Summary:

No recession yet, at least partially due to the increased federal deficit spending on interest payments as the Fed hikes rates: With debt/GDP the rate hikes have had the effect of about 0 billion/year of additional (highly regressive) federal deficit spending:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

No recession yet, at least partially due to the increased federal deficit spending on interest payments as the Fed hikes rates: With debt/GDP the rate hikes have had the effect of about 0 billion/year of additional (highly regressive) federal deficit spending:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

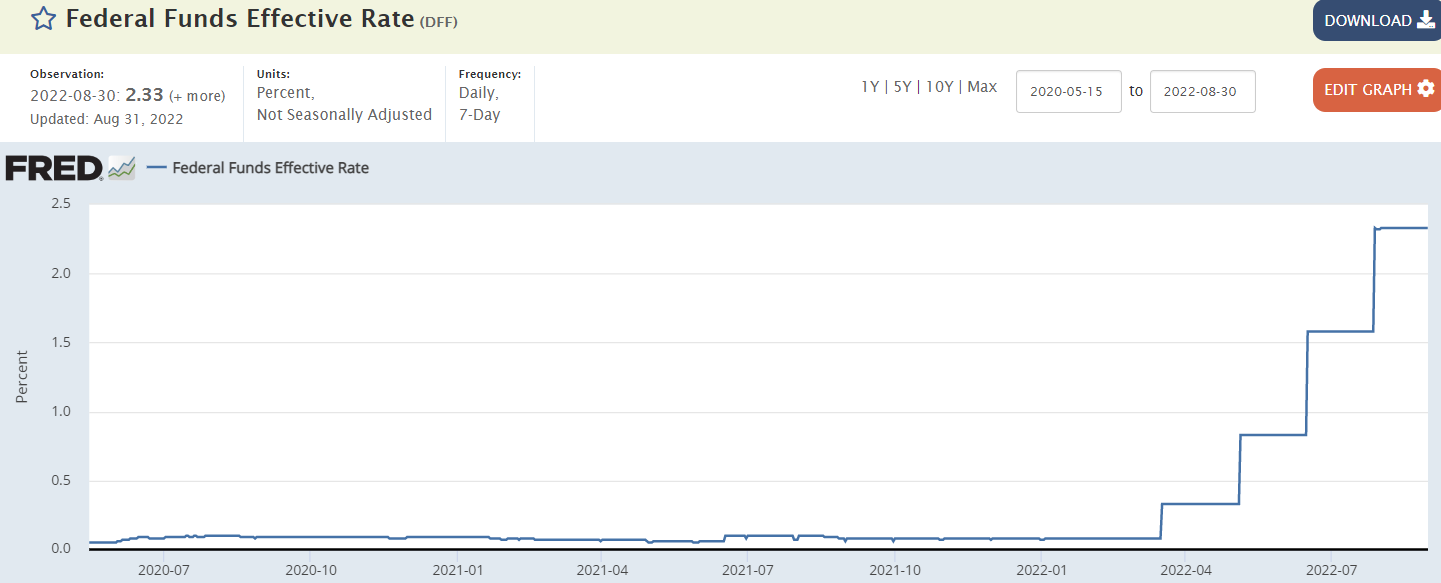

No recession yet, at least partially due to the increased federal deficit spending on interest payments as the Fed hikes rates:

With debt/GDP the rate hikes have had the effect of about $500 billion/year of additional (highly regressive) federal deficit spending: