Extract from Resolutions of Brussels International Financial Conference 1920 SummaryThe UK is experiencing, as a result of the COVID 19 crisis and response, its most severe economic downturn on record; the largest in the last century was in 1921, when annual GDP fell by 9.7%. In assessing the likely level of the fall, the Office for Budget Responsibility (OBR)’s “reference scenario” seeks to take account of previous pandemic experience. The OBR and Resolution Foundation draw on a recent research paper (Barro, Weng & Ursúa) which claims that Spanish flu-generated economic declines for GDP and consumption amounted “in the typical

Topics:

Jeremy Smith considers the following as important: Economic History, Economics & Ideology, International & World

This could be interesting, too:

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Ann Pettifor writes Global Economic Governance: What’s “Growth” Got to Do with It?

Nick Falvo writes Homelessness among racialized persons

Merijn T. Knibbe writes Something about prices (IV). Gift exchange prices.

Extract from Resolutions of Brussels International Financial Conference 1920

Summary

The UK is experiencing, as a result of the COVID 19 crisis and response, its most severe economic downturn on record; the largest in the last century was in 1921, when annual GDP fell by 9.7%. In assessing the likely level of the fall, the Office for Budget Responsibility (OBR)’s “reference scenario” seeks to take account of previous pandemic experience. The OBR and Resolution Foundation draw on a recent research paper (Barro, Weng & Ursúa) which claims that Spanish flu-generated economic declines for GDP and consumption amounted “in the typical country” to 6 and 8% respectively.

While the flu pandemic must have had some real economic impact, at least in the short term, I contend that the macroeconomic evidence (at least for Europe and North America) as shown in the GDP and GDP per head statistics does not justify the conclusion at that level of decline, having regard to other factors. In particular, the research does not consider the deliberate policy responses at national and international levels at the end of World War I. The resolutions of the Brussels Financial Conference of autumn 1920 are cited.

These policy responses were uniformly in the direction of austerity (cutting public spending, getting rid of deficits and inflation), driven also to a large degree by the perceived imperative of a return to the gold standard – with the UK determined to do so at the pre-war rate.

The evidence demonstrates that, in the immediate aftermath of war and the flu pandemic, the UK government’s policy response of hard-line austerity and unremitting focus on balanced government budgets, allied to a dear money deflationary policy, was disastrous. The UK economy grew at a much slower rate than other major economies such as France and the US, with sustained mass employment.

The lesson for the future is that we must not fall back on another round of government-driven austerity. While the Financial Times, for example, has called for “Radical reforms — reversing the prevailing policy direction of the last four decades”, the Resolution Foundation seem to be calling largely for more of the same, with unimaginative calls for fiscal rules and return to central bank 2% inflation targeting. This risks a slide back into austerity politics, and fails to grasp the scale of the challenge. If we continue more or less as before, the next disaster will swiftly befall us.

This article is available here in pdf format

The COVID 19 depression

It is certain that the UK economy, as a result of the COVID 19 crisis and response, will experience its deepest depression for very many decades. During the last 100 years, the biggest annual fall in GDP was exactly 99 years ago, in 1921, when (if the statistics are to be trusted) the decline was 9.7%. What was worse was that this was the third successive year of major falls in output. The UK’s peak year for output, when the economy was on fullest war footing, was 1918. In 1919, real-terms output (GDP) is estimated to have fallen by 7.8%, and in 1920 by 5.8%. The total fall from peak to trough, over three years, was a huge 21.6%. (All this via the Bank of England’s “A millennium of macroeconomic data” database).

This past week, the Office for Budget Responsibility published their “Corona virus reference scenario”, in which they envisage that GDP in 2020 as a whole will fall 12.8%. This is based on the assumption that in Q2, (April to June) the decline will be 35.1% (to make the calculations simpler, this pretends that the damage begins in April, i.e. at the start of Q2, with March assumed stable).

But what is extraordinary about the OBR’s ‘scenario’ is that they assume that the economy will bounce back to ‘normal’ in Qs 3 and 4, i.e. from July onward, and that real GDP will grow in 2021 by a record-shattering 17.9%! (This ‘only’ brings things back more or less to where they would have been had the virus not struck, but is a very ‘brave’ assumption to make).

Seeking evidence from previous pandemics

The OBR’s paper includes a short section “Evidence from previous flu pandemics” (p.3), in which they say that “to calibrate some of our assumptions we have drawn on the Resolution Foundation’s (RF) survey of evidence from previous pandemics” from which RF argued “that annual output losses should therefore be at least as big as the high single or double digit peak losses seen during Spanish Flu and Ebola….”

The RF had published a Briefing Note in March (“Safeguarding governments’ financial health during coronavirus - what can policymakers learn from past viral outbreaks?”), in which the author, Richard Hughes, refers to the “Spanish flu” pandemic of 1918/19 as well as more recent, but more limited, instances such as SARS:

“During all of these past outbreaks and even more so during the current coronavirus pandemic, governments play a central role in not only treating the sick and containing the spread of the virus, but also in mitigating its economic impact on people, businesses, and the economy as a whole….

While its GDP impacts are difficult to disentangle from the economic consequences of the First World War and subsequent demobilisation, countries hardest hit by the [Spanish flu] pandemic saw GDP contract by 6 per cent in the US, 11 per cent in Canada, and 13 per cent in the UK in the aftermath of the outbreak in 1919. Recent research put the average falls in real per capita GDP attributable to Spanish flu at between 8.4 and 9.9 per cent for a typical country.”

This research referred to is set out in a paper (also March 2020) by Robert Barro, Joanna Weng and José Ursúa on “Lessons from the ‘Spanish Flu’ for the Coronavirus’s Potential Effects on Mortality and Economic Activity”, and its findings are summarised:

“Regressions with annual information on flu deaths 1918-1920 and war deaths during WWI imply flu-generated economic declines for GDP and consumption in the typical country of 6 and 8 percent, respectively. There is also some evidence that higher flu death rates decreased realized real returns on stocks and, especially, on short-term government bills.”

A small point – the RF paper is wrong in stating that this research puts the fall in real GDP per head attributable to Spanish flu at between 8.4 and 9.9% for a typical country. In fact, the authors state elsewhere (Vox EU) that

“The Great Influenza Pandemic is estimated to have reduced real per capita GDP and consumption of the typical country by 6.0% and 8.1%, respectively. WWI is associated with declines in GDP and consumption by 8.4% and 9.9%, respectively.”

So the figures cited by RF relate to the impact of the War, not of the Flu. Moreover, in a Table headed “The human and economic costs of past viral outbreaks have been large” (included in this and the RF’s April report “Doing more of what it takes - next steps in the economic response to coronavirus”), the RF cite the GDP loss from the Spanish flu pandemic (for 187 countries) as 6-13%, with a footnote stating that this refers to Canada, the US and UK, without qualification. As set out below, there are several reasons to doubt this range of figures which exceeds even that put forward by Barro et al.

But the problems go further. We can surely agree that the Spanish flu pandemic will have had some real economic impact, given that younger (therefore potentially economically active) people were more likely to die from it, and at its peak there would have been considerable social as well as economic dislocation. But how can we – and if so how far - isolate the economic impact from other developments, given the lack of action (beyond war-related actions) at the time by “largely laissez-faire systems of government”, as David Killingray, writing in 2003, put it? [A New 'Imperial Disease': The Influenza Pandemic of 1918-9 and its Impact on the British Empire] As Killingray notes,

“dramatic government intervention had to await the new economic climate and ideas provoked by the Depression years of the 1930s”

While it is entirely legitimate for economic researchers to seek to make broad estimates of the economic impact of the Spanish flu pandemic, I am not convinced by the methodology and the results of the research by Barro, Weng and Ursua. This involves isolating just two elements, with many assumptions made across the 42 countries included, namely war mortality and flu mortality, and excluding – in this most political of periods – the effects of any economic policy-making decisions. Despite this, the authors claim to be able to separate the economic impact of war (and war’s end) from the impact of the virus.

The authors summarise their methodology:

“Table 3 uses regression analysis to assess effects of the Great Influenza Epidemic and World War I on economic growth, gauged by growth rates of real per capita GDP and real per capita consumption (personal consumer expenditure). The sample periods for annual growth rates are 1901 to 1929. The start year is somewhat arbitrary, and results are similar if we go back to 1870. The ending of the sample in 1929 simplifies the analysis by excluding the Great Depression.”

An analysis whose time sample is “simplified” by deliberately excluding the Great Depression surely raises some issues. Moreover, the economic data for most countries for the period in question is at best approximate (though Barro has made his contribution to improving the Maddison historic datasets (see here for more on this), and has been reconstructed from a range of sources. While there is certainly a correlation between the end of WWI and significant falls in output, the extent of a causal relationship with the flu pandemic is very far from clear. After WW2, the UK and US, for example, both saw very significant falls in GDP and GDP per head. In the UK, GDP per head fell from peak 1943 to trough 1947 by around 14.5% (GDP by a little less). In the US, the fall from peak (1944) to trough in 1947 was also over 14%.

There is however another, more significant, weakness in the specifics of the case made by Barro et al. - there is not a single reference in their research paper to the governmental or international economic policy responses to the war-end and post-war circumstances.

There is a lot of evidence to show that economic policy-makers, in the aftermath to WWI, designed and delivered a deliberate but damaging international policy response – not to the Spanish flu virus, which they in effect ignored, but to the perceived dangers of unbalanced budgets and inflation. In short, the answer was stringent austerity everywhere, and a push for a rapid return to the Gold Standard. In the lead throughout were the British, including both the Bank of England and the Treasury.

The evidence for this lies in both UK domestic and international domains.

Domestically, this highly conservative economic policy was already expressed clearly by the Cunliffe Committee in their Interim Report in August 1918:

“We are aware that immediately after the war there will be strong pressure for capital expenditure by the state in many forms for reconstruction purposes. But it is essential to the restoration of an effective gold standard that the money for such expenditure should not be provided by the creation of new credit, and that, in so far as such expenditure is undertaken at all, it should be undertaken with great caution… This caution is particularly applicable to far-reaching programmes of housing and other development schemes.”

(Lord Cunliffe was Governor of the Bank of England from 1914 to 1918).

The Brussels International Financial Conference

Internationally, the same philosophy of austerity was articulated for example, in the work and aftermath of the Brussels International Financial Conference. This conference was promoted by the newly-formed League of Nations, held in September 1920 and attended by representatives of the business and banking sectors from over 40 countries. The British contingent included (among others from the banking and finance sector) Lord Chalmers ‘as specially representing The Treasury’ (of which he had been Permanent Secretary), Henry Bell of Lloyds Bank, and Lord Cullen, till recently Governor of the Bank of England, and who (according to R.S.Sayers, the Bank’s historian) kept the new Governor – Montagu Norman – “in close touch”.

The conference adopted a number of resolutions, coming from the Conference Commissions. The Conference’s results were then reviewed in 1922, with reports from over 20 countries on the economic steps taken, and published in a long, detailed report. In its many pages and highly detailed reports, I have so far found not a single reference to the Spanish flu pandemic, let alone to its economic impact, or to any steps governments may have taken. The US report may obliquely refer, when it refers to “In the early part of 1919, following a short period of price deflation and business contraction…” but soon after, the report also refers to “a period of expansion, inflation and speculation, the like of which has never before been seen…”

To be blunt, a virus that had just killed millions around the world was not considered by policy-makers at the time, it seems, to have any economic relevance for present or future.

The Conference Resolutions

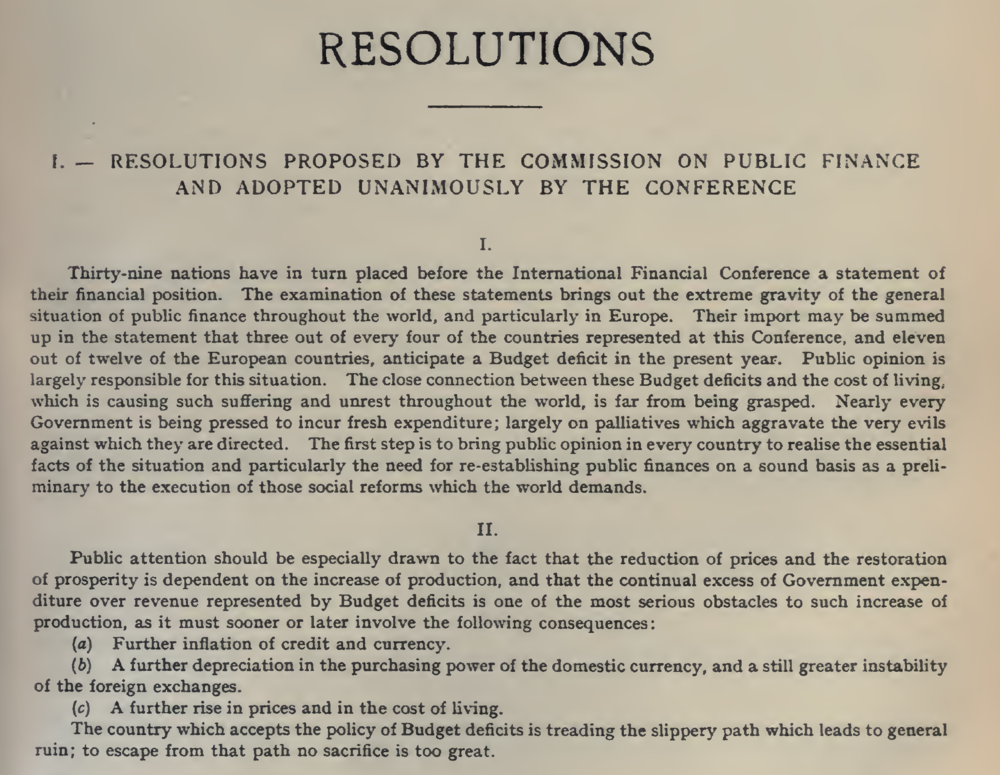

I intend to look at the work of the Brussels International Financial Conference of 1920 (and the politically more important Genoa Conference of 1922) in more detail in a later article, but let me here give a few examples from the Brussels Conference Resolutions, which were adopted unanimously. They give a very clear view of what the financial establishment from all major countries (excepting the already ‘politically distancing’ USA which was absent) saw as priorities. In a nutshell, get rid of budget deficits, cut public spending, tackle inflation, free banks from political (democratic) control, and return as soon as possible to the Gold Standard.

First, the Commission on Public Finance.

I

Thirty-nine nations have in turn placed before the […] Conference a statement of their financial position. The examination of these statements brings out the extreme gravity of the general situation of public finance throughout the world, and particularly in Europe. Their import may be summed up in the statement that three out of every four of the countries [present], and eleven out of the twelve European countries, anticipate a budget deficit in the present year. Public opinion is largely responsible for this situation. The close connection between these Budget deficits and the cost of living, which is causing such suffering and unrest throughout the world, is far from being grasped…

II

…The country which accepts the policy of Budget deficits is treading the slippery path which leads to general ruin; to escape from that path no sacrifice is too great.

III

It is therefore imperative that every Government should, as the first social and financial reform, on which all others depend:

(a) Restrict its ordinary recurrent expenditure, including the service of the debt to such an amount as can be covered by its ordinary revenue…

(c) Abandon all unproductive extraordinary expenditure.

(d) Restrict even productive extraordinary expenditure to the lowest possible amount.

V

[T]he Conference considers that every Government should abandon at the earliest practicable date all uneconomical and artificial measures which conceal from the people the true economic situation; such measures include:

(a) The artificial cheapening of bread and other foodstuffs, and of coal and other materials by selling them below cost price to the public, and the provision of unemployment doles of such a character as to demoralize instead of encouraging industry.

(b) the maintenance of railway fares, postal rates and charges for other government services on a basis which is insufficient to cover the cost of the services given, including annual charges on capital account.

Next, the Commission on Currency and Exchange:

The currencies of all belligerent, and of many other, countries, though in greatly varying degrees, have since the beginning of the war been expanded artificially… It should be clearly understood that this artificial and unrestrained expansion, or “inflation” as it is called, of the currency or of the titles to immediate purchasing power, does not and cannot add to the total real purchasing power in existence… It is, in fact, a form of debasing the currency…

Therefore:

It is of the utmost importance that the growth of inflation should be stopped…

The chief cause in most countries is that the Governments, finding themselves unable to meet their expenditures out of revenue, have been tempted to resort to the artificial creation of fresh purchasing power, either by the direct issue of additional legal tender money, or more frequently by obtaining – especially from the Banks of Issue, which in some cases are unable and in others unwilling to refuse them – credits which must themselves be satisfied in legal tender money. We say, therefore, that –

II

Governments must limit their expenditure to their revenue (We are not considering here the finance of reconstructing devastated areas)

III

Banks, and especially Banks of Issue, should be freed from political pressure and should be conducted solely on the lines of prudent finance.

And so on and on for 8 pages of Resolutions. A loud cry for universal balanced budgets, cuts in government spending, austerity for all. But no recognition of the “paradox of thrift” - that, if everyone stops spending at much the same time, the economy will contract. Which is what happened next, in many countries.

The US and UK deflation

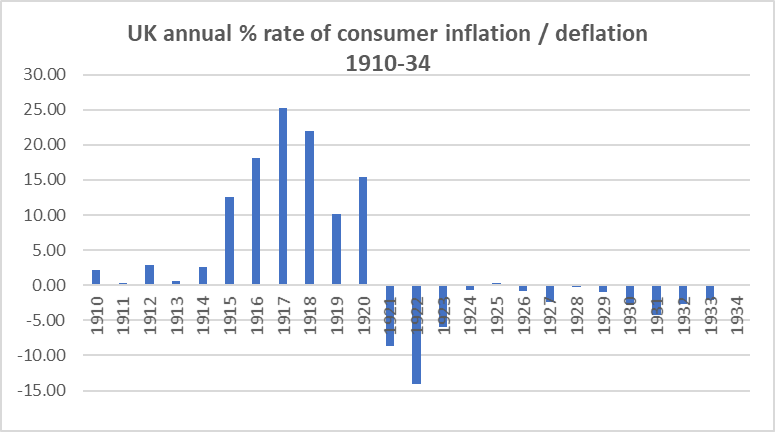

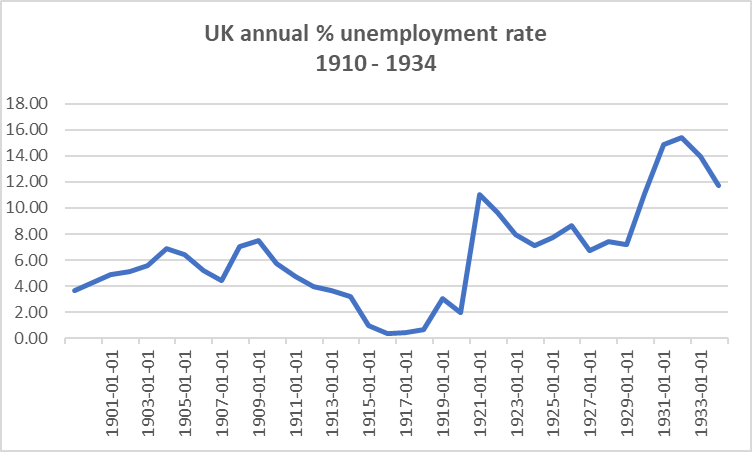

For even as the Brussels Conference convened, the two most important economic powers – the USA and UK – were on the verge not of rampant inflation (as those resolutions would lead one to believe), but rampant deflation. With the Bank of England raising its discount rate from 5 to 6% in November 1919, and then to 7% in April 1920, the value of the pound moved upwards, inflation finally peaked, and then rapid, severe deflation started. Prices fell by 8.6% on average in 1921, and by 14% in 1922. At the same time, and as a direct result of the extreme credit squeeze, unemployment lurched upwards. For 12 of the next 14 years, the UK experienced deflation, thereby strengthening the hand of creditors (the value of whose loans increased) while employers forced nominal wages down.

The two charts below (via the Federal Reserve Economic Data (FRED) show the UK’s inflation/deflation and unemployment rates during this period.

Via FRED (see next chart)

Bank of England, Unemployment Rate in the United Kingdom [UNRTUKA], retrieved from FRED, Federal Reserve Bank of St. Louis; April 12, 2020.

This deflation and deepened recession were policy-driven, not pandemic-driven. As Adam Tooze put it in “The Deluge”,

“By comparison with Japan, in the UK the deflationary adjustment was more clearly policy-induced. Already on 15 December 2019 Chamberlain [Chancellor of the Exchequer] had solemnly announced to the House of Commons that the long-term aim of British policy was the restoration of the pre-war gold standard… To enable a return to the pre-war exchange rate against the dollar, the British price level would have to be brought into line with that in the United States.”

However, American prices also began to fall (i.e. inflation turned to deflation), and the challenge for sterling grew ever greater:

“Britain not only had to close the gap between British and American wartime inflation. It now had to match the American deflation as well.”

Taxes were raised, public spending was cut, interest rates (real and nominal) increased, debts hugely increased in value as the pound strengthened – “By the autumn of 1920” (when the Brussels conference took place) “the British economy was in free fall.” [Tooze, ibid.]

In a thoughtful article in The Atlantic magazine reviewing “The Deluge”, David Frum (once speechwriter for George W.Bush, now a fierce Trump critic), summarized the issues from an American perspective:

“As the economy revived, workers scrambled for wage increases to offset the price inflation they’d experienced during the war. Monetary authorities, worried that inflation would revive and accelerate, made the fateful decision to slam the credit brakes, hard.

Unlike the 1918 recession, that of 1920 was deliberately engineered. There was nothing invisible about it…

But 1920-21 was an inflation-stopper with a difference. In post-World War II America, anti-inflationists have been content to stop prices from rising. In 1920-21, monetary authorities actually sought to drive prices back to their pre-war levels. They did not wholly succeed, but they succeeded well enough. One price especially concerned them: In 1913, a dollar bought a little less than one-twentieth of an ounce of gold; by 1922, it comfortably did so again.

Frum points out that (except for the US itself) the other warring nations had left the gold standard at the start of war, and at its end, each had to decide whether to return to the gold standard, and if so, at what rate:

The American depression of 1920 made that decision all the more difficult. The war had vaulted the United States to a new status as the world’s leading creditor, the world’s largest owner of gold, and, by extension, the effective custodian of the international gold standard. When the U.S. opted for massive deflation, it thrust upon every country that wished to return to the gold standard (and what respectable country would not?) an agonizing dilemma. Return to gold at 1913 values, and you would have to match U.S. deflation with an even steeper deflation of your own, accepting increased unemployment along the way. Alternatively, you could re-peg your currency to gold at a diminished rate…

Britain chose the former course; pretty much everybody else chose the latter.”

Comparing the French experience

Among the “everybody else” was France. The difference in approach is expressed in a 2012 paper for the Cato Institute by Douglas Irwin entitled “The French Gold Sink and the Great Deflation of 1929–32”:

The reconstructed gold standard started off on the wrong foot in 1925 when Britain rejoined it at an exchange rate that overvalued the pound… This not only harmed the competitive position of export industries but also meant that the British balance of payments remained in a fragile state. The balance of payments weakness required the Bank of England to maintain a tight monetary policy to support the pound, keeping interest rates high and thereby diminishing domestic investment. This kept economic growth in check and made it difficult for Britain to reduce its already high level of unemployment. As a result, Britain suffered through a low-grade deflation from 1925 until the country left gold in 1931.

Meanwhile, after enduring a traumatic bout of inflation in 1924–26, France stabilized the franc at an undervalued rate. There is some debate about whether the undervaluation was deliberate or not. French policymakers certainly debated which exchange rate the country should choose… Finance Minister Raymond Poincaré wanted to allow the franc to appreciate before formally establishing the peg to gold, while Bank of France Governor Emile Moreau wanted to resist the exchange market pressure and keep the franc at the lower rate. France formalized its adoption of the gold standard with the Monetary Law of June 1928, which officially restored convertibility of the franc in terms of gold at the rate set in December 1926.” [i.e. well below its pre-war rate].

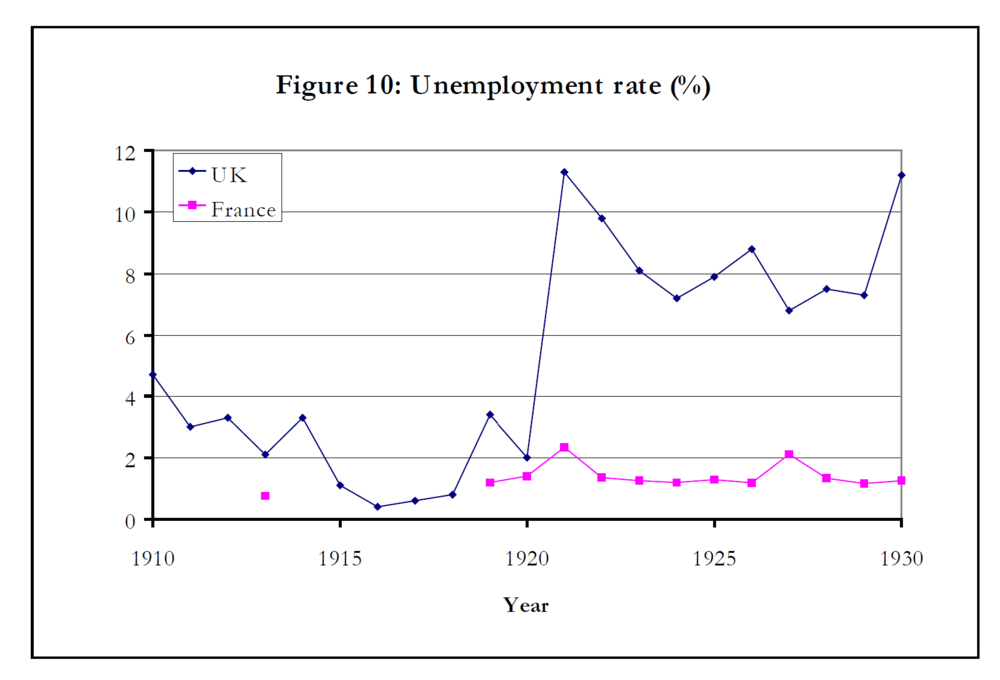

In another paper, “Why didn't France follow the British Stabilization after World War One?” Michael Bordo and Pierre-Cyrille Hautcœur (2003) also contend (whilst pursuing a generally anti-Keynesian approach) that in effect the post-war French governments did not have the scope to pursue the rigid deflationary policies employed by the British. While inflation remained very high in France for some years, the effect was a higher rate of industrial and other output (GDP), and a far lower rate of unemployment than in the UK.

Their chart on the unemployment rate tells its own story (n.b. after 1930, France’s rate increased, though not to UK levels):

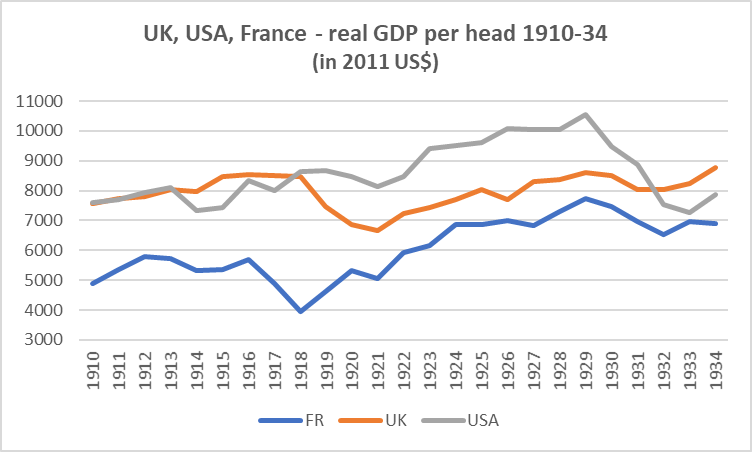

In order to see the effects of the different economic/political policy choices (or challenges) faced by Britain, France and the United States, the following chart looks at their respective development in terms of real GDP per head of population over a 15 year period, from 1910 (i.e. well before WWI) to 1925:

Source: Maddison Project database 2018

We see that the UK and USA started at a similar level before the war, but that the US moved far ahead from 1918 on, despite the significant deflation-driven dip from 1920 to 1922, until the crash in 1929. France started from a much lower base, and saw a huge fall in output from 1916 to 1918, but then grew in real terms at a significant pace despite (or because of?) its more inflationary circumstances, narrowing the gap with the UK by a significant margin until the 1929 crash. The UK, in contrast, reached its GDP peak in wartime; from 1918 on to 1921 it saw sharp declines, totalling some 22% from peak to trough, before very gently recovering. However it was not till 1928 and 1929 that the UK clawed back to its wartime level, and only after it left the Gold Standard (September 1931) did the economy grow more strongly, despite sustained unemployment.

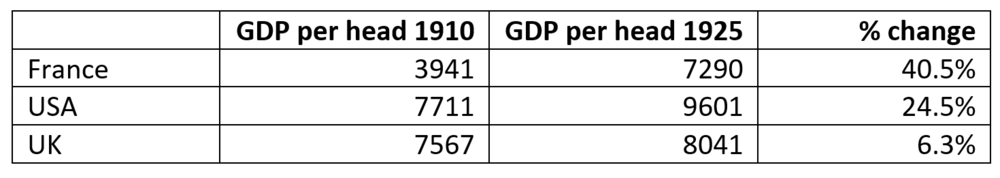

If we compare real GDP per head per country (in 2011 US$) taking the years 1910 and 1925 (the latter being in effect relatively ‘normal’ for all three), we find the following:

(A 10 year comparison between the UK and France from 1918 (end of war) to 1928 shows an even more extraordinary difference – French GDP per head was 85% higher at the end of the period; the UK’s was 1.1% smaller in 1928 than 1918.)

Can we deduce the economic impact of the Spanish flu pandemic?

This brings us back to our initial issue – how far is it reasonable to infer specific economic impacts from the Spanish flu pandemic, at least for western Europe and North America? On the one hand, in late 1918 and early 1919, hundreds of thousands were dying or ill, and these mainly of working age. It would be strange if the economic impact were nil. I assume there was some significant impact. On the other hand, it is hard from the data – which is not always wholly reliable, but whose main features and trends are likely to be broadly accurate – to draw any specific conclusions. The economic losses appear to be relatively limited in duration and degree. The human consequences, of course, were catastrophic for millions of people, families and communities.

The best description of at least significant temporary impacts comes from a recent paper (April 2020) “Pandemics Depress the Economy, Public Health Interventions Do Not: Evidence from the 1918 Flu” by S.Correia, S.Luck and E.Verner, looking at the differences between US cities that imposed strong public health interventions, and those that did not. Its main argument is that those that pursued more stringent interventions not only saved lives but did no worse economically than their ‘laissez-faire’ comparators, and the paper includes an Appendix with fascinating contemporary newspaper accounts of the economic slowdown and control measures taken in various cities at the time.

The authors conclude that “the pandemic leads to a sharp and persistent fall in real economic activity”, but this is hard to see with clarity from the US’s estimated GDP figures. These show an increase in 1918 of nearly 8%, followed by near stagnation in 1919. The peak mortality impact of the flu (and therefore presumably the immediate economic impact) was in Q4 2018. It is indeed difficult to disentangle the economic consequences of virus and the transition from war to peace.

For France, which was certainly a major centre for the pandemic, 1918 was indeed a terrible year economically as well as in human terms. French output, however, had peaked in 1916 before falling 14% in 1917, well before the flu crisis began. There was a further fall of 20% in 1918, to which the flu epidemic is likely to have made its contribution. The USA economy grew strongly in 1918, by nearly 8%, and very slightly in 1919 (+0.4%), before falling in 1920 and 1921. If these falls were significantly due to the continuing economic impact of the virus – which seems less likely on other grounds, notably the deliberate deflationary decisions taken – we need to ask why the picture differs so strongly from France, where the economic impact would appear to have been immediate and not continuing.

As for the UK, its economy (GDP) peaked in 1916 and 1918, before falling for the next 3 years. Here too, the main mortality impact was in late 1918. The Spanish flu hit the UK in most deadly form at roughly the same time as in France, and with similar human impacts, yet their economies diverged completely. The French economy fell in 1918 while the UK’s did not, and the UK’s economy fell from 1919 at the time that the French economy grew rapidly.

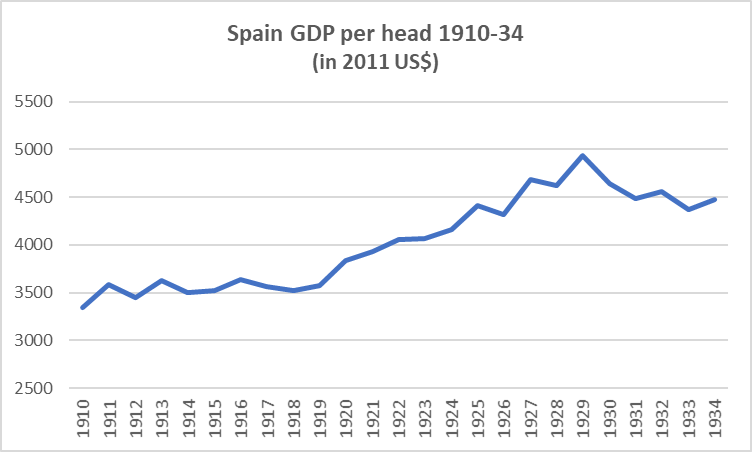

One other chart may be helpful in assessing the specifically economic impact of Spanish flu (though once again, we need to note that the data may not be wholly reliable) – a chart that shows how Spain’s economy performed (also in real GDP per head):

Source: Maddison Project

Spain was not a WWI belligerent, but its economy was undoubtedly affected by the war, and it was heavily affected – in terms of death and illness – by the flu pandemic. From an economic perspective, the economy (as measured here in GDP per head) declined slightly in 1917, by 2%, and by a further 1.1% in 1918, the peak virus year. In 1919 GDP per head rose by 1.5%, then jumped by around 8% in 1920. So once again, in the country that (inaccurately) gave its name to the flu virus, it is difficult from these GDP statistics to infer more than a modest direct macroeconomic impact.

The economic lessons to learn

In 1918 to 1919, central governments generally did not take any serious action to deal with the Spanish flu pandemic. Individual cities and local authorities, however, took steps to try to impose some ‘social distancing’ and other public health measures, but to a large extent, people were left to look after themselves, or turn to charitable and community support. The economy was in war mode, or in the transition from war to peace - the last period of WWI coincided with the virus’s most deadly period. There was then massive demobilization and industrial re-purposing.

Such a transition at the end of a long, terrible war is likely to have a major negative economic impact, as the UK and USA experienced at the end of WW2. Moreover, a substantial proportion of deaths due to the flu – at least in European countries) were among those still within the military forces, as the Commonwealth War Graves Commission remind us:

“As many as one million service personnel across all the combatant nations lost their lives to the virus. The memory of the disease was largely overshadowed by the end of the war and it is only recently that the 1918 pandemic has been reconsidered in the light of modern medicine.”

In 2020, the reaction of governments (with general support, and even if inadequately in many cases) has generally and rightly been to seek to protect lives as the number one priority, and to accept the huge negative economic impact of that choice. Indeed, in today’s world, that may even be the lesser economic price to pay, given that the ‘laissez faire’ alternative (do nothing and leave people to their fate) would probably lead to even greater social and economic disturbance.

So from the evidence, I am not at all persuaded by the argument of Barro, Weng and Ursúa that the 1918/19 flu virus caused a fall in GDP per head of as much as 6% in a typical country, if indeed the concept of ‘typical country’ has any useful meaning. There is too much diversity in the national statistics, including a lot of material that runs counter to the thesis, or does not bear it out; there are too many other factors, and too many political decisions, to enable such a conclusion to be firmly drawn.

But what the evidence does demonstrate with sharp clarity is that the UK government’s policy response of hard-line austerity and unremitting focus on balanced government budgets, allied to a dear money deflationary policy, was disastrous. The UK economy grew, as we have seen, at a much slower rate than other major economies such as France and the US, with sustained mass employment. This policy-driven macroeconomic weakness in turn hindered the UK’s public debt position, as a share of the economy.

The lesson for the future is that we must not fall back on another round of austerity. In their latest paper, “Doing more of what it takes: Next steps in the economic response to coronavirus” (April 2020) the Resolution Foundation seem to be heading, if cautiously, in this direction, with echoes of the 1920 Brussels Conference:

“The coronavirus outbreak is likely to leave the Government with a sizeable deficit and a greatly elevated stock of debt, leaving the public finances much more exposed to a sudden increase in interest rates or rise in inflation. In these circumstances, it can be tempting for governments to continue to rely on their central banks to affordably finance what becomes a structural deficit – either through continued direct monetary financing or pressure to keep interest rates low. In the UK, a permanent return to the so-called ‘fiscal dominance’ of monetary policy would risk an increase in inflation... Both the Treasury and the Bank of England should have an incentive to end monetary financing of deficits as quickly as possible, in order to keep inflation expectations firmly anchored around the 2 per cent target.“

Now surely the one thing that is truly unimportant, given the state of things, is to keep inflation expectations anchored around a 2% target. If (for the sake of argument) inflation were well above this in a couple of years but the economy reviving, why would this matter? In reality, the greater fear is of another round of deadly deflation.

The Resolution Foundation’s report indeed shows a depressing lack of imagination about the scale of the challenge not just to our economy, but to our society. The authors assume – even in their more severe (longer lockdown) scenario - that things will (and by implication should) return to “normal”:

“Crucially, however, unlike in other recessions, this one should not lead to wholesale changes to the structure of the economy, particularly in the short term. Indeed, if a sector or industry was profitable before the spread of the virus, for the most part we would expect that sector to be profitable in future, too.”

One of this report’s authors is Richard Hughes, who until last year was employed by HM Treasury as Director of Fiscal Policy, where he “oversaw the government’s fiscal strategy”. The Treasury’s conservative ideology (which we in PRIME have always contested) seems to be showing.

Compare this with the Financial Times’s recent editorial (3 April), headed “Virus lays bare the frailty of the social contract”, which argues

“Radical reforms — reversing the prevailing policy direction of the last four decades — will need to be put on the table. Governments will have to accept a more active role in the economy. They must see public services as investments rather than liabilities, and look for ways to make labour markets less insecure.”

Alas, the Resolution Foundation shows no sign of such a necessary radical spirit. Instead, it returns to tired old platitudes about the need for fiscal rules, the primacy of monetary over fiscal policy (even if the latter is allowed to work for the moment of crisis), balancing the current budget, central bank independence (rather than a joint partnership with government), the perverse belief that low productivity causes slow economic development, rather than being an outcome, and the need to ensure that there is confidence in the 2% inflation target. In other words, a return to the old order. The only new element here is a call for a tax surcharge on higher earners who were able to continue working full time during the lockdown and recovery.

A key problem is the narrow focus on public finance and fiscal rules. As I have argued elsewhere, fiscal rules are without value, other than as instruments of propaganda. They involve examining just one item from a complex economic ecology, as if the plant’s well-being was separate from the nature and health of the soil in which it is embedded, and the development of other plants (i.e. the private sector) . What is needed are clear and realistic public objectives for the whole economy, of which the public finances are of course a significant part. This focus on the public finances, not the economy, was the deliberate error (or untruth) propagated here in the UK in 2010 by Chancellor George Osborne, and in Europe by its leaders at the time of the euro crisis. The Global Financial Crisis was always a private debt crisis, but this did not suit the political needs of those determined to reduce the size of the state by cutting public services.

The failure of the current economic system

In the 1920s, successive governments cut public expenditure drastically, pursued a strong pound, and were generally fiscally prudent. The result was very slow and limited economic development, and sky-high unemployment.

We have now had two severe economic crises in a decade. The Global Financial Crisis has never been resolved, merely papered over. The interests of finance (which are now focused in what is still if wrongly called the shadow banking sector) are shown the fullest support, and dominate the economy. In the UK, thanks also to post-2010 Governments’ sustained commitment to austerity, economic development has been the worst (slowest) since the 1920s, with stagnant real pay, and - alongside the continued dismantling of employment protections and security - has increased structural inequality.

The current crisis has shown us how the current system fails us – with the greatest intensity at moments of crisis. The system is brittle and designed (in the name of efficient markets) to exclude resilience. Ensuring food, health and employment security has been deemed to be inefficient (or even dismissed as ‘autarkic’) and therefore to be ignored or despised. Just in Time, however, has become Just Not Available When Really Needed. The extreme ‘free market’ of recent decades has proven wholly unworthy of the legal and financial privileges lavished upon its corporate denizens.

Now, as our economy shakes and shrivels as we confront the virus’ threat to our lives, we face the double challenge for the future of recreating a resilient and more equal society and economy, as well as speeding the transition to the non-fossil fuel economy. How to finance it? As my partner in PRIME, Ann Pettifor, puts it, “We can afford what we can do.” In this she adapts and is inspired by Keynes, who in a BBC radio talk in 1942, said “Anything we can actually do, we can afford.” In the same spirit, in his famous 1933 essay on National Self-sufficiency (n.b. he only argued for partial self-sufficiency, not autarky) Keynes had said:

“If I had the power to-day, I should most deliberately set out to endow our capital cities with all the appurtenances of art and civilization on the highest standards of which the citizens of each were individually capable, convinced that what I could create, I could afford--and believing that money thus spent not only would be better than any dole but would make unnecessary any dole.” [My emphasis]

The task is - and will be - to decide what we will do, and how to organise to do it. If we continue more or less as before, the next disaster will swiftly befall us.