Summary:

Leveling off at approximately pre-Covid levels. The growth rate slowed as deficit spending dropped: Still in expansion but it has come way down with the post-Covid war.Drop in deficit spending that has been driving the general deceleration: Not looking good. The parts shortage is largely over, so it is about a lack of demand as deficit spending falls and prices in general rise faster than incomes: Oil prices (not money supply, for example) continue to drive headline inflation as Saudis continue to set the OSP spreads above ‘fair economic value’ which continuously drive price higher until demand collapses: And as Saudis set price and then pump and sell as much as is demanded at their price. Increased production indicates demand is increasing for their output: Oil

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Leveling off at approximately pre-Covid levels. The growth rate slowed as deficit spending dropped: Still in expansion but it has come way down with the post-Covid war.Drop in deficit spending that has been driving the general deceleration: Not looking good. The parts shortage is largely over, so it is about a lack of demand as deficit spending falls and prices in general rise faster than incomes: Oil prices (not money supply, for example) continue to drive headline inflation as Saudis continue to set the OSP spreads above ‘fair economic value’ which continuously drive price higher until demand collapses: And as Saudis set price and then pump and sell as much as is demanded at their price. Increased production indicates demand is increasing for their output: Oil

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

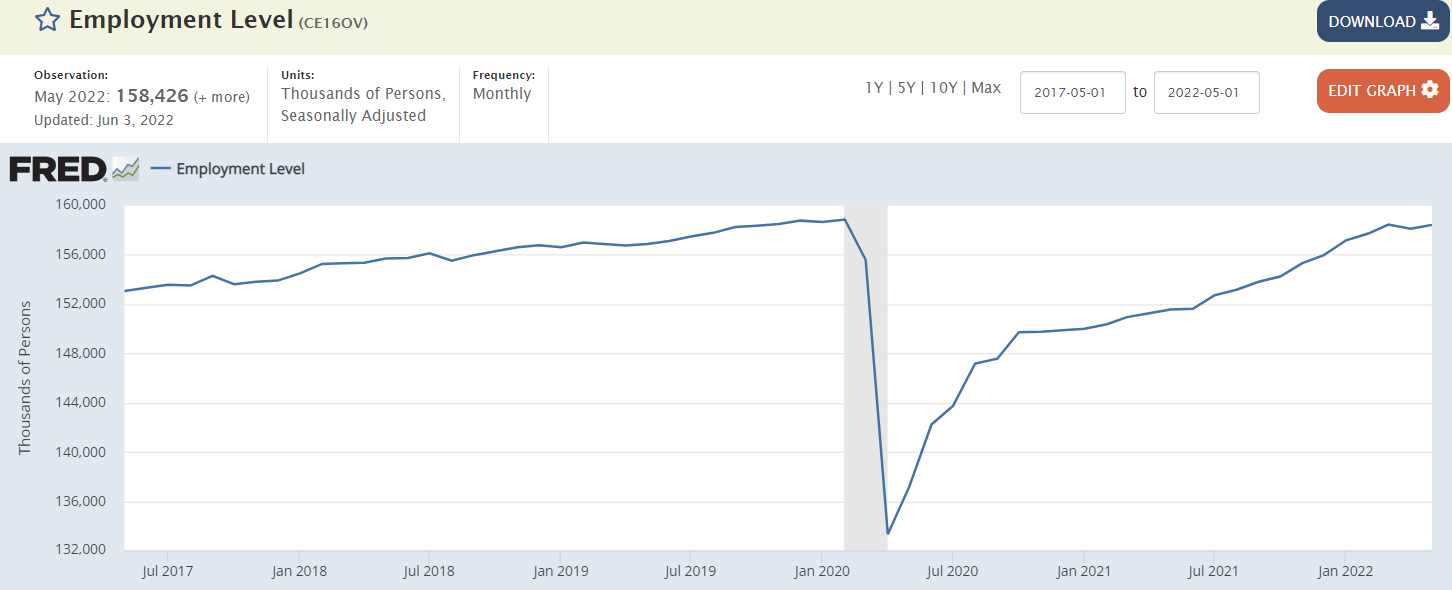

Leveling off at approximately pre-Covid levels.

The growth rate slowed as deficit spending dropped:

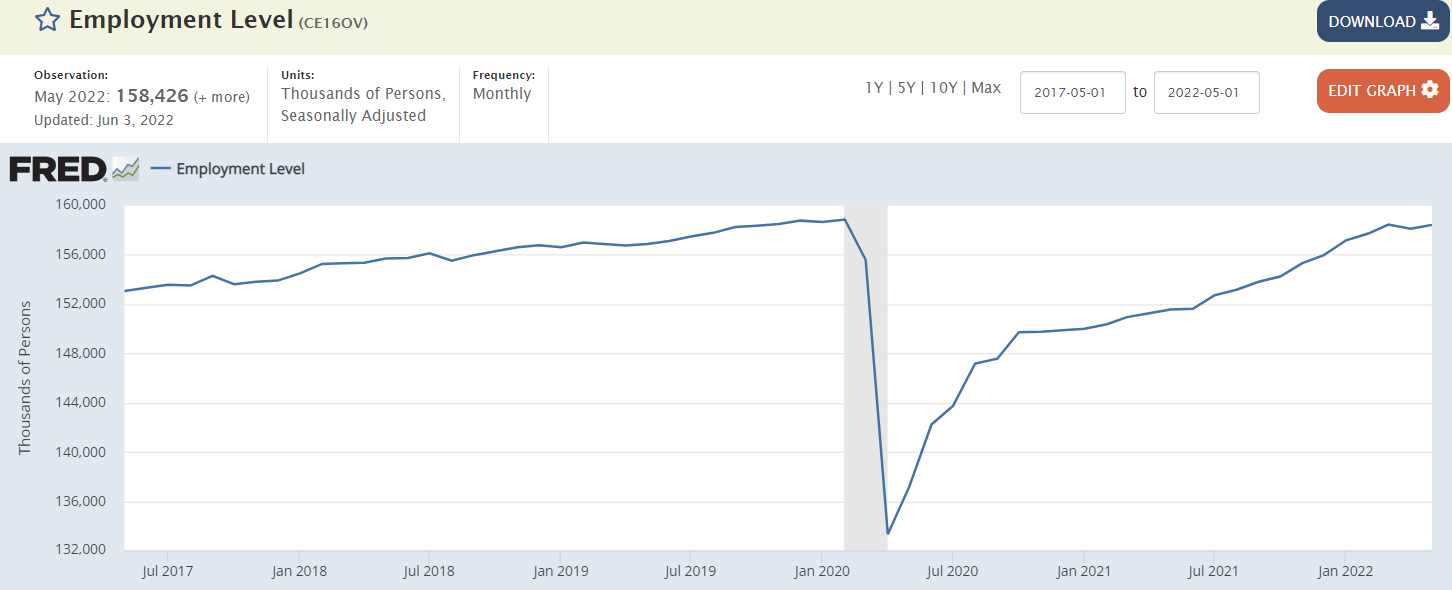

Still in expansion but it has come way down with the post-Covid war.

Drop in deficit spending that has been driving the general deceleration:

Drop in deficit spending that has been driving the general deceleration:

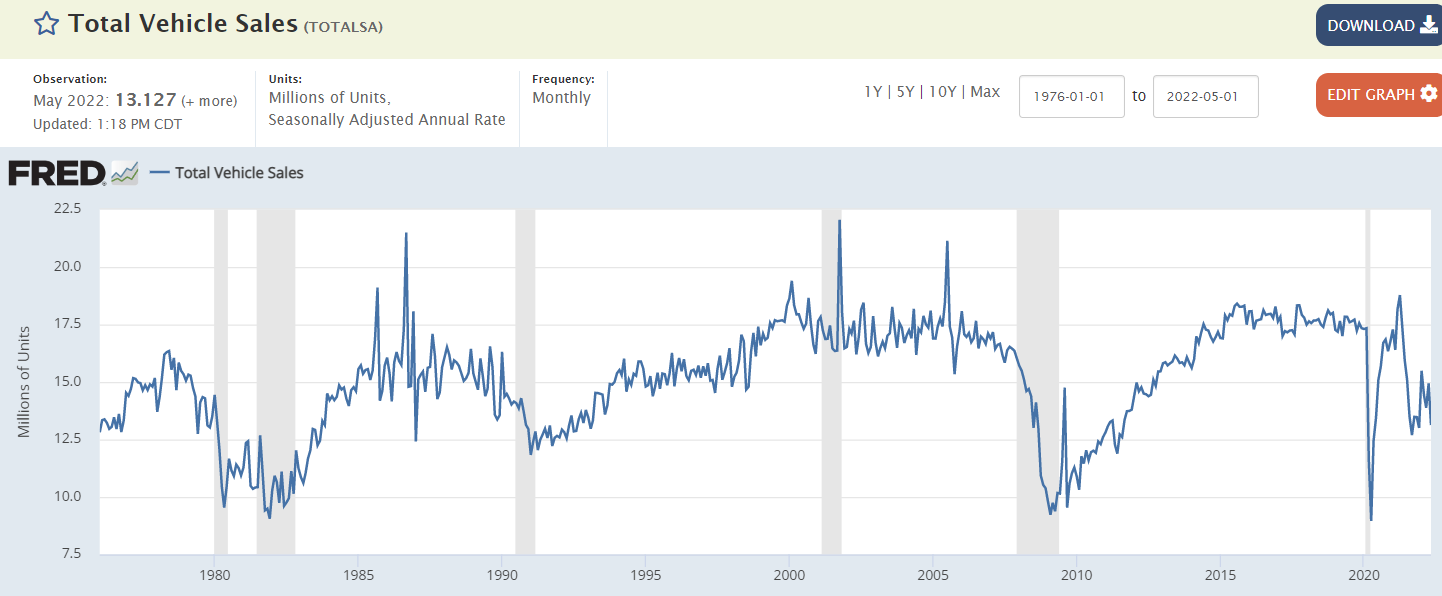

Not looking good. The parts shortage is largely over, so it is about a lack of demand as deficit spending falls and prices in general rise faster than incomes:

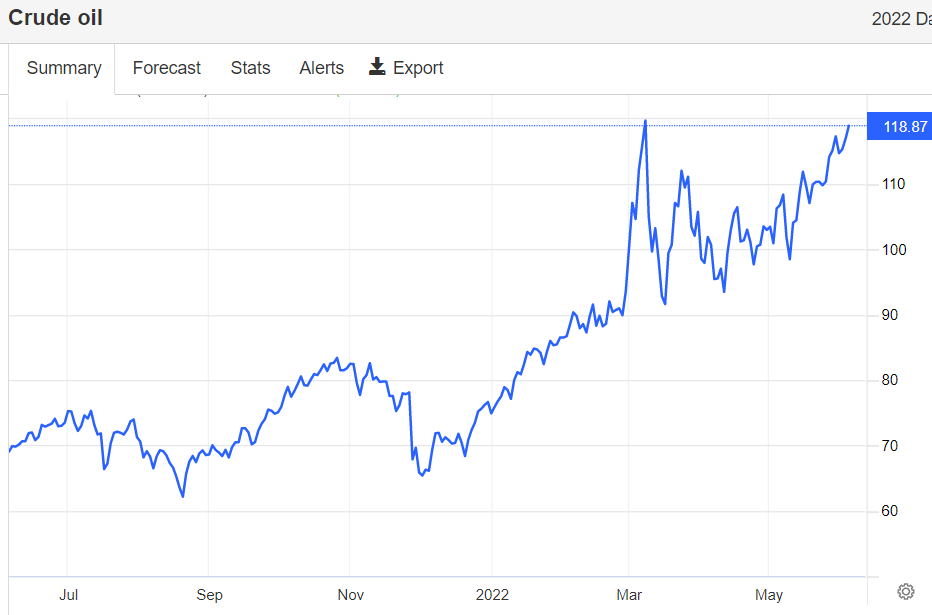

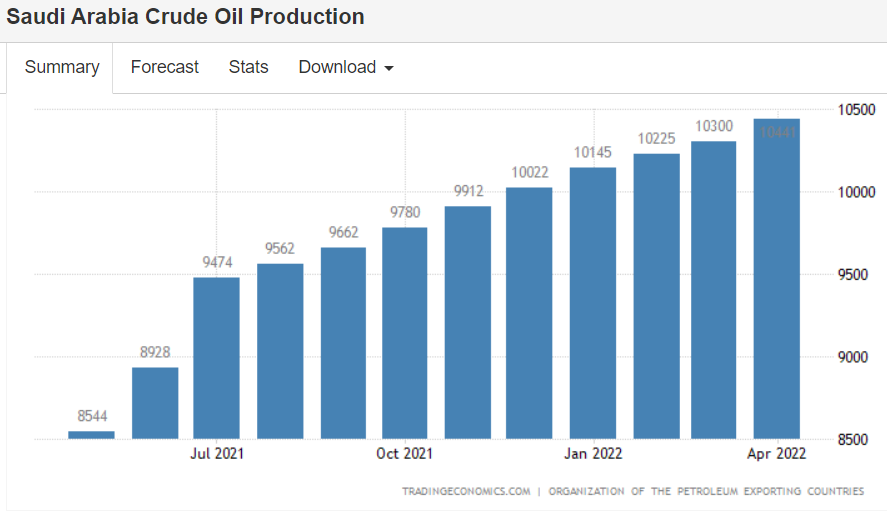

Oil prices (not money supply, for example) continue to drive headline inflation as Saudis continue to set the OSP spreads above ‘fair economic value’ which continuously drive price higher until demand collapses:

And as Saudis set price and then pump and sell as much as is demanded at their price.

Increased production indicates demand is increasing for their output:

Oil Jumps After EIA Confirms Large Crude Inventory Draw | OilPrice.com

Crude oil prices rose further after the Energy Information Administration reported today an inventory draw of 5.1 million barrels for the week to May 27.

This compared with a draw of 1 million barrels for the previous week.

At 414.7 million barrels, U.S. crude oil inventories are some 15 percent below the five-year average for this time of the year.