Still back to the lower, pre mini spike levels. Industrial production was up due to elevated utility bills, which might explain why retail sales are low: Highlights Same-store sales growth continued the glacial pace of the prior week and was up just 0.3 percent year-on-year in the January 21 week, a sharp deacceleration from the 2-percent plus growth seen in the final weeks of December. Versus December, month-to-date January sales were down 3.5 percent, more than twice the decline seen in January last year. Full month year-on-year sales were up just 0.5 percent, down from 1.5 percent in the last week of December and the slowest growth for this reading since early October. The sales growth slowdown in Redbook’s sample continues to point to weakness in core retail sales for January. Yes, manufacturing is now muddling through at relative low levels, as weakness has spread to the service sector: The Flash Markit Manufacturing PMI in the United States increased to 55.1 in January of 2017 from 54.3 in the previous month, beating market expectations of 54.5. It is the highest reading since March of 2015 as new work boosted output and purchasing activity while growth in new export work remained muted and employment eased.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

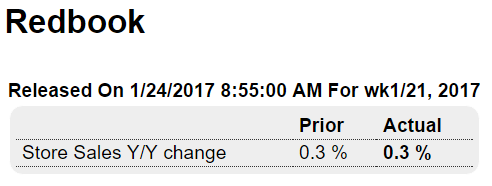

Still back to the lower, pre mini spike levels. Industrial production was up due to elevated utility bills, which might explain why retail sales are low:

Highlights

Same-store sales growth continued the glacial pace of the prior week and was up just 0.3 percent year-on-year in the January 21 week, a sharp deacceleration from the 2-percent plus growth seen in the final weeks of December. Versus December, month-to-date January sales were down 3.5 percent, more than twice the decline seen in January last year. Full month year-on-year sales were up just 0.5 percent, down from 1.5 percent in the last week of December and the slowest growth for this reading since early October. The sales growth slowdown in Redbook’s sample continues to point to weakness in core retail sales for January.

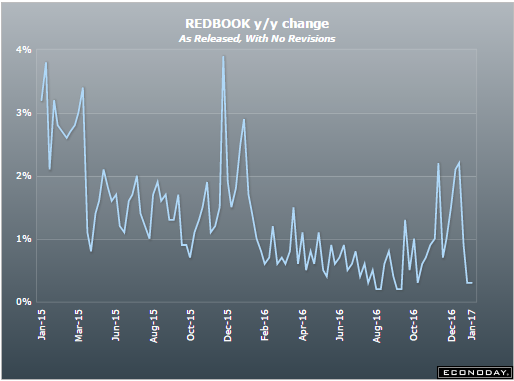

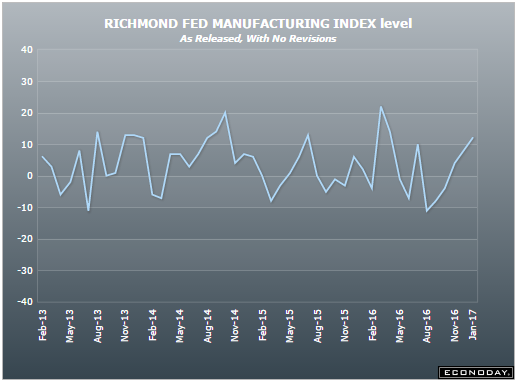

Yes, manufacturing is now muddling through at relative low levels, as weakness has spread to the service sector:

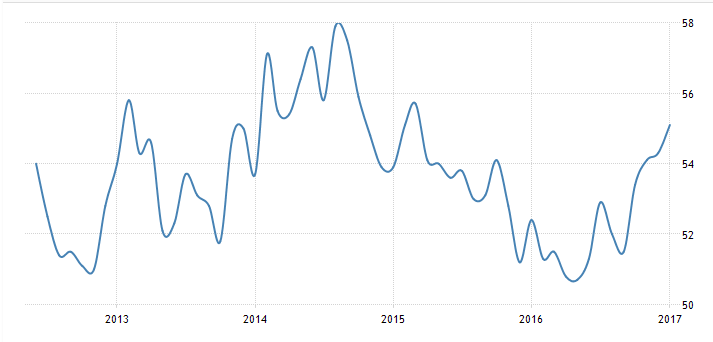

The Flash Markit Manufacturing PMI in the United States increased to 55.1 in January of 2017 from 54.3 in the previous month, beating market expectations of 54.5. It is the highest reading since March of 2015 as new work boosted output and purchasing activity while growth in new export work remained muted and employment eased.

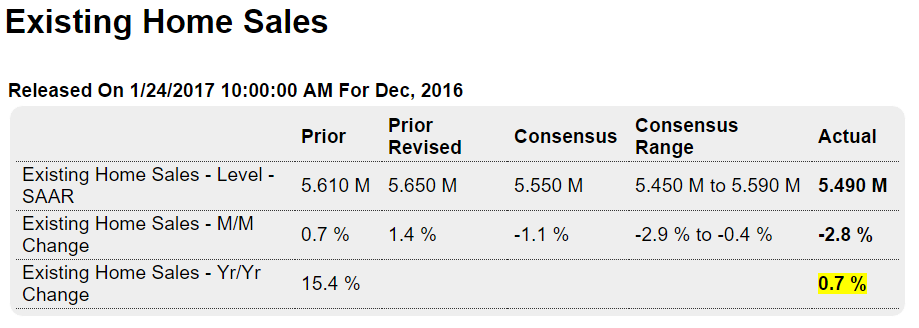

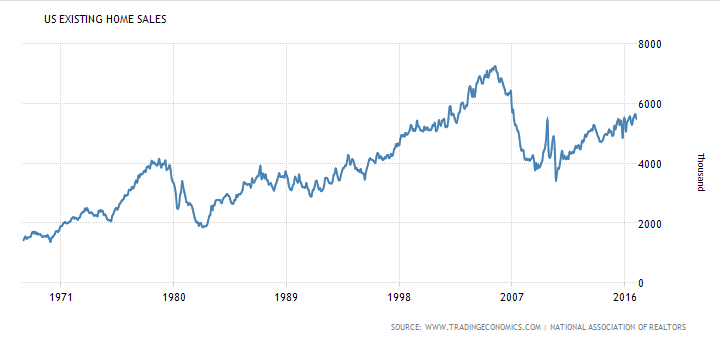

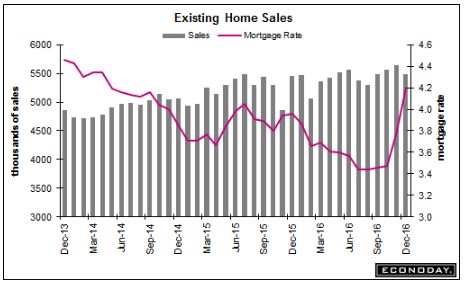

Housing remains depressed, now due to a jump in rates not caused by demand, but by market fears of future Fed actions:

Sales of previously owned houses in the United States slumped 2.8 percent month-over-month to a seasonally adjusted annual rate of 5490 thousand in December of 2016, below market expectations of 5520 thousand. Sales of condos shrank 10.3 percent to 610 thousand and those of single family homes fell 1.8 percent to 4880 thousand. The average price declined 0.9 percent, the months’ worth of supply went down to 3.6 from 3.9 and the supply of houses on the market decreased to 1.65 million, the lowest since 1999. The November figure was revised up to 5650 thousand from 5610 thousand.

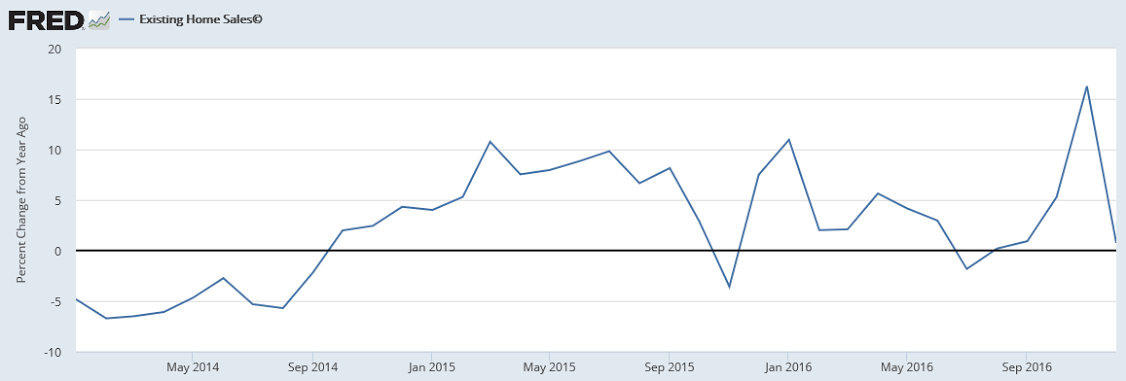

A bit of a rush to buy before rates went up, then back down:

Here we go. Net spending cuts or even ‘neutrality’ are likely to be contractionary, as spending generally has a much higher multiple than tax cutting.

And growth has already been decelerating continuously for over two years:

Trump Budget Director Says National Debt Needs Quick Action

By Jennifer Jacobs and Erik Wasson

(Bloomberg) — President Donald Trump’s pick for budget director Mick Mulvaney said the nearly $20 trillion national debt is the equivalent of an ordinary American family owing more than a quarter of a million dollars on their credit cards, a problem that needs to be “addressed sooner rather than later.”

“Families know what that would mean for them,” Mulvaney will say Tuesday in Washington when he faces a pair of Senate committees over his nomination as director of the Office of Management and Budget, according to his prepared testimony. “It is time for government to learn the same lesson.”

A Republican congressman from South Carolina, Mulvaney was part of the wave of fiscal-conservative Tea Party members elected in 2010 and has been one of the most pugilistic advocates for cutting government spending. He is one of eight Trump nominees that Senate Minority Leader Chuck Schumer has placed in “the most troubling” column. More than 50 groups have sent letters to Capitol Hill urging members of Congress to reject Mulvaney’s nomination, arguing he’s too extreme.

Mulvaney has voted against debt ceiling increases and criticized House Speaker Paul Ryan’s budgets for spending too much. If he’s installed in the post — and given the leeway to negotiate his way — the next debt-limit debate could include a fight over whether future spending should be cut to offset money spent in decades past. The debt limit returns in March, so those discussions aren’t far away.

He will appear before the Budget Committee in the morning and the Homeland Security and Governmental Affairs Committee in the afternoon.Earned Honestly

“I believe, as a matter of principle, that the debt is a problem that must be addressed sooner, rather than later,”

Mulvaney said in the remarks provided in advance of the hearings. “Part of fixing that problem also means taking a hard look at government waste…and then ending it. American taxpayers deserve a government that is efficient, effective, and accountable. American families earn their money honestly; they expect the government to spend it honestly. We owe them that much.”

Still, Mulvaney said he appreciates the safety net that Social Security and Medicare provide, and would like them to be there for his three children, who are triplets.

Mulvaney is a founding member of the House Freedom Caucus, hardline Republicans who have opposed compromising with Democrats just to keep the government operating during budget disputes. He helped lead the 2013 effort that resulted in a government shutdown over Obamacare funding.

“I will be loyal to the facts, and to the American people whom I serve,” he said in the prepared remarks.At Odds

Mulvaney’s long-held position that new spending must be offset with equal cuts elsewhere could put him at odds with the president when it comes time to make good on Trump’s campaign promise to invest $1 trillion in roads, bridges and other infrastructure. He was on the losing side of a push to ensure spending on Hurricane Sandy relief was matched with reductions in other parts of the government.

Mulvaney has voted for unsuccessful proposals that sought to cut spending deeply enough to bring the federal budget into balance within a five-year window. Those proposals by the Republican Study Committee, a faction of fiscal conservatives, included raising the Social Security full-benefits age to 70 and changing the measure of inflation to reduce the retirement program’s payouts.

On the campaign trail, Trump promised he wouldn’t cut Social Security.

The most recent version of the group’s budget proposal would have given an extra $38 billion to the military while reducing domestic spending by $100 billion, in part by eliminating the National Endowment for the Arts and the Kennedy Center and ending funding for the Washington, D.C.-area’s metro transit system.

While a majority of congressional Republicans supported using a war-funding account for regular military needs, Mulvaney worked with Maryland Democrat Chris Van Hollen to demand all routine Pentagon purchases stay within legal spending caps.

Mulvaney’s opposition to that cap-skirting maneuver could become another pressure point, given Trump’s promise to beef up troop levels and weaponry.

Congress is expecting the administration to send up an emergency military spending request in the next few weeks.

The CIA on how they will ‘manage’ their approach to President Trump:

CIA starts recruiting its newest asset Donald Trump

The key to Trump? “He likes to win. He has a nostalgia for a period in history when U.S. always won,” Medina said. So on climate change, for instance, rather than pointing out that there’s science behind it, or that the U.S. needs to set an example, an analyst could point out that the solar energy business is likely to be a “gazillion-dollar business and the U.S. wants to be the winner,” she said. “That’s not politicizing the intelligence, it’s talking to the consumer.”

If Trump’s style means talking to him rather than giving him a written report, that’s fine, said former Acting CIA Director John McLaughlin.

As previously discussed:

Mnuchin Says Excessively Strong Dollar May Hurt U.S. Economy (Bloomberg) U.S. Treasury Secretary nominee Steven Mnuchin said an “excessively strong dollar” could have a negative short-term effect on the economy. “The strength of the dollar has historically been tied to the strength of the U.S. economy and the faith that investors have in doing business in America,” Mnuchin said in a written response to a senator’s question about the implications of a hypothetical 25 percent dollar rise. “From time to time, an excessively strong dollar may have negative short-term implications on the economy.”

Strong euro stuff:

Private sector growth slows slightly but manufacturing remains buoyant (Markit) Flash Germany PMI Composite Output Index at 54.7 (55.2 in December). Services PMI Activity Index at 53.2 (54.3 in December). Manufacturing PMI at 56.5 (55.6 in December). Manufacturing Output Index at 57.6 (57.0 in December). As was the case with activity, manufacturers outperformed service providers with regard to new order growth. New export work in the goods producing sector rose at the steepest rate since September 2016. Despite robust growth of new work, volumes of outstanding business at German private sector firms rose only fractionally.