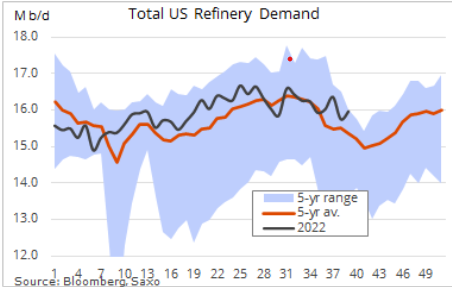

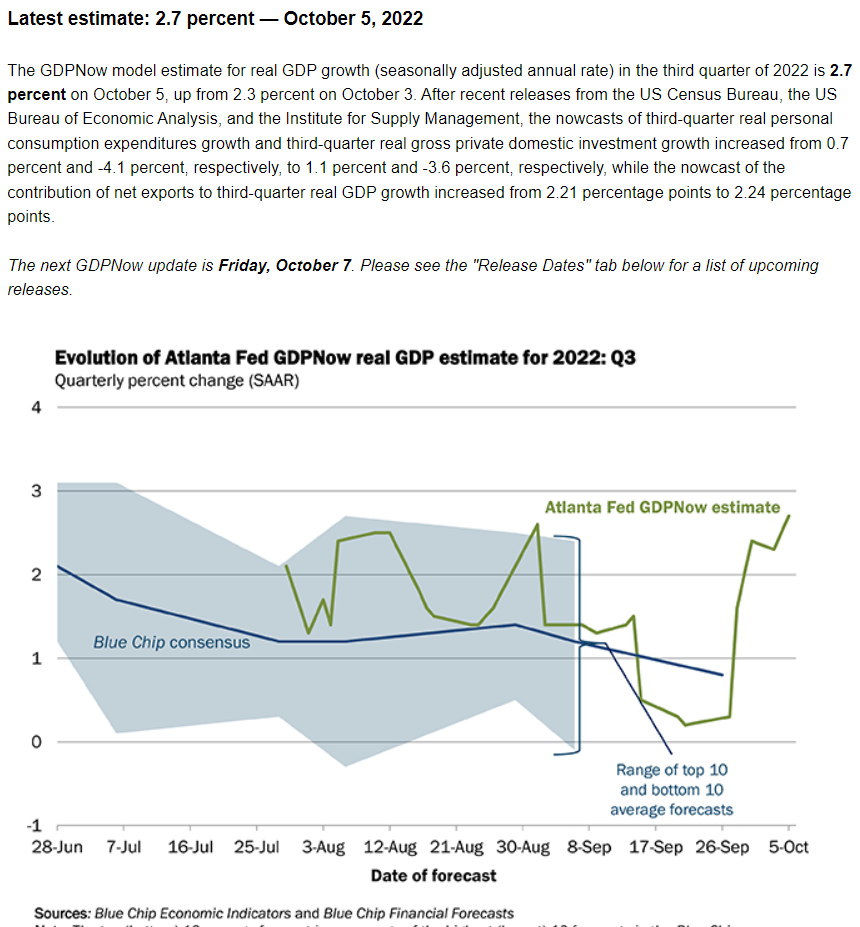

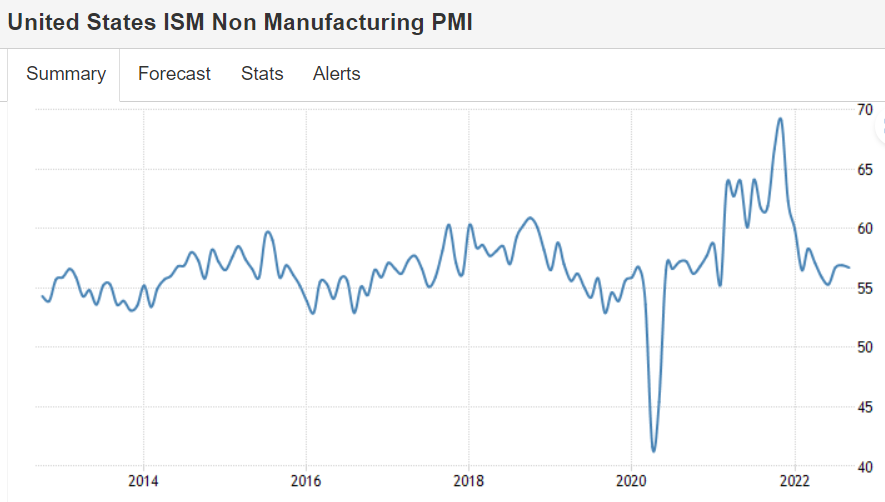

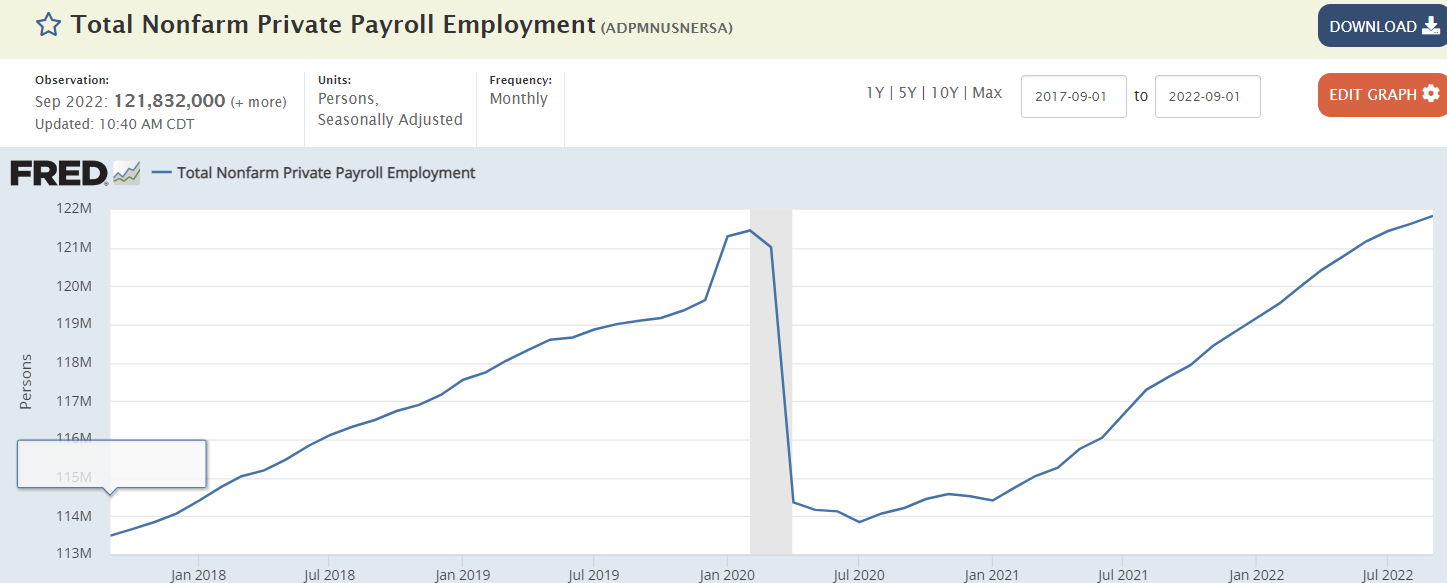

Remains in positive growth mode: No recession indication here- this is a forecast for Friday’s employment report: My take is at the July meeting with President Biden the Saudis agreed to bring prices down in return for various favors. The only way for this to happen was for them to confidentially discount their official selling prices with their customers, and for this was done without consultation with the rest of OPEC+. For reasons unknown to me that agreement has come to an end. Selling price spreads to benchmarks have been modestly increased and the discounting has ended. Additionally OPEC+ has announced large production cuts as cover for the actual reason prices are have reversed and will now rise continuously until policy changes or demand, which is currently

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Furthermore, the proposed price caps on Russian oil, if implemented, will most likely and immediately result in higher prices as the world needs Russian oil a whole lot more than Russia needs $US.

“Oil prices surged almost 2% on Wednesday, with WTI futures rising to almost $88 a barrel and Brent crude to above $93 a barrel, on expectations of tighter supply. Ministers from OPEC+ agree to cut production by 2M barrels per day today, double the volume previously flagged. The move came despite pressures from the US, with Washington arguing that economic fundamentals do not support a reduction in production. Still, output cuts could have a smaller effect on global supply because several countries are already pumping well below their quotas. Meanwhile, the EIA report showed US crude stocks unexpectedly fell by 1.356 million barrels last week, the second consecutive drop and the biggest in five weeks.”