Even lower than expected as weakness continues: U.S. Light Vehicle Sales decline to 17.1 million annual rate in January By Bill McBride Feb 1, (calculated Risk) — Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.1 million SAAR in January. That is down 1.2% from January 2017, and down 3.8% from last month. Once again, prior month revised down, and current month higher than expected. In any case as the chart shows, construction growth remains depressed: Highlights Construction ended a modest year on a strong note, rising 0.7 percent in December to lift the year-on-year gain by just more than a point to 2.6 percent. The strength has been in housing where residential spending rose 0.5 percent in the month for a yearly and very strong 6.2

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Even lower than expected as weakness continues:

U.S. Light Vehicle Sales decline to 17.1 million annual rate in January

By Bill McBride

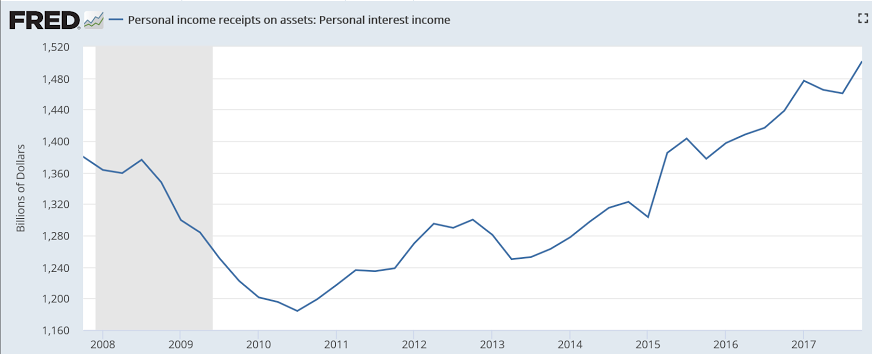

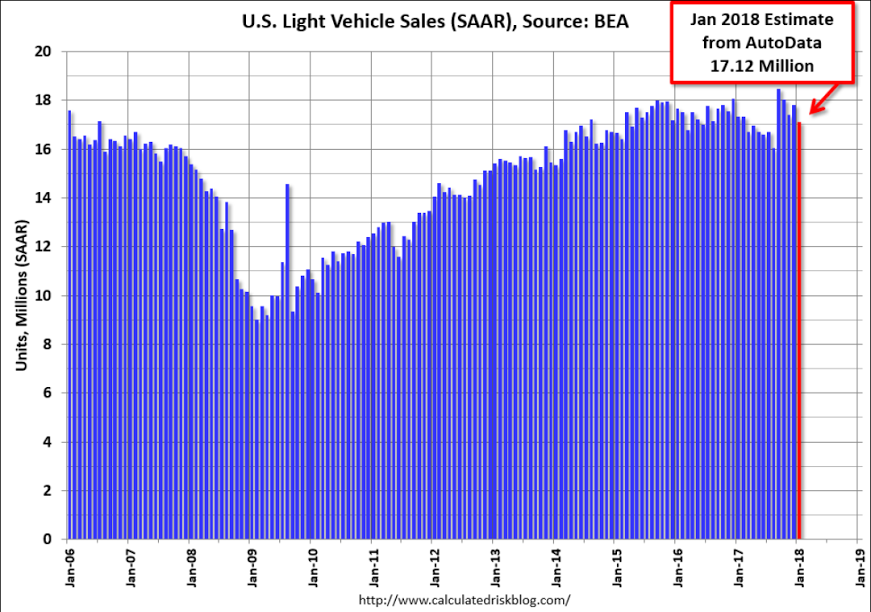

Feb 1, (calculated Risk) — Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.1 million SAAR in January.

That is down 1.2% from January 2017, and down 3.8% from last month.

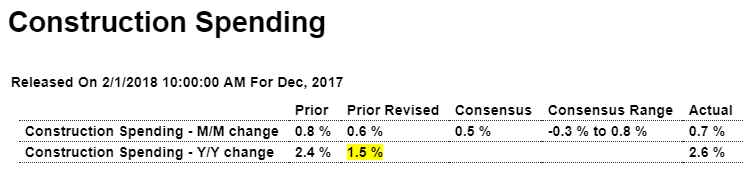

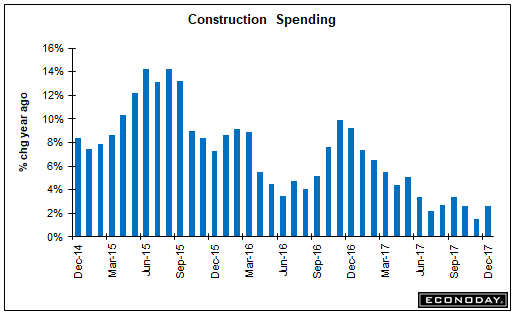

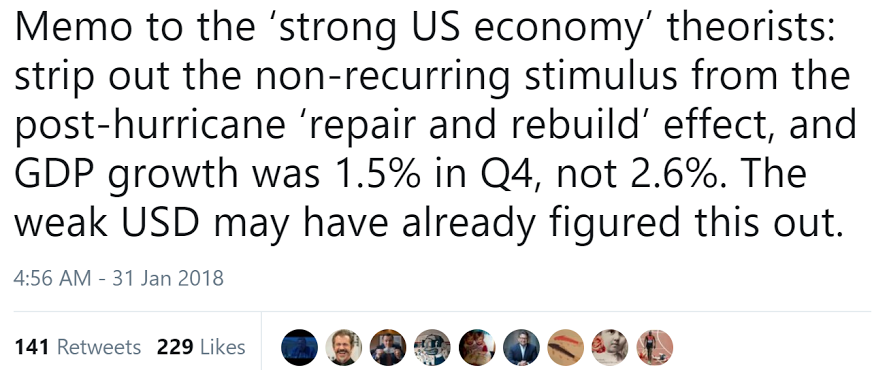

Once again, prior month revised down, and current month higher than expected. In any case as the chart shows, construction growth remains depressed:

Highlights

Construction ended a modest year on a strong note, rising 0.7 percent in December to lift the year-on-year gain by just more than a point to 2.6 percent. The strength has been in housing where residential spending rose 0.5 percent in the month for a yearly and very strong 6.2 percent increase. All components — single-family, multi-family, home improvements — have been solid contributors.

Holding down the results has been private nonresidential spending which did rise 1.1 percent in December though the yearly rate is still in the negative column at minus 2.5 percent. Spending on office construction fell 5.0 percent in the year with manufacturing and power both falling just over 10 percent. Commercial building was a positive at a 5.1 percent gain with transportation, the smallest of these subcomponents however, up an outsized 36 percent on the year.

Public spending was a positive but this is a small component compared to housing and private nonresidential. Federal spending rose 5.3 percent on the year with state and local up 4.3 percent.

The housing side of this report is positive but needs to accelerate even further to feed supply to what has been a housing sector starved of new homes and condos.

This is more than expected and to the extent it’s incrementally spent will support GDP:

Debt-limit deadline likely in first half of March

Jan 31 (The Hill) — The CBO said the Treasury Department will most likely run out of cash in the first half of March if Congress doesn’t raise or suspend the debt limit before then. “Because the tax legislation reduced individual income taxes for most taxpayers, the IRS released new income tax withholding tables for employers to use beginning no later than the middle of February 2018,” CBO said. “As a result of those changes, CBO now estimates that, starting in February, withheld amounts of individual income taxes will be roughly $10 billion to $15 billion per month less than anticipated before the new law was enacted.”

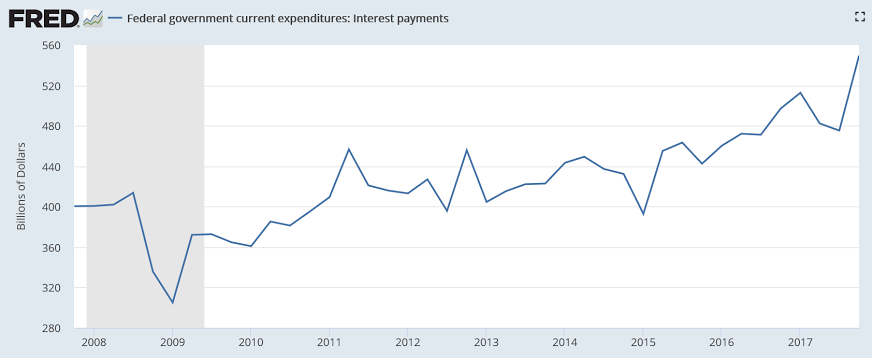

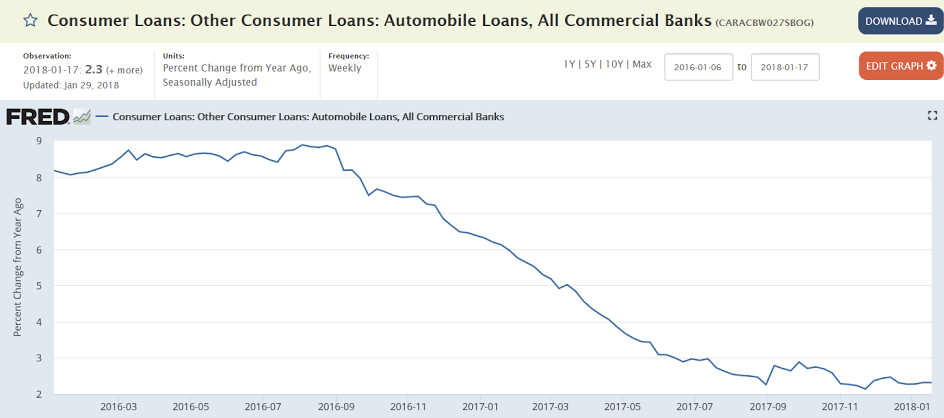

With government a large, net payer of interest to the economy, higher rates increase net federal spending add to income (I’ve called said govt. interest payments ‘basic income for those who already have $), thereby supporting aggregate demand and contributing to ‘inflation’. While the rate increases have been relatively small, the hikes have now increased the policy rate by about 1.5%:

Fed Signals Cautious Optimism and Support for Higher Rates

Jan 31 (Bloomberg) — “Gains in employment, household spending and business fixed investment have been solid, and the unemployment rate has stayed low,” the Fed said. “The committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,” the FOMC said, adding the word “further” twice to previous language. Officials also said inflation “is expected to move up this year and to stabilize” around the goal, in phrasing that marked an upgrade from their statement in December.

And households are net savers: