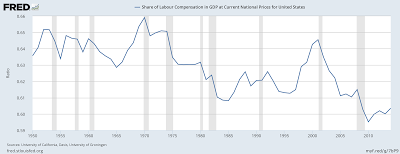

I discussed on several occasions before the worsening of income distribution and the squeeze of the labor share in total income. Figure below provides updated information. Professor Autor and some of his co-authors suggest this in part might result from the rise of the 'superstar firm.' In other words, Facebook, Google (Alphabet), Amazon, Apple, etc and the winner take all economy. This paper (h/t Santiago Capraro) argues that this results from market power reflected in higher mark ups.Note that the paper by Autor et. al. suggests that superstar firms are more efficient and as their share of the market increase, their higher productivity and reduced labor force leads to a lower share for labor in the aggregate. It is mostly a technological effect for them.I have my doubts, of course,

Topics:

Matias Vernengo considers the following as important: inequality, mark up pricing, super firms

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Robert Skidelsky writes The Roots of Europe’s Immigration Problem – Project Syndicate

Nick Falvo writes Report finds insufficient daytime options for people experiencing homelessness

Nick Falvo writes Housing and homelessness in London (England)

Professor Autor and some of his co-authors suggest this in part might result from the rise of the 'superstar firm.' In other words, Facebook, Google (Alphabet), Amazon, Apple, etc and the winner take all economy. This paper (h/t Santiago Capraro) argues that this results from market power reflected in higher mark ups.

Note that the paper by Autor et. al. suggests that superstar firms are more efficient and as their share of the market increase, their higher productivity and reduced labor force leads to a lower share for labor in the aggregate. It is mostly a technological effect for them.

I have my doubts, of course, about any story that leaves out the relative bargaining power of the labor force, and in this story the regulatory environment that has allowed the information age firms to have such large shares of the market. But that's another story.