That Argentina is in for a major crisis is, I think, pretty clear and well-known. I won't delve too much on the political aspects of what Finchelstein refers to as wannabe Fascistic tendencies of the new president. Today a major protest should take place, and the same people that suggested that Peronists groups forced the recipients of social transfers to participate (something that was never proved) under threat of being cutoff, are threatening to cutoff those that participate. You know, because they defend individual liberties and all.First of all, the economic plan (and many heterodox authors had been calling for what exactly done) was simply maxi-depreciation, of 100 percent, of the official exchange rate, to try to close the gap with the parallel market (or blue) rate, and the

Topics:

Matias Vernengo considers the following as important: Bimonetarism, contractionary depreciation, Dollarization, inflation

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Lars Pålsson Syll writes How inequality causes financial crises

Matias Vernengo writes Inflation, real wages, and the election results

That Argentina is in for a major crisis is, I think, pretty clear and well-known. I won't delve too much on the political aspects of what Finchelstein refers to as wannabe Fascistic tendencies of the new president. Today a major protest should take place, and the same people that suggested that Peronists groups forced the recipients of social transfers to participate (something that was never proved) under threat of being cutoff, are threatening to cutoff those that participate. You know, because they defend individual liberties and all.

First of all, the economic plan (and many heterodox authors had been calling for what exactly done) was simply maxi-depreciation, of 100 percent, of the official exchange rate, to try to close the gap with the parallel market (or blue) rate, and the announcement of a massive fiscal adjustment, supposedly of about 5 percent of GDP. As discussed here several times, the effects of these policies are certainly a significant acceleration of inflation, and a massive recession. These are well-known effects of a maxi-depreciation. Prices will adjust to the massive increase in the cost of imported inputs, and the increase will reduce real wages (that, by the way, is one of the main reasons for the measure), and have a contractionary effect on spending, that will be compounded by the fiscal adjustment.

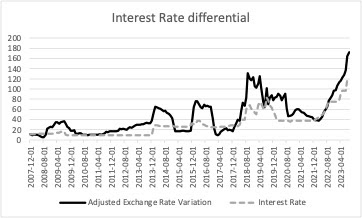

Two brief technical things. The adjustment may not per se improve the fiscal accounts, since the economic collapse will reduce revenue too. It is a well-known rule that consolidations (reductions of debt and of deficits, the results of policies) tend to be more successful with a growing economy, and without a massive adjustment (reduction in spending and/or higher taxes, the direct policies).* Second, the reduction in the exchange rate premium (the gap between official and parallel rates) is not an indication that things are better, if it is done, as it was, by depreciating massively the official rate. In particular, the question is what will happen with the parallel premium in the near future. The official exchange rate will be on a crawling peg, if the announcement of the new minister is believable. And the premium has been very high, because of the interest rate differential between returns in pesos and in dollars, adjusted for risk (see figure below, which shows the interest rate in pesos compared to the actual depreciation of the currency, plus the US rate and the EMBI from JP Morgan). The remuneration in dollars is always higher.

The government has also announced a plan to essentially transform the central bank bonds (Leliqs) into treasury bonds. And the interest rate on the central bank bonds were kept low, presumably to get everybody into the treasury ones. However, the treasury bonds will have to pay a very high rate, since the the expected depreciation is large, and the government announced it will continue. That suggests that they are expecting people to continue to go to dollars, and that might actually lead to a persistence or increase of the exchange rate premium. In particular, if there is significant wage resistance, to be expected after this massive depreciation, and inflation accelerates.

In the absence of dollars, there is little chance of a stabilization. The government may very well be trying to accelerate inflation to create the conditions for a dollarization later on.

* Most economists confuse adjustment and consolidation of fiscal accounts. In part to cloud the fact that consolidation does not require adjustment. The US reduced its massive debt accumulation during World War II, without adjustment, by growing fast in the post-war era, in which the government did run deficits frequently and the welfare state was actually expanded, particularly in the 1960s.