Trumped up expectations vs ‘hard data’: Highlights January was a flat month for the Chicago PMI which could manage only 50.3, virtually at the breakeven 50.0 level that indications no change from the prior month. New orders have now joined backlog orders in contraction in what is a negative combination for future production and employment. Current production eased but is still solid though employment is clearly weakening, in contraction for a 3rd straight month. One special note is pressure on input costs which are at a 2-1/2 year high. Business spirits and consumer expectations may be high, but they have yet to give the Chicago economy much of a boost. Watch for the consumer confidence report later this morning at 10:00 a.m. ET. Trumped up expectations starting to cool: Highlights Consumer confidence held strong and steady in January, at 111.8 for only a slight decrease from December’s 15-year high of 113.3 (revised). Details are positive including a noticeable decline in those saying jobs are hard to get right now, at 21.5 percent vs December’s 22.7 percent, combined with a solid rise in those who say jobs are plentiful, at 27.4 vs 26.0 percent. But the outlook is less upbeat with more saying there will be fewer jobs 6 months from now and fewer saying there will be more. Confidence in income prospects is also down.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

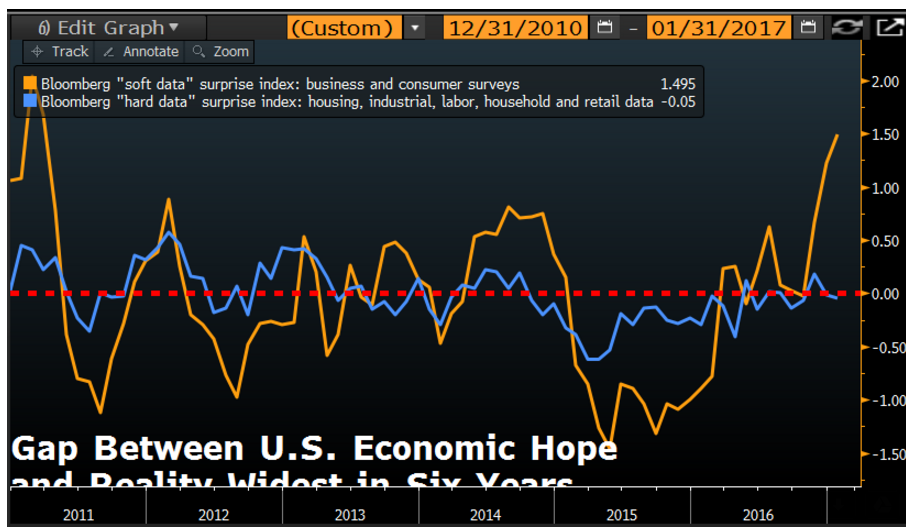

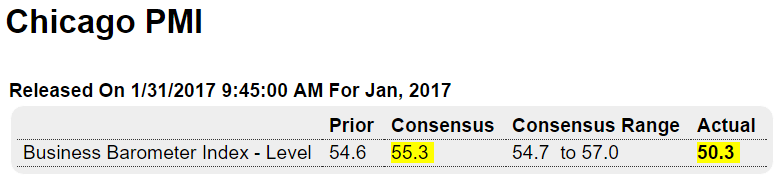

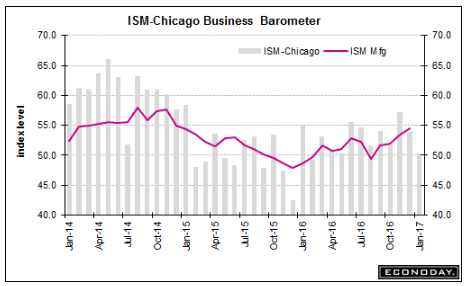

Trumped up expectations vs ‘hard data’:

Highlights

January was a flat month for the Chicago PMI which could manage only 50.3, virtually at the breakeven 50.0 level that indications no change from the prior month. New orders have now joined backlog orders in contraction in what is a negative combination for future production and employment. Current production eased but is still solid though employment is clearly weakening, in contraction for a 3rd straight month. One special note is pressure on input costs which are at a 2-1/2 year high. Business spirits and consumer expectations may be high, but they have yet to give the Chicago economy much of a boost. Watch for the consumer confidence report later this morning at 10:00 a.m. ET.

Trumped up expectations starting to cool:

Highlights

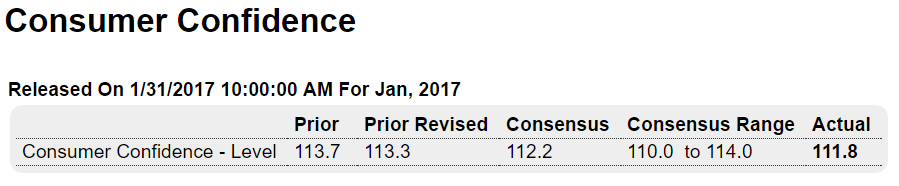

Consumer confidence held strong and steady in January, at 111.8 for only a slight decrease from December’s 15-year high of 113.3 (revised). Details are positive including a noticeable decline in those saying jobs are hard to get right now, at 21.5 percent vs December’s 22.7 percent, combined with a solid rise in those who say jobs are plentiful, at 27.4 vs 26.0 percent.

But the outlook is less upbeat with more saying there will be fewer jobs 6 months from now and fewer saying there will be more. Confidence in income prospects is also down.

And there’s red flags in the details, including a nearly 2 percentage point drop in buying plans for autos. This suggests that auto demand, after several months of very strong sales, may have understandably flattened. Home sales have been less strong than auto sales, but here too buying plans are down sharply.

Back to the lows:

Inventories and Low Deflator Boost Low GDP Estimate

By Rick Davis

Jan 29 (Econintersect) — The BEA’s “bottom line” (their “Real Final Sales of Domestic Product”, which excludes the growing inventories) recorded a sub 1% growth rate (+0.87%), down over 2% (-2.17%) from 3Q-2016.

Real annualized household disposable income was reported to have grown by $177 quarter-to-quarter, to an annualized $39,405 (in 2009 dollars). The household savings rate decreased by -0.2% to 5.6%.

For the fourth quarter the BEA assumed an effective annualized deflator of 2.12%. During the same quarter (October 2016 through December 2016) the inflation recorded by the Bureau of Labor Statistics (BLS) in their CPI-U index was 3.41%. Under estimating inflation results in correspondingly over optimistic growth rates, and if the BEA’s “nominal” data was deflated using CPI-U inflation information the headline growth number would have been much lower, at a +0.62% annualized growth rate.

Trump gives an inaccurate explanation of how pipelines are built and shipped

By Tom DiChristopher

Jan 30 (CNBC) — President Donald Trump on Monday gave an inaccurate explanation of how foreign-made pipes are made and shipped to the United States.

The president made the comments as part of his case to convince oil and gas pipeline makers to use U.S. materials and equipment rather than imported parts.Speaking to a group of small business leaders, Trump described a process that “hurts the pipe” — suggesting that many miles of America’s pipelines contain substandard parts which presumably would have to be replaced. But he simultaneously indicated that he is not actually familiar with how pipelines are made, using a variation of “I imagine” three times and saying “I assume” as he explained the process.

“These are big pipes. Now, the only way I can imagine they [ship them] is they must have to cut them. Because they’re so big, I can’t imagine — they take up so much room — I can’t imagine you could put that much pipe on ships. It’s not enough. It’s not long enough,” he said.

“So I assume they have to fabricate and cut, which hurts the pipe, by the way,” he said.

A spokesperson for the Association of Oil Pipe Lines said he had never heard of foreign pipe makers cutting segments into portions to send them overseas. Manufacturers create pipes in lengths that can be shipped rather than chopping up vast lengths of pipe.

TransCanada, the company behind the controversial Keystone XL pipeline, also told CNBC that pipes it buys from overseas are not cut into smaller segments before being shipped.

So it’s rule by executive orders and tweets supported by alternative facts:

How Islamophobes and “Alternative Facts” Shaped Trump’s Muslim Ban

And as previously discussed, looks like a weak dollar policy is in the works:

Obama

>Euro spikes after Trump’s trade adviser says Germany is using ‘grossly undervalued’ currency

Germany is using a “grossly undervalued” euro to gain advantage over the United States and its own European Union partners, Donald Trump’s top trade adviser told the Financial Times, echoing a sentiment he gave last week on CNBC.

Peter Navarro, the head of Trump’s new National Trade Council, told the newspaper that the euro was like an “implicit Deutsche Mark” whose low valuation gave Germany a competitive advantage over its main partners.

Navarro said that Germany was one of the main hurdles to a U.S.-EU trade deal and that talks over a Transatlantic Trade and Investment Partnership (TTIP) were dead, the newspaper reported.

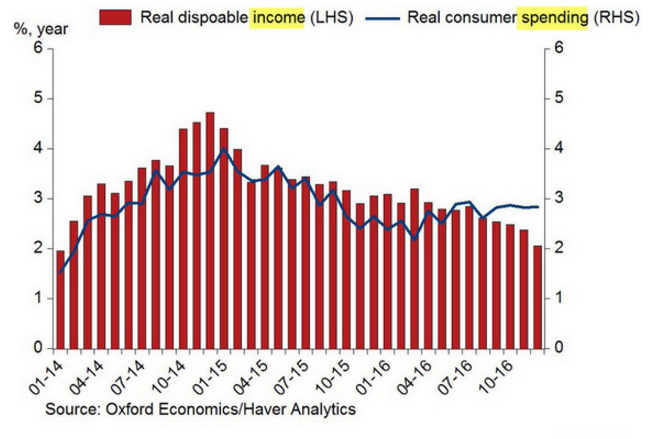

As previously discussed, weak income tends to drag down spending:

As previously discussed, weak income tends to drag down spending: