Summary:

This is about borrowing to spend, indicating positive spending and GDP: Pressures easing here: And this may indicate global spending is holding up: So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

This is about borrowing to spend, indicating positive spending and GDP: Pressures easing here: And this may indicate global spending is holding up: So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

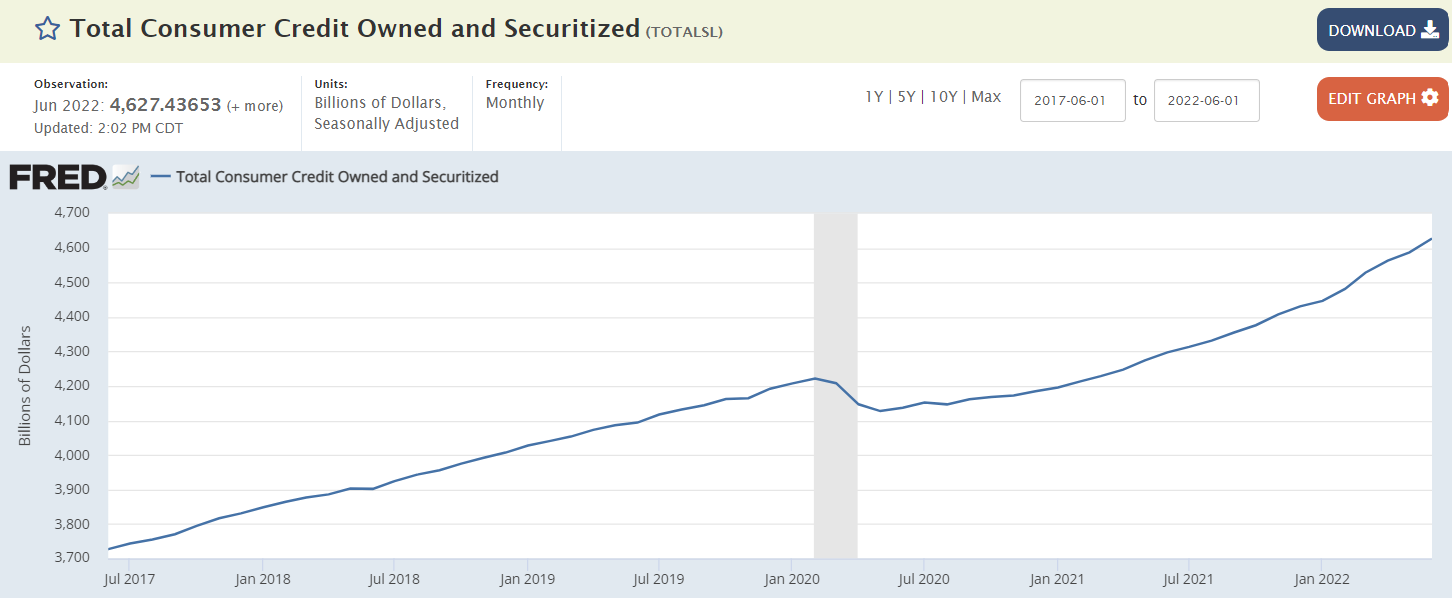

This is about borrowing to spend, indicating positive spending and GDP:

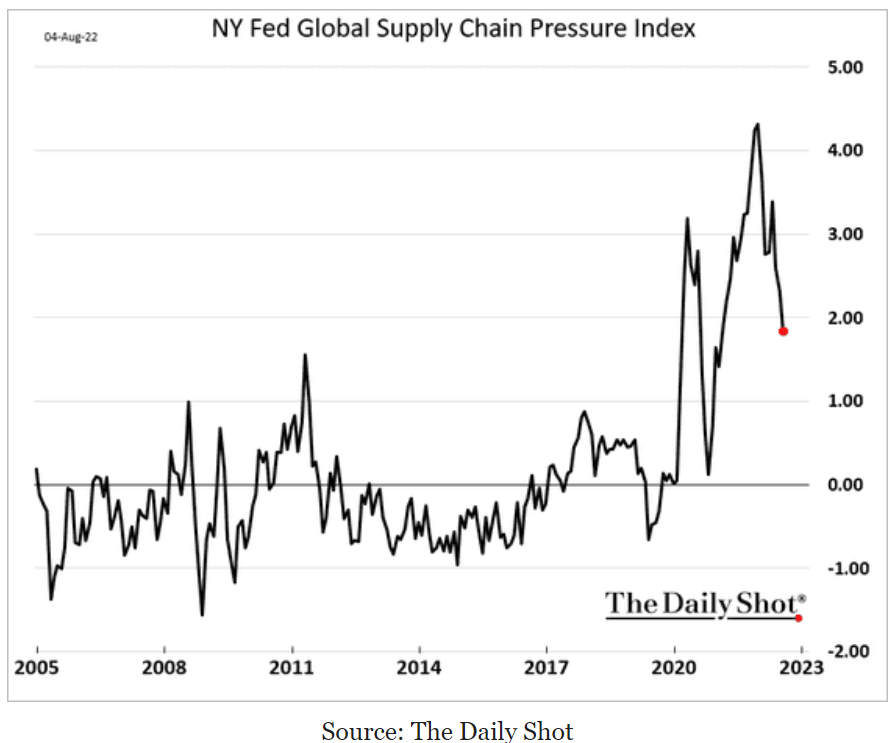

Pressures easing here:

And this may indicate global spending is holding up:

So in short we had Covid deficit spending north of 15% of GDP supporting strong growth, followed by a collapse in deficit spending that resulted in a strong deceleration of growth. However sufficient deficit spending remains (about 5% of GDP) to sustain more modest levels of growth.