Summary:

Growth overall remains sluggish as the economy becomes dependent on private sector credit expansion (private sector deficit spending) to offset the too tight post-Covid fiscal policy. Fed rate hikes add interest income to the economy as gov pays more interest on the + trillion of public debt, which, if anything, supports rather than dampens demand or credit expansion, but it does contribute to higher prices which further reduces the real, inflation adjusted value of the public debt, which is a fiscal tightening. This is a repeat of 1979 where the increase in the price level exceeded the growth in deficit spending which is functionally the same as the govt running a budget surplus. Down for the month but so far the weak upward trend remains: Perhaps leveling off at

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Growth overall remains sluggish as the economy becomes dependent on private sector credit expansion (private sector deficit spending) to offset the too tight post-Covid fiscal policy. Fed rate hikes add interest income to the economy as gov pays more interest on the + trillion of public debt, which, if anything, supports rather than dampens demand or credit expansion, but it does contribute to higher prices which further reduces the real, inflation adjusted value of the public debt, which is a fiscal tightening. This is a repeat of 1979 where the increase in the price level exceeded the growth in deficit spending which is functionally the same as the govt running a budget surplus. Down for the month but so far the weak upward trend remains: Perhaps leveling off at

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Growth overall remains sluggish as the economy becomes dependent on private sector credit expansion (private sector deficit spending) to offset the too tight post-Covid fiscal policy.

Fed rate hikes add interest income to the economy as gov pays more interest on the $30+ trillion of public debt, which, if anything, supports rather than dampens demand or credit expansion, but it does contribute to higher prices which further reduces the real, inflation adjusted value of the public debt, which is a fiscal tightening. This is a repeat of 1979 where the increase in the price level exceeded the growth in deficit spending which is functionally the same as the govt running a budget surplus.

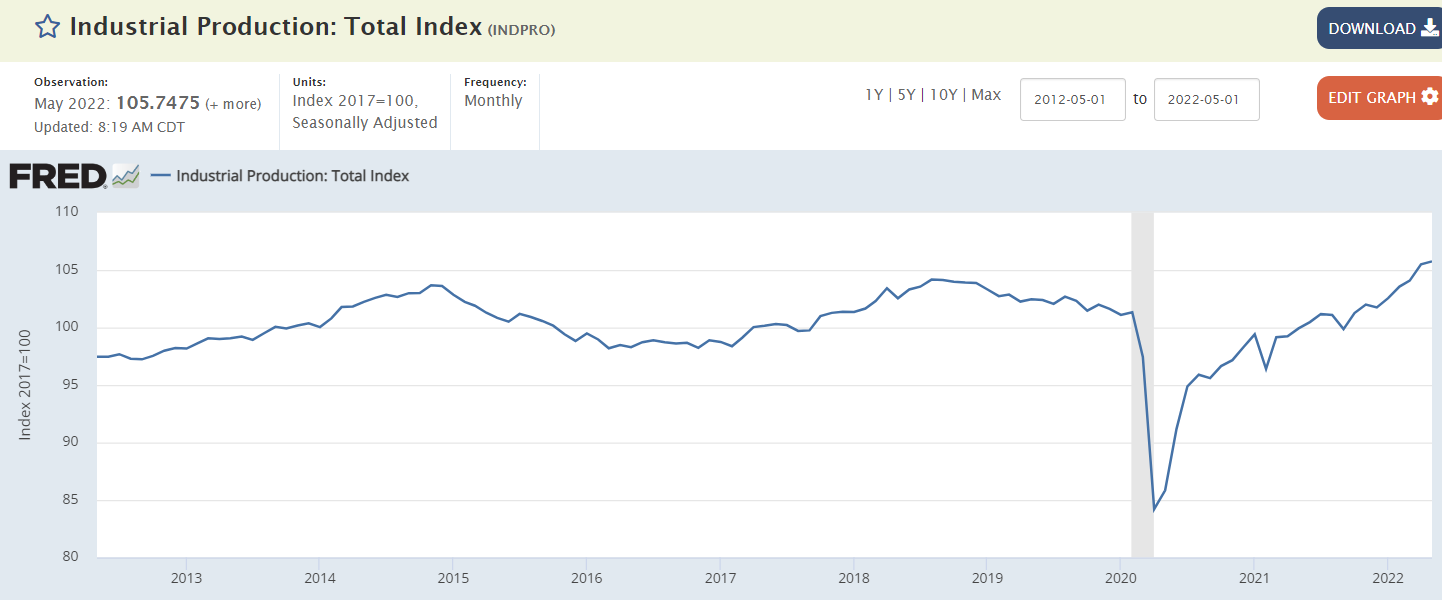

Down for the month but so far the weak upward trend remains:

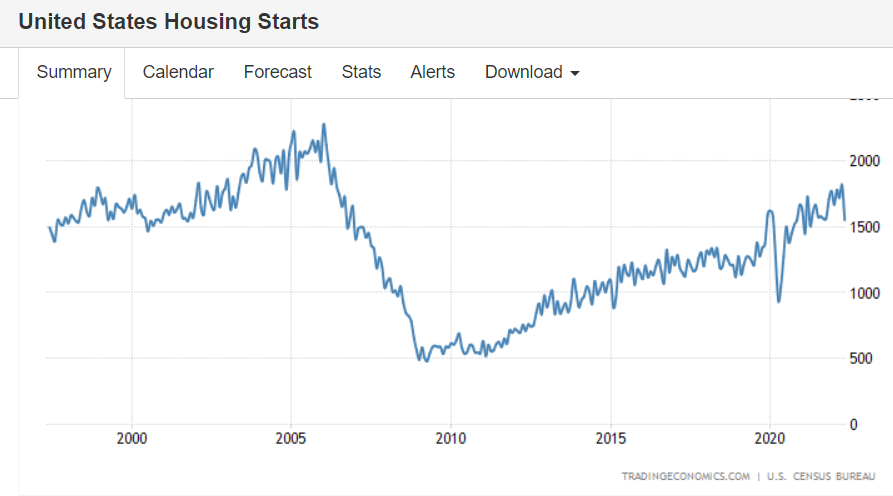

Perhaps leveling off at pre-Covid levels:

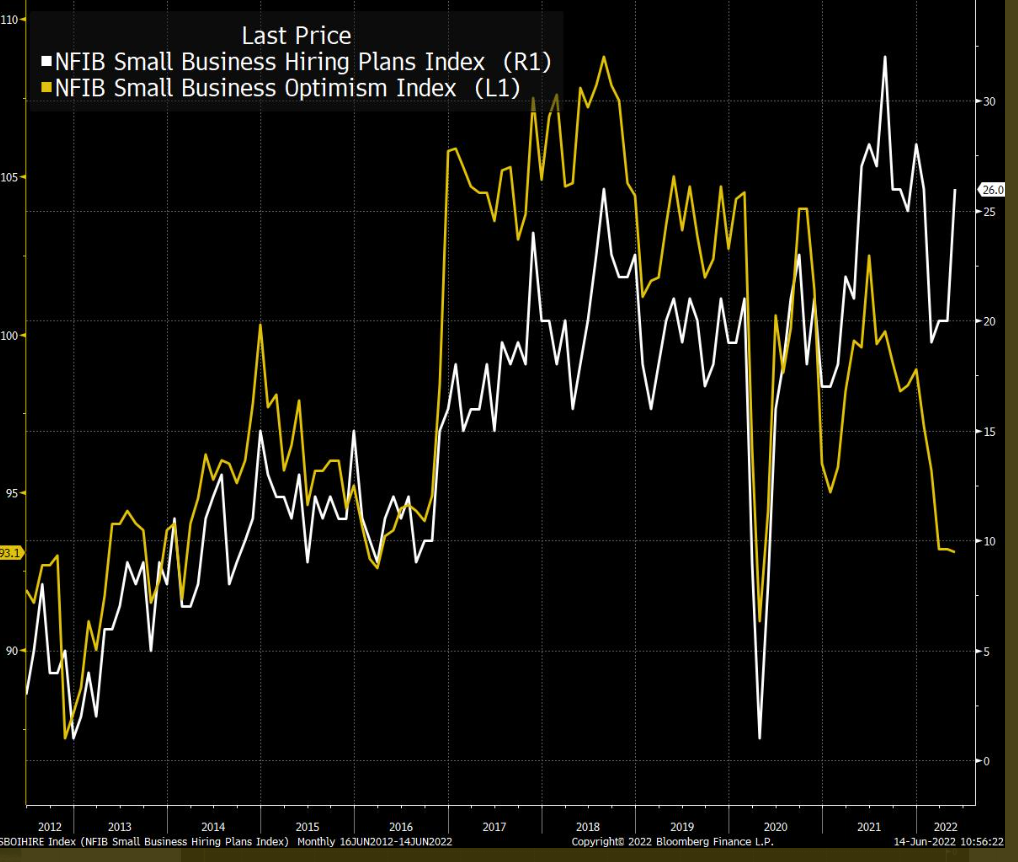

Big drop in the main index but hiring plans remain elevated: