Summary:

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared? Still a very high number- well above pre-Covid levels: Back to pre-Covid trend line: A slight decline for the month but still trending higher. No sign of recession here: The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Continues to look to me to like the increased government deficit from the rate hikes, at the macro level, continues to support output and employment and is not triggering a recession as feared?

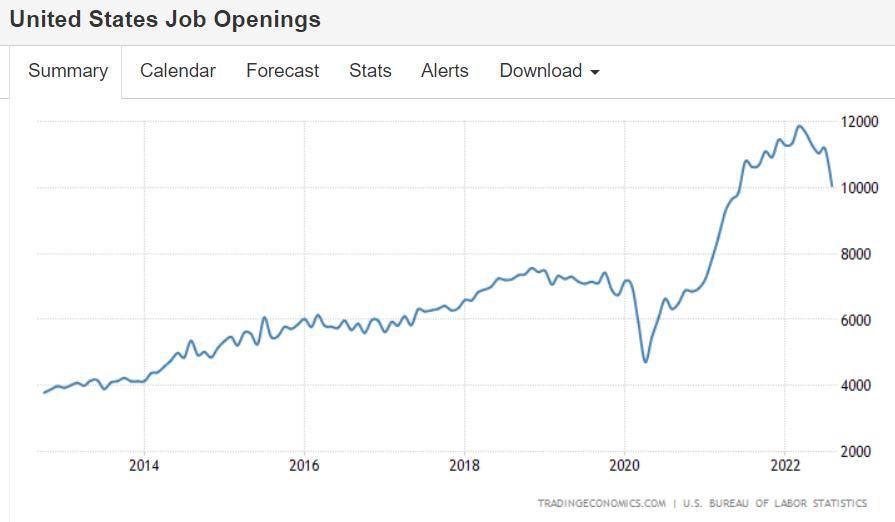

Still a very high number- well above pre-Covid levels:

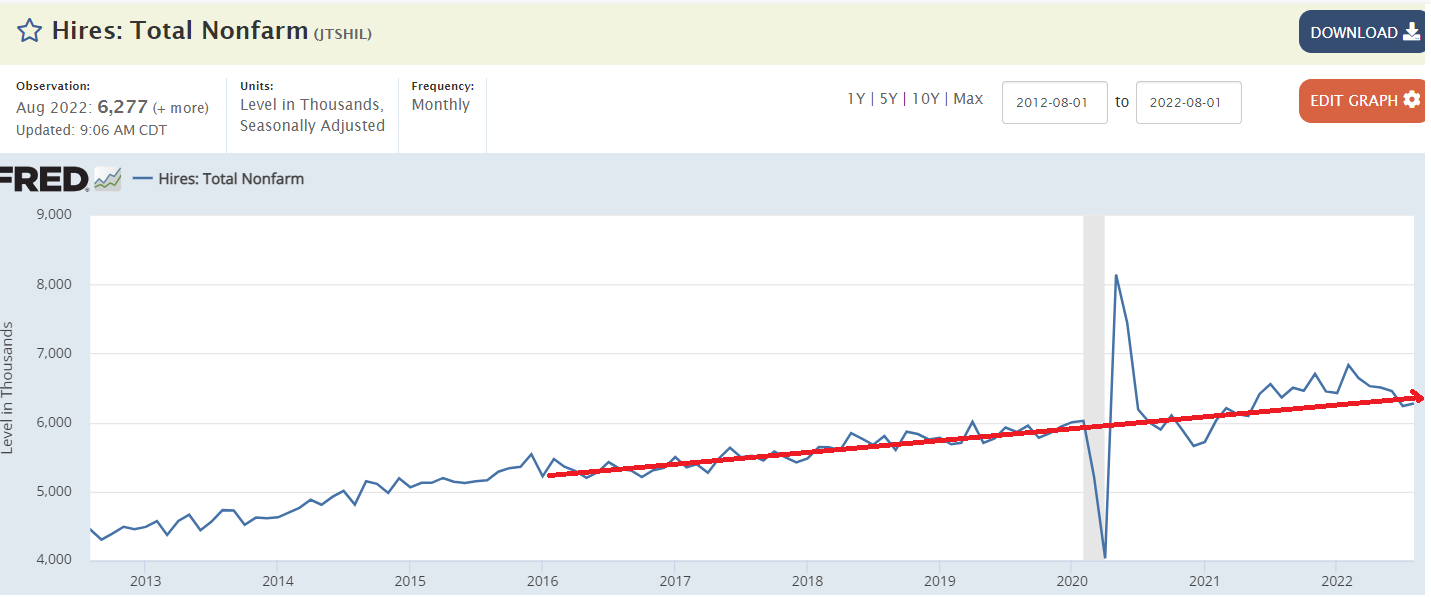

Back to pre-Covid trend line:

A slight decline for the month but still trending higher. No sign of recession here:

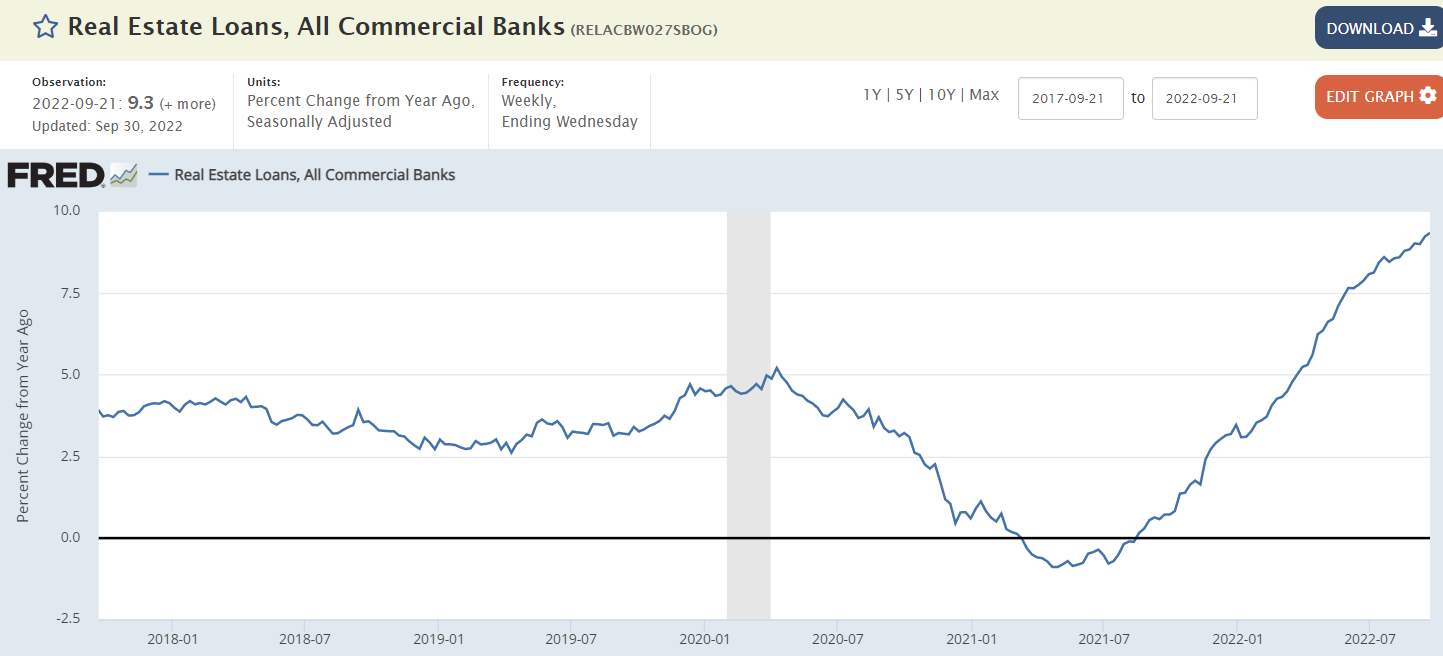

The rate of growth of bank real estate lending continues to increase since the rate hikes were initiated: