Summary:

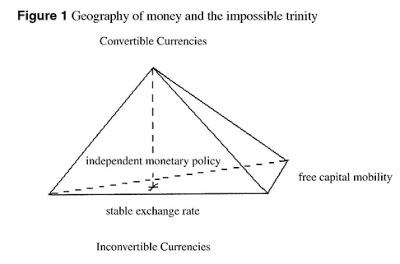

The Economist's brief is available here (subscription required). I have discussed the limitations of the Mundell-Fleming model in some posts (here and here, for example). But I have not discussed the limits to the trilemma fully. In this paper, I argue that under certain circumstances, associated to what Ben Cohen calls the geography of money, the trilemma might not hold. The countries at the top of the pyramid with convertible currencies do not face the harsh trade offs of the countries at the base. As I said back then: "The United States during the current crises is an example of the reduced impact of the trinitarian trade-offs for countries with convertible currencies. In fact, even though the economy was in a deep recession by the last quarter of 2008, the dollar, which had depreciated considerably over the previous years, started to appreciate as investors increasingly fled to Treasury bonds for safety. In other words, even though rates of interest were reduced to deal with the recession and the financial crisis, and capital mobility was preserved, a certain degree of exchange rate stability was maintained." If you're not at the top, I would recommend to give up the complete free mobility of capital, which should be no surprise.

Topics:

Matias Vernengo considers the following as important: Benjamin J. Cohen, capital controls, Geography of Money, Impossible Trinity

This could be interesting, too:

The Economist's brief is available here (subscription required). I have discussed the limitations of the Mundell-Fleming model in some posts (here and here, for example). But I have not discussed the limits to the trilemma fully. In this paper, I argue that under certain circumstances, associated to what Ben Cohen calls the geography of money, the trilemma might not hold. The countries at the top of the pyramid with convertible currencies do not face the harsh trade offs of the countries at the base. As I said back then: "The United States during the current crises is an example of the reduced impact of the trinitarian trade-offs for countries with convertible currencies. In fact, even though the economy was in a deep recession by the last quarter of 2008, the dollar, which had depreciated considerably over the previous years, started to appreciate as investors increasingly fled to Treasury bonds for safety. In other words, even though rates of interest were reduced to deal with the recession and the financial crisis, and capital mobility was preserved, a certain degree of exchange rate stability was maintained." If you're not at the top, I would recommend to give up the complete free mobility of capital, which should be no surprise.

Topics:

Matias Vernengo considers the following as important: Benjamin J. Cohen, capital controls, Geography of Money, Impossible Trinity

This could be interesting, too:

Matias Vernengo writes Dollar Hegemony and Argentina

Matias Vernengo writes Dollar Hegemony, coming soon

Matias Vernengo writes Capital controls and economic development

Matias Vernengo writes Raúl Prebisch as a Central Banker and Money Doctor

The Economist's brief is available here (subscription required). I have discussed the limitations of the Mundell-Fleming model in some posts (here and here, for example). But I have not discussed the limits to the trilemma fully. In this paper, I argue that under certain circumstances, associated to what Ben Cohen calls the geography of money, the trilemma might not hold. The countries at the top of the pyramid with convertible currencies do not face the harsh trade offs of the countries at the base.

As I said back then:

As I said back then:

"The United States during the current crises is an example of the reduced impact of the trinitarian trade-offs for countries with convertible currencies. In fact, even though the economy was in a deep recession by the last quarter of 2008, the dollar, which had depreciated considerably over the previous years, started to appreciate as investors increasingly fled to Treasury bonds for safety. In other words, even though rates of interest were reduced to deal with the recession and the financial crisis, and capital mobility was preserved, a certain degree of exchange rate stability was maintained."If you're not at the top, I would recommend to give up the complete free mobility of capital, which should be no surprise.