For the last year and a half the biggest sentiment driver in markets has undoutedly been COVID-19. This is perfectly reasonable as the virus is probably the biggest single driver of variables that matter in financial markets – from inflation expectations to earnings. Yet it has been striking that most financial analysts have been outsourcing their analysis of the trajectory of the virus to those in public health. In theory this is reasonable. Many are assuming that the public health experts are, well, experts. And since financial analysts are not experts in epidemiology, deferring to those that are is a rational course to take. Yet if this pandemic has made one thing crystal clear it is that the public health experts are far from infallible. This seems to be coming to a head

Topics:

Philip Pilkington considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

For the last year and a half the biggest sentiment driver in markets has undoutedly been COVID-19. This is perfectly reasonable as the virus is probably the biggest single driver of variables that matter in financial markets – from inflation expectations to earnings. Yet it has been striking that most financial analysts have been outsourcing their analysis of the trajectory of the virus to those in public health.

In theory this is reasonable. Many are assuming that the public health experts are, well, experts. And since financial analysts are not experts in epidemiology, deferring to those that are is a rational course to take. Yet if this pandemic has made one thing crystal clear it is that the public health experts are far from infallible.

This seems to be coming to a head this week. This week at least three major newspapers are throwing in the towel and admitting that the vaccine is not nearly effective enough to get the virus under control. The Financial Times runs the headline “Are vaccines becoming less effective at preventing Covid infection?”; the New York Times has “Israel, Once the Model for Beating Covid, Faces New Surge of Infections”; while The Times of London has “Double Covid vaccine doesn’t stop symptoms for half of Delta cases”.

The problem here for markets is simple enough: reflation and solid earnings growth was thought to be coming because the vaccine would return things to normal. Now that this looks unlikely, it is difficult to provide an alternative rational for reflation and solid earnings growth.

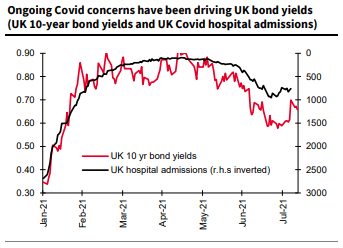

Are the markets waking up to this? Maybe. UK gilt yields have been tracking hospitalisations and in recent days they have ticked up.

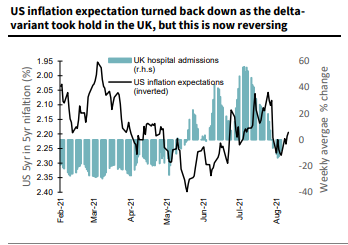

Inflation expectations took a dip too, although they later reversed.

It seems fair to say that markets are currently attempting to process the facts as they come in. There is no way they are at the point where they are accepting widespread failure of the vaccination program, but they are starting to feel out this possibility.

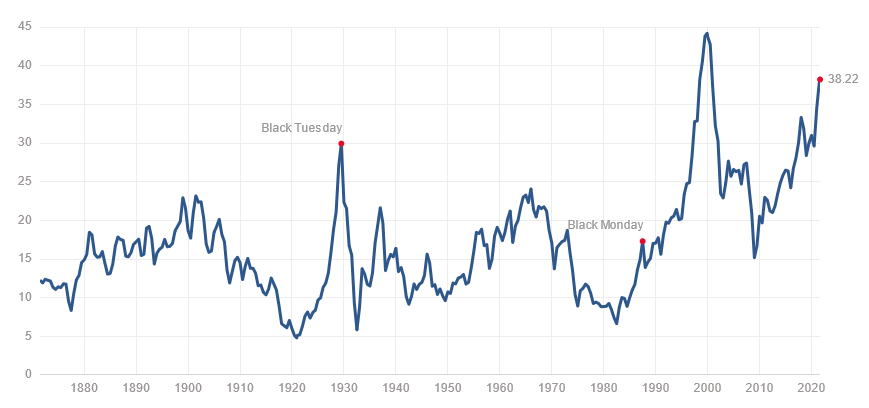

This isn’t just a question of interest to traders either. Investors should pay close attention too. Stock market valuations have gone truly nuts on what we must assume are very inflated future earnings growth expectations. The Shiller CAPE is at it’s second highest point in history.

Tobin’s Q has gone totally gangbusters, now exceeding any previous peak.

These are markets priced for perfection. Yet as we enter autumn/winter with a vaccine that is not keeping to the promises made on its behalf, we could be facing down another wave of the virus. This will then spur debate about more interventions that will impact the economy and with it earnings.