Summary:

I'm still reading The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, which is fun, well-written and in my view less controversial than what most reviews have suggested. Yes, inequality tends to fall mostly by violent means during periods of crisis. Note, also, that Walter Scheidel uses in this book the concept of surplus, and as noted earlier here (or here and here) before is part of this broader group of social scientists that still use the concepts of the old and forgotten classical political economists. There are significant advantages to this approach (see here, for example). Having said there is an issue that is a bit annoying in the book, which is it simplistic Monetarist view of hyperinflation. For example, he says about

Topics:

Matias Vernengo considers the following as important: Great Compression, Hyperinflation, inequality, Scheidel, Surplus Approach

This could be interesting, too:

I'm still reading The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, which is fun, well-written and in my view less controversial than what most reviews have suggested. Yes, inequality tends to fall mostly by violent means during periods of crisis. Note, also, that Walter Scheidel uses in this book the concept of surplus, and as noted earlier here (or here and here) before is part of this broader group of social scientists that still use the concepts of the old and forgotten classical political economists. There are significant advantages to this approach (see here, for example). Having said there is an issue that is a bit annoying in the book, which is it simplistic Monetarist view of hyperinflation. For example, he says about

Topics:

Matias Vernengo considers the following as important: Great Compression, Hyperinflation, inequality, Scheidel, Surplus Approach

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Robert Skidelsky writes The Roots of Europe’s Immigration Problem – Project Syndicate

Nick Falvo writes Report finds insufficient daytime options for people experiencing homelessness

Nick Falvo writes Housing and homelessness in London (England)

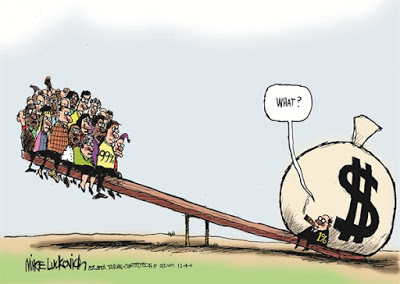

I'm still reading The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, which is fun, well-written and in my view less controversial than what most reviews have suggested. Yes, inequality tends to fall mostly by violent means during periods of crisis. Note, also, that Walter Scheidel uses in this book the concept of surplus, and as noted earlier here (or here and here) before is part of this broader group of social scientists that still use the concepts of the old and forgotten classical political economists. There are significant advantages to this approach (see here, for example).

Having said there is an issue that is a bit annoying in the book, which is it simplistic Monetarist view of hyperinflation. For example, he says about the two world wars and the inter-war period that:

... the United Kingdom, the United States, and Canada were prepared to 'soak the rich,' whereas more autocratic systems such as Germany, Austria-Hungary, and Russia preferred to borrow or print money to sustain their war effort. The latter, however, later paid a high price through hyperinflation and revolution, shocks that likewise compressed inequality.”

There is no more detailed analysis, but one would infer from this that if the elites chose to print money to finance their war incurred fiscal deficits they ended up with hyperinflation. I have discussed hyperinflations before here (see also this one). Don't get me wrong, hyperinflations are destructive forces and certainly played a role in the Great Contraction (the inequality reducing forces that operated in this period, although I would put, as Scheidel seems to do also, more emphasis on the policy variables like New Deal kind of programs, taxation, land reform, etc). However, money supply was simply endogenous and had little impact on economies that were already in shambles. Inflation (hyper) resulted from the collapse of the economies and more often than not the pressing need for foreign currency that led to massive depreciation, and wage resistance.

You can read my paper on inflation and money here, if you're interested.