualized +0.74% growth rate over the past 37 quarters. Household disposable income took another hit. Less money was available, and less money was saved — so that a significant portion of the already softening consumer spending came from savings, not pay checks.

At this meeting Papadopoulos told everyone he was setting up a meeting with Putin:

North Korea on verge of ‘catastrophe’ at nuclear site – China warns Kim to STOP tests

North Korea on verge of ‘catastrophe’ at nuclear site – China warns Kim to STOP tests (Express) Scientists from Beijing believe the Punggye-ri nuclear facility is unstable and that just one more explosion could blow the top off of Mount Mantap, beneath which all six of North Korea’s nuclear tests have been conducted. That could lead to the mountain collapsing, causing radioactive waste to escape and blow across the border into China just 50 miles away. Researchers from the Chinese Academy of Sciences’ Institute of Geology and Geophysics warned Pyongyang delegates of the risk during a briefing in Beijing soon after North Korea’s last nuclear test on September 3, according to the South China Morning Post.