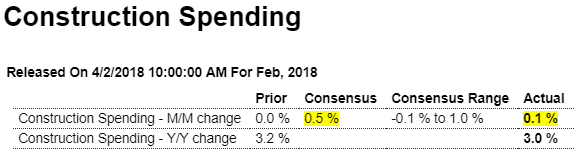

Worse than expected, weak, and decelerating: Highlights Construction spending has been soft, inching only 0.1 percent higher in February after posting no change in January but there are definitely signs of strength in the details. The most important gains are being posted for new single-family homes, up 0.9 percent for a second straight month for a year-on-year February increase of 9.5 percent. Multi-family homes, where spending has been weak, bounced back a monthly 1.2 percent for a yearly 0.9 percent increase. The weakness in February’s overall report comes from home improvements, which fell a monthly 1.5 percent for only a 1.4 percent yearly gain. Public spending also weakened in February with educational and highway spending both slipping into slightly negative ground

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

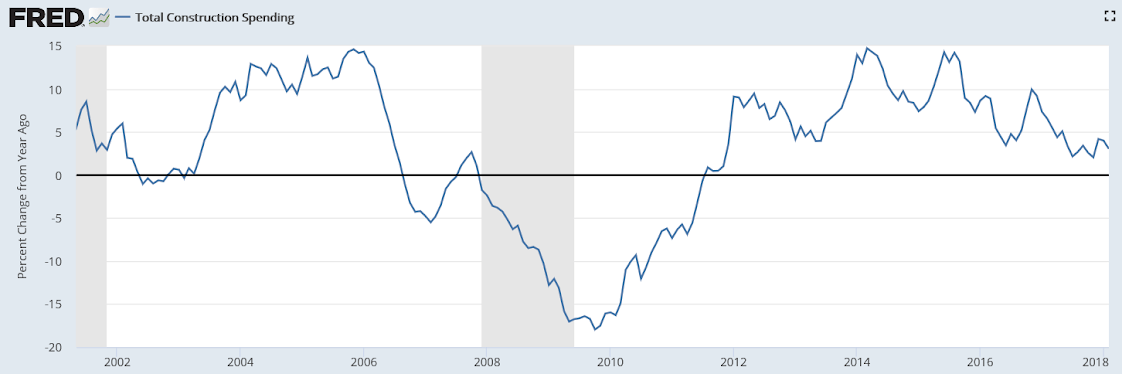

Worse than expected, weak, and decelerating:

Highlights

Construction spending has been soft, inching only 0.1 percent higher in February after posting no change in January but there are definitely signs of strength in the details. The most important gains are being posted for new single-family homes, up 0.9 percent for a second straight month for a year-on-year February increase of 9.5 percent. Multi-family homes, where spending has been weak, bounced back a monthly 1.2 percent for a yearly 0.9 percent increase. The weakness in February’s overall report comes from home improvements, which fell a monthly 1.5 percent for only a 1.4 percent yearly gain.

Public spending also weakened in February with educational and highway spending both slipping into slightly negative ground on the month. But private nonresidential spending is a positive, up 1.5 percent on the month though the year-on-year increase is still subdued at 1.1 percent. Power and manufacturing construction have been showing the most weakness though both posted gains in February. Transportation, despite a February slip, has been very strong as has commercial building while office spending, after a big monthly jump, moved back into the year-on-year plus column.

But total year-on-year spending is still subdued, down 2 tenths to only 3.0 percent. Yet the gains in single-family homes are a big plus for the housing market and should help build expectations for a badly needed rise in housing supply in what would prove a major plus for housing sales. Watch on Friday for construction payrolls in the employment report, a component that has been showing solid gains over the past year.

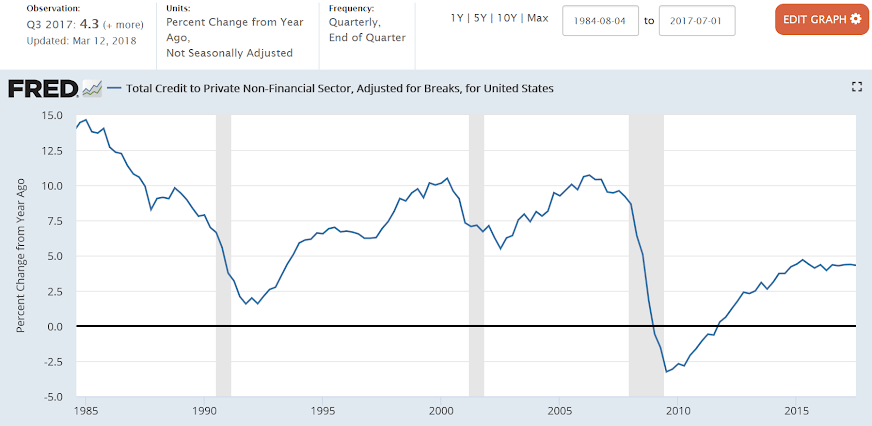

Another indicator showing how the credit expansion has stalled:

Erdogan has it right, of course:

Emerging Markets: A quote from Turkey’s Recep Tayyip Erdogan showing incredible ignorance:

The interest rate is both the mother and the father of the inflation. Those who don’t know this, they should. Anyone attempting to act against this would find me facing them.

This is not going to end well for Turkey.