[embedded content] My talk at the Universidad Centroamericana José Simeón Cañas (UCA), El Salvador 20/10/2020. On capital controls and development and in Spanish, of course.

Read More »Raúl Prebisch as a Central Banker and Money Doctor

Here we edited with Esteban Pérez and Miguel Torres some unpublished manuscripts from Prebisch related to the Federal Reserve missions, led by Robert Triffin, to the Dominican Republic and Paraguay, in which he emphasizes the need of capital controls in peripheral countries that did NOT have the key hegemonic currency. There is also a discussion of Keynes and White's plans for Bretton Woods, which were partially published before. In Spanish. Happy New Year!

Read More »A Tale of Two Currency Crises: A Short Comment

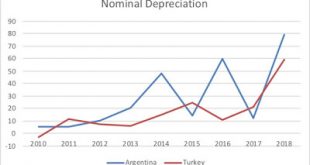

So the Turkish foreign exchange crisis is all over the news. But the Argentine one is less conspicuous in the international media. Turkey's economy has had many similarities with Latin American economies over the years, in terms of the incomplete process of industrialization, and the types of crises associated with neoliberal reforms over the last three decades. Note, however, that the Argentine nominal depreciation has been larger than the Turkish (the same is true if you go back to the...

Read More »Bill Mitchell — The Left propaganda that the state is powerless – continues

When we published our latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World – last September, Thomas Fazi and I approached the UK Guardian to see if they would publish an Op Ed by us summarising the main arguments presented in the book. We received no response. Pluto tell us that the book is one of their better sellers since it was published. And it is not as if the topic is irrelevant in the Guardian’s assessment. That is clear from the fact...

Read More »Daniela Gabor — MMT Meets Rey’s Dilemma: A Balance Sheet View Of Capital Flight (Coming Soon To An Em Country Near You)

Recently, a colleague emailed with the following set of questions: ‘a balance sheet approach to defending currencies. Do you know literature that explains in detail the globally interlocking balance sheets between central banks, commercial banks and what happens when a national government has to defend its currency? What is the role of national and foreign reserves and how do they travel these balance sheets in the process of trying to defend a currency? I came back to this question when...

Read More »Bill Mitchell — Prime Minister Corbyn should have no fears from global capital markets

Bill addresses many issues in this post that MMT economists don't ordinarily focus on like capital markets, capital flows, capital flight, capital controls, and exchange rate depreciation. Since most progressives don't understand the background and dynamics they generally get sucked into commonly deployed neoliberal traps. Bill shows how they don't need to.Bill Mitchell – billy blogPrime Minister Corbyn should have no fears from global capital marketsBill Mitchell | Professor in Economics...

Read More »The Impossible Trinity Revisited

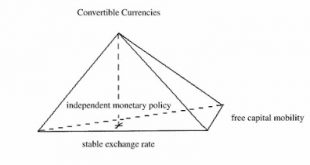

The Economist's brief is available here (subscription required). I have discussed the limitations of the Mundell-Fleming model in some posts (here and here, for example). But I have not discussed the limits to the trilemma fully. In this paper, I argue that under certain circumstances, associated to what Ben Cohen calls the geography of money, the trilemma might not hold. The countries at the top of the pyramid with convertible currencies do not face the harsh trade offs of the countries at...

Read More »A novel capital control proposal

New book By Pablo Bortz (Guest blogger)*After the breakdown of the Bretton Woods regime and the subsequent deregulation in capital flows around the globe, the movement of financial assets and liabilities has increased several times faster than trade and GDP growth. While still mainly concentrated between advanced countries, financial flows to emerging and developing economies (EDEs) have been rising at an exponential rate, particularly in the last two decades. However, public external...

Read More »Ilene Grabel on capital controls

New paper on the resurgence of capital controls. From the Abstract: The startling resuscitation of capital controls during the global crisis has substantially widened policy space in the global north and south. The paper highlights five factors that contribute to the evolving rebranding of capital controls. These include: (1) the rise of increasingly autonomous developing states, largely as a consequence of their successful response to the Asian crisis; (2) the increasing confidence and...

Read More »There are controls, and then there are controls….

Guest post by Sigrún DavídsdóttirNow that Greece has controls on outtake from banks, capital controls, many commentators are comparing Greece to Iceland. There is little to compare regarding the nature of capital controls in these two countries. The controls are different in every respect except in the name. Iceland had, what I would call, real capital controls – Greece has control on outtake from banks. With the names changed, the difference is clear.Iceland – capital controlsThe controls in...

Read More » Heterodox

Heterodox