Summary:

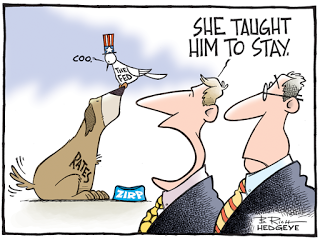

The Fed has left the interest rate unchanged... for now. One dissident vote for raising the rate now. The main reason according to the press release is that: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Pressures for a hike in October or December will increase significantly, even if the official position is vague enough. They say: "The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

Topics:

Matias Vernengo considers the following as important: Interest rates

This could be interesting, too:

The Fed has left the interest rate unchanged... for now. One dissident vote for raising the rate now. The main reason according to the press release is that: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Pressures for a hike in October or December will increase significantly, even if the official position is vague enough. They say: "The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

Topics:

Matias Vernengo considers the following as important: Interest rates

This could be interesting, too:

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

Lars Pålsson Syll writes Central bank independence — a convenient illusion

Merijn T. Knibbe writes How to deal with inflation?

Matias Vernengo writes Brief note on public debt and interest rates in Brazil

The Fed has left the interest rate unchanged... for now. One dissident vote for raising the rate now. The main reason according to the press release is that: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Pressures for a hike in October or December will increase significantly, even if the official position is vague enough. They say: "The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term."