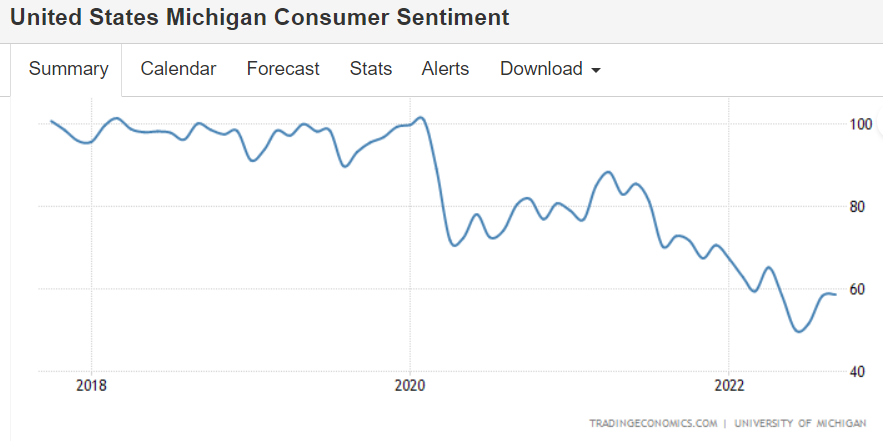

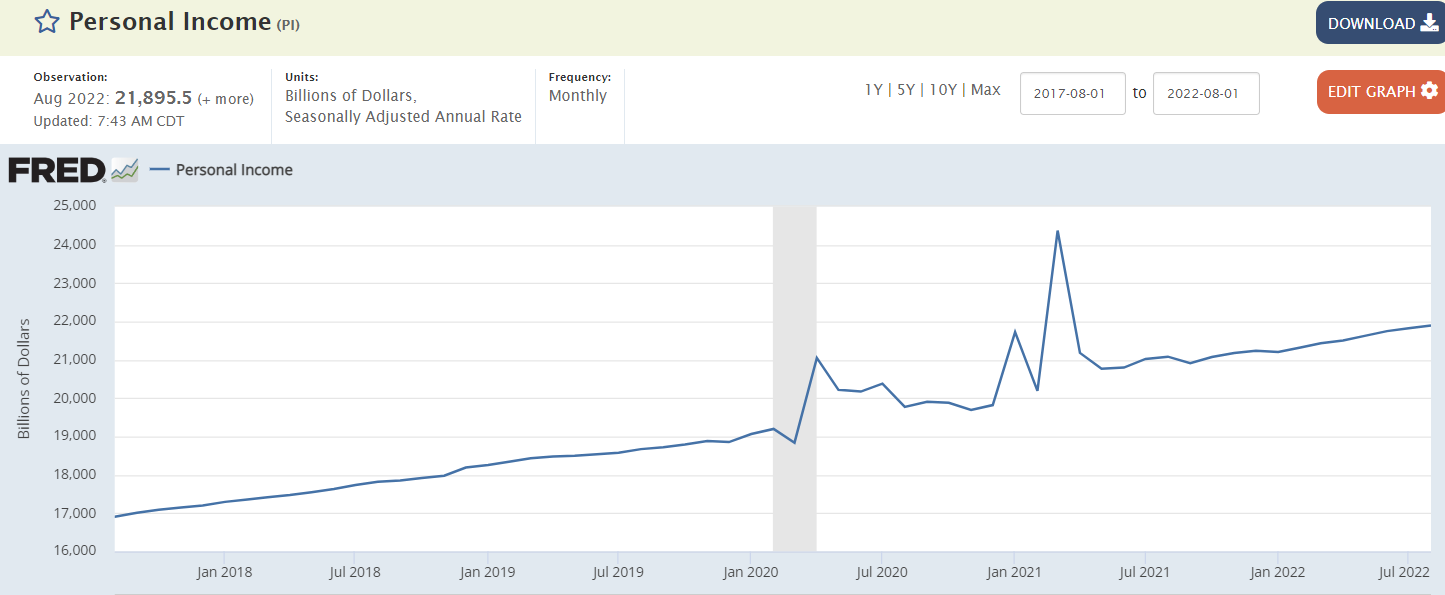

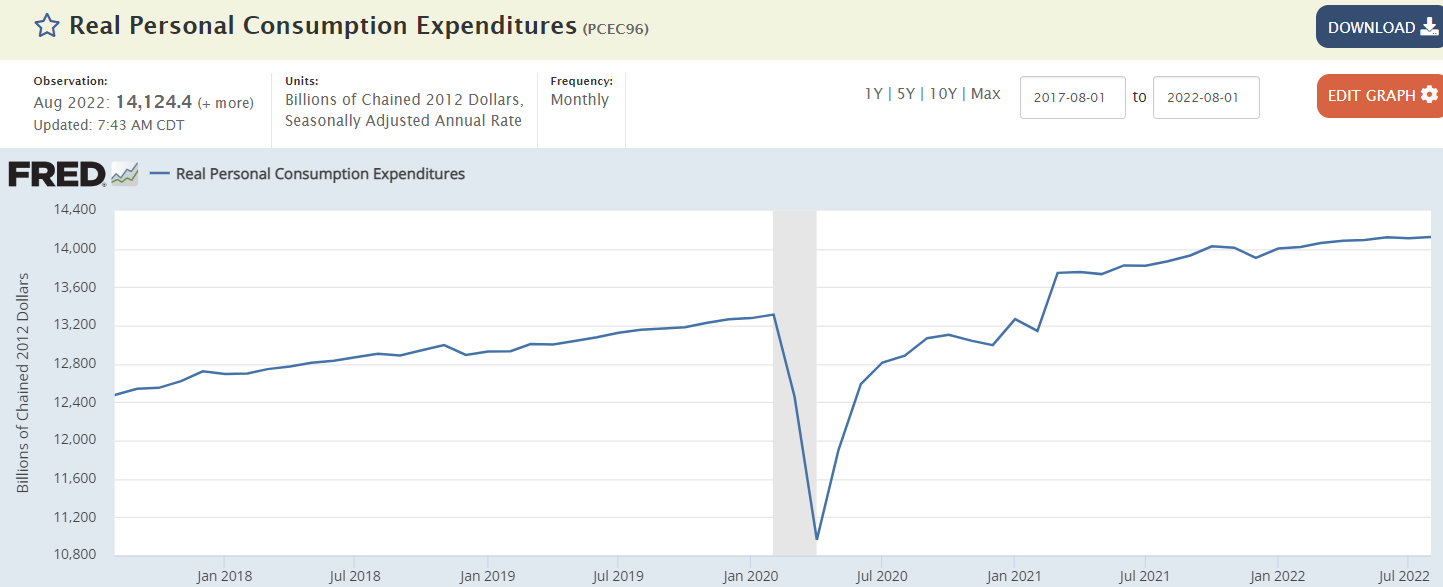

Modest growth continues.The data keeps telling me the rate hikes are helping the economy rather than hurting it: This is nominal, not adjusted for inflation, and there is no evidence of rate hikes slowing anything down: Same here for inflation-adjusted consumption: Too soon to say it is turned up, but better than expected and not indicating a recession: “The University of Michigan consumer sentiment for the US was revised lower to 58.6 in September of 2022 from a preliminary of 59.5, but remained above 58.2 in August and the highest in five months. Expectations were revised sharply lower (58 vs 59.9 in the preliminary estimate) while current conditions were seen better (59.7 vs58.9). Buying conditions for durables and the one-year economic outlook continued lifting

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The data keeps telling me the rate hikes are helping the economy rather than hurting it:

“The University of Michigan consumer sentiment for the US was revised lower to 58.6 in September of 2022 from a preliminary of 59.5, but remained above 58.2 in August and the highest in five months. Expectations were revised sharply lower (58 vs 59.9 in the preliminary estimate) while current conditions were seen better (59.7 vs58.9). Buying conditions for durables and the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook for business conditions. Meanwhile, inflation in the year ahead was seen higher (4.7% vs 4.6% in the preliminary estimate) while the five-year outlook was revised lower (2.7% vs 2.8%).” (United States Michigan Consumer Sentiment)