Summary:

Ilene Grabel's new book, When Things Don't Fall Apart: Global Financial Governance and Developmental Finance in an Age of Productive Incoherence, is out. From Dani Rodrik’s Foreword: “It happens only rarely and is all the more pleasurable because of it. You pick up a manuscript that fundamentally changes the way you look at certain things. This is one such book. Ilene Grabel has produced a daring and delightful reinterpretation of developments in global finance since the Asian financial crisis of 1997–1998.” From the jack description: In When Things Don’t Fall Apart, Ilene Grabel challenges the dominant view that the global financial crisis had little effect on global financial governance and developmental finance. Grabel’s chief positive claim is that the global crisis induced

Topics:

Matias Vernengo considers the following as important: Global crisis, Grabel

This could be interesting, too:

Ilene Grabel's new book, When Things Don't Fall Apart: Global Financial Governance and Developmental Finance in an Age of Productive Incoherence, is out. From Dani Rodrik’s Foreword: “It happens only rarely and is all the more pleasurable because of it. You pick up a manuscript that fundamentally changes the way you look at certain things. This is one such book. Ilene Grabel has produced a daring and delightful reinterpretation of developments in global finance since the Asian financial crisis of 1997–1998.” From the jack description: In When Things Don’t Fall Apart, Ilene Grabel challenges the dominant view that the global financial crisis had little effect on global financial governance and developmental finance. Grabel’s chief positive claim is that the global crisis induced

Topics:

Matias Vernengo considers the following as important: Global crisis, Grabel

This could be interesting, too:

Matias Vernengo writes The New IMF and the Covid Crisis

Andrew Jackson writes Crashed: How a Decade of Financial Crises Changed the World

Matias Vernengo writes The Global Crisis: Beyond Secular Stagnation

Marc Lee writes An Analysis of Financial Flows in the Canadian Economy

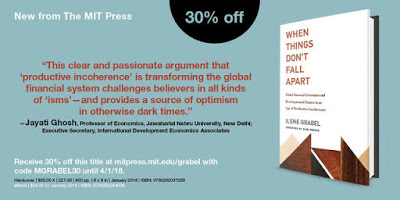

Ilene Grabel's new book, When Things Don't Fall Apart: Global Financial Governance and Developmental Finance in an Age of Productive Incoherence, is out. From Dani Rodrik’s Foreword:

“It happens only rarely and is all the more pleasurable because of it. You pick up a manuscript that fundamentally changes the way you look at certain things. This is one such book. Ilene Grabel has produced a daring and delightful reinterpretation of developments in global finance since the Asian financial crisis of 1997–1998.”From the jack description:

In When Things Don’t Fall Apart, Ilene Grabel challenges the dominant view that the global financial crisis had little effect on global financial governance and developmental finance. Grabel’s chief positive claim is that the global crisis induced disconnected and ad hoc discontinuities in global financial governance and developmental finance that are now having profound effects on emerging market and developing economies. Most observers have failed to appreciate this phenomenon owing to a heroic narrative of social change that discounts all but grand, systemic ruptures in institutions and policy. The chief normative claim is that the resulting incoherence in global financial governance is productive rather than debilitating. In the age of productive incoherence a more complex, dense, fragmented, and pluripolar form of global financial governance is expanding possibilities for policy and institutional experimentation, policy space for economic and human development, financial stability and resilience, and financial inclusion. Grabel draws on key theoretical commitments of Albert Hirschman to cement the case for the productivity of incoherence. Inspired by Hirschman, Grabel demonstrates that meaningful change often emerges from disconnected, erratic, experimental, and inconsistent adjustments in institutions and policies as actors pragmatically manage in an evolving world. Grabel substantiates her claims with empirically-rich case studies that explore the effects of recent crises on established and new networks of financial governance (such as the G-20); transformations within the IMF; institutional innovations in liquidity support and project finance from the national to the transregional levels; and the “rebranding” of capital controls. Grabel concludes with careful examination of the opportunities and risks associated with the evolutionary transformations underway.The book has been endorsed by Antonio Ocampo, Jayati Ghosh, Ha-Joon Chang, and Mark Blyth. It's a must if you're interested in the changes in the post-Bretton Woods financial architecture after the Global Financial Crisis of 2008.