New Working Paper published by the Political Economy Research Institute (PERI). From the abstract:Interest rates have declined over the last 40 years, a period of increasing inequality. The steady decline in interest rates has been interpreted by and large as resulting from a decline of the natural rate of interest. This paper surveys the main explanations associated with the notion of a decline in the natural rate of interest, including the savings glut and the secular stagnation...

Read More »Rational expectations, New Classicals, and Real Business Cycles Schools

[embedded content] A video conversation with LP Rochon and my co-author Bill McColloch on our chapter for the forthcoming book on the history of ideas. Many topics, including Friedman vs Lucas relevance, the Lucas critique, the empirical turn in the profession, and more. More info on the book soon.

Read More »Friedman vs. Wicksell

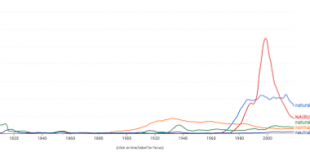

Slowly, but steadily the Wicksellian concept of a natural, normal or neutral rate of interest is making a come back and becoming more relevant and cited than Friedman's natural rate of unemployment and its awkward twin the Non Accelerating Inflation Rate of Unemployment (NAIRU).Note that up to Friedman's infamous presidential address the normal rate dominated the field. But in all fairness, even thought it has lost space it seems that Friedman's natural rate of unemployment has a lot of...

Read More »Di Bucchianico on Krugman and the Liquidity Trap

New paper on the problems of Krugman and the Liquidity Trap argument (some will be able to download if for free, and I recommend this version; however, there is a previous working paper linked at the bottom for those unable to open).From the abstract: Krugman’s ‘liquidity trap’ model constituted a ground-breaking contribution by attributing the long-lasting Japanese stagnation to a negative natural interest rate. Our critique to such a proposal will focus on three aspects. First, we will...

Read More »“Natural Rate”–What if it isn’t? — Matt Reed

Users of Twitter know the thrill of seeing a tweet so good that you want to have it embroidered on pillows. The form lends itself to aphorisms or clever asides; Oscar Wilde and Dorothy Parker would have loved it. This week, the economist Stephanie Kelton posted a tweet for the ages: “What is the natural rate of college enrollment?” It’s slyly great. It’s a play on the “natural rate of unemployment,” a discredited concept popular in the 90’’s. The NAIRU was supposed to represent the...

Read More »Forget the Natural Rate, says the Head of the Minneapolis Fed

Low rates are here to stay The head of the Minneapolis Fed agrees with something that I discussed several times here (or here for the use of alternative unemployment measures like U6) in the blog, that the unemployment level (U3) is not a good measure of the slack in the labor market. Neel Kashkari says: No one knows how many more Americans want to work. But if the job market continues to improve with only modest wage growth and below-target inflation, it can be safely assumed that...

Read More »Peter Cooper — One of the Fundamental Differences Between Modern Monetary Theory and New Keynesian Economics

Independent economist Peter Cooper addresses the "we-knew-it-all-along" claim and shows, not really.heteconomistOne of the Fundamental Differences Between Modern Monetary Theory and New Keynesian EconomicsPeter Cooper

Read More »Symposium on “Milton Friedman’s Presidential Address at 50”

Here all the links to the papers of the last issue of the Review of Keynesian Economics:Thomas Palley and Matías Vernengo: Milton Friedman’s Presidential Address at fifty Robert Solow: A theory is a sometime thing Robert J. Gordon: Friedman and Phelps on the Phillips curve viewed from a half century’s perspective David Laidler: Why the fuss? Friedman (1968) after 50 years Roger E. A. Farmer: The role of financial policy James Forder: Why is labour market adjustment so slow in...

Read More »Bob Solow on Friedman’s Presidential address and the natural rate failure

His full paper was published in the Review of Keynesian Economics. He reminds us that it was a talk to undermine 'eclectic Keynesianism' about which he says: Milton Friedman's famous presidential address of 1968... aims to undermine the eclectic American Keynesianism of the 1950s and 1960s, the habits of thought to which Joan Robinson attached the (unintentionally) complimentary label of ‘bastard’ Keynesianism. I will only say a little about what that was. In fact, the adjective ‘eclectic’...

Read More »Dirk Ehnts — A Post-Keynesian comment on “Marx’s “Capital”‘ (6th ed.) [by (Ben Fine and Alfredo Saad-Filho]

This debunks the idea by the authors (Ben Fine and Alfredo Saad-Filho) that “underlying Keynesianism is the idea that there is a natural or equilibrium full-employment interest rate”. Keynes quotes proving the point.econoblog 101A Post-Keynesian comment on “Marx’s “Capital”‘ (6th ed.)Dirk Ehnts | Lecturer at Bard College Berlin

Read More » Heterodox

Heterodox