In a post last week, I raised the possibility that the vaccines might not get the virus under control this winter. Since the markets still seem to be pricing in vaccine success, this could have implications for investors. How might we think this through in more depth? One way to do this is by looking at the Google Mobility Index and seeing if it is any good at explaining EPS growth in the S&P. Here I take an aggregate construction from the index that encompasses all of the economic variables – transport, retail, grocery and workplace movement. I also push the mobility index forward one quarter which seems to give a more reasonable fit – presumeably due to an accounting lag with the EPS data. Looks pretty good. Here is the same data in linear regression space. Okay, so at

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

In a post last week, I raised the possibility that the vaccines might not get the virus under control this winter. Since the markets still seem to be pricing in vaccine success, this could have implications for investors. How might we think this through in more depth?

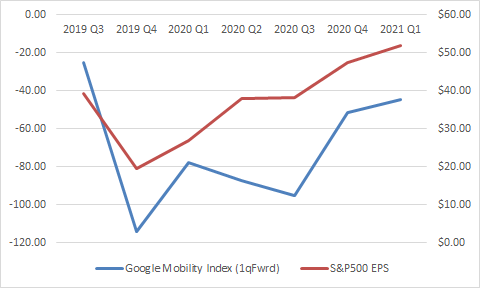

One way to do this is by looking at the Google Mobility Index and seeing if it is any good at explaining EPS growth in the S&P. Here I take an aggregate construction from the index that encompasses all of the economic variables – transport, retail, grocery and workplace movement. I also push the mobility index forward one quarter which seems to give a more reasonable fit – presumeably due to an accounting lag with the EPS data.

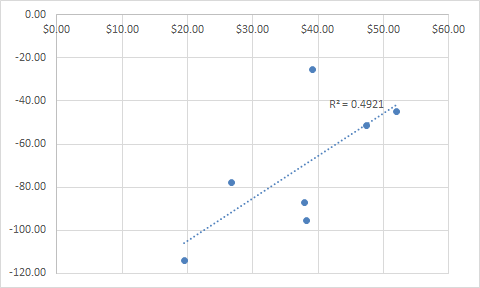

Looks pretty good. Here is the same data in linear regression space.

Okay, so at least histroically there appears to be a strong relationship here. It also makes logical sense as the mobility index should be tracking levels of footfall related to economic activity.

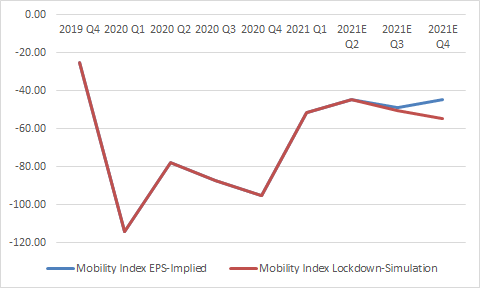

Because the EPS index always comes accompanied by handy analyst forecasts this means that we can pull out an implied mobility index forecast – assuming the linear relationship shown in the above regression. We can also construct a scenario where restrictions are reimposed (details in the appendix). Here is what they look like.

This tells us exactly what we assumed in the last post: namely, that EPS forecasts – and presumeably therefore price action in the stock market – is implying a slight improvement or at least stability in footfall related to economic activity; that is, no more lockdowns or similar interventions. By contrast our – very conservative (see appendix) – lockdown-simuluation shows a slight deterioration.

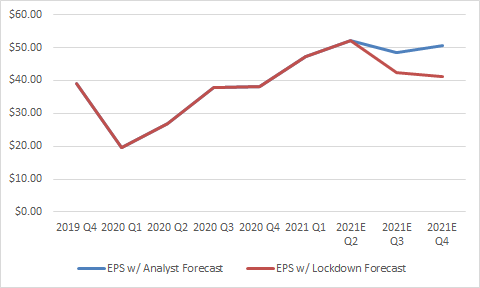

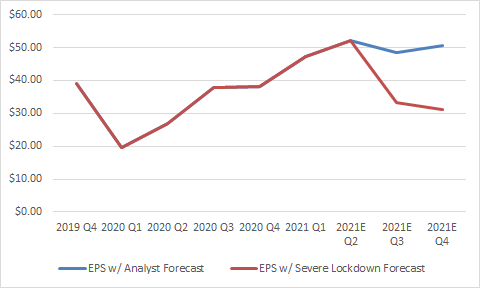

Using our alternative mobility index we can then pull out an EPS forecast and compare it to the analyst forecast.

As we would expect we see that EPS goes back into decline. Not a very marked decline, mind you – we have made a very conservative assumption for lockdown severity. But enough of a reversal that it would likely capture the attention of the markets.

So, is this model realistic? Maybe, maybe not. It is perfectly possible that businesses are now perfectly well adapted to lockdown and lockdown-lite interventions and that the correlation between the mobility index and EPS will breakdown this winter. But we are making very conservative assumptions about the impact of the lockdown on mobility for this reason.

I reckon that this is not an unreasonable estimate. Anyway, the real point of this exercise is to put some numbers on a much more important intuition. An intuition that leads us to ask the question once more: are markets ready for vaccine failure and possible lockdown-ish interventions this winter?

Finally, let us see what EPS looks like if we assume a severe lockdown scenario. This is a scenario where the lockdown is as punitive as it was in autumn-winter 2020 and we assume that businesses and consumers have not adapted since then. I do not believe that this is a reasonable estimate – for one, it seems unlikely that many red states would lock down even if blue states did this year – but it is a nice exercise to work through to see a true worst-case scenario.

Ouch.

Appendix

I estimate the impact of a lockdown as such. I take the percentage decline from Q2 2020 to Q3 2020 and apply it to Q2 2021/Q3 2021. I do the same for Q4.

This is conservative because I am taking percentage decline instead of actual decline. We can see how this is conservative if we take an example.

Between Q2 2020 and Q3 2020 we saw a 12% decline in the Google Mobility Index. Applying this to the same period in 2021, the index declines from -44.6 to -50.2. If we took the actual decline between Q2 2020 and Q3 2020 (-9.6) and applied it to the 2021 data we would see the index decline from -44.6 to -54.3. This effect would be amplified further in Q4 which would fall to -62.2 rather than -54.8 using the percentage decline method.

As I have stated above, I use the percentage decline method to make a conservative assumption when considering future locdown-ish policies because there has probably been some level of economic adaption since last year.