Summary:

Not adjusted for inflation but not showing signs of recession: If oil prices remain near current levels the inflation is over and we’re back to pre-Covid low inflation and slow growth, with a government deficit of maybe 5-6% of GDP (including the new interest expense from the rate hikes which support the economy) supporting demand and a Congress that believes the deficit has to come down to contain inflationary pressures. But I think it’s far more likely that oil prices spike much higher as Saudis have hiked prices again and are working with Russia to destabilize the west. And with higher oil prices it all falls apart again:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Not adjusted for inflation but not showing signs of recession: If oil prices remain near current levels the inflation is over and we’re back to pre-Covid low inflation and slow growth, with a government deficit of maybe 5-6% of GDP (including the new interest expense from the rate hikes which support the economy) supporting demand and a Congress that believes the deficit has to come down to contain inflationary pressures. But I think it’s far more likely that oil prices spike much higher as Saudis have hiked prices again and are working with Russia to destabilize the west. And with higher oil prices it all falls apart again:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

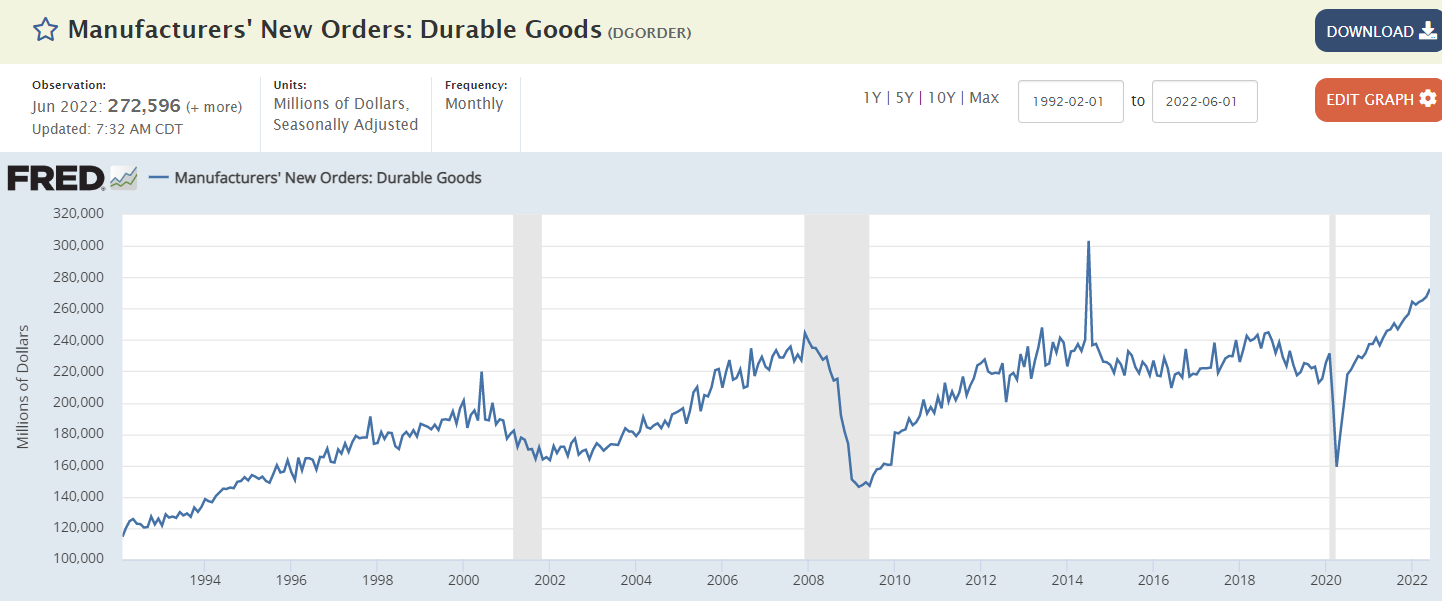

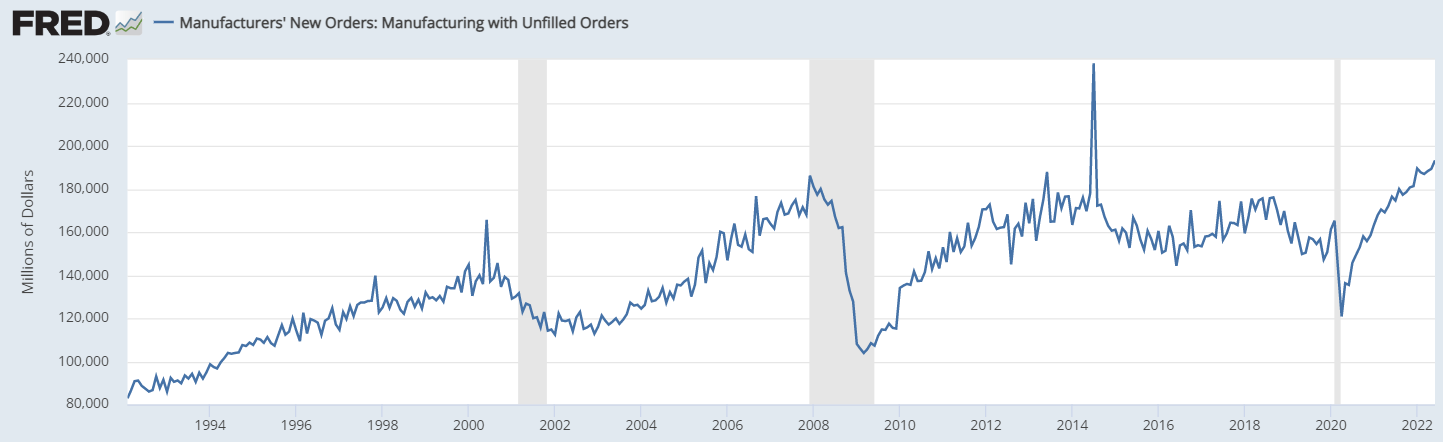

Not adjusted for inflation but not showing signs of recession:

If oil prices remain near current levels the inflation is over and we’re back to pre-Covid low inflation and slow growth, with a government deficit of maybe 5-6% of GDP (including the new interest expense from the rate hikes which support the economy) supporting demand and a Congress that believes the deficit has to come down to contain inflationary pressures.

But I think it’s far more likely that oil prices spike much higher as Saudis have hiked prices again and are working with Russia to destabilize the west. And with higher oil prices it all falls apart again: