The Bank of Canada is widely expected to increase its policy interest rate again this week, for the eighth time in the last 10 months. Media and financial market commentary on its decision has made numerous throwaway references to how Canada’s economy is still “running hot,” and that i why a rate hike is needed. This common claim is surprising, and not consistent with economic evidence. Canada’s economy is not “running hot” by any concrete measure. Here are six: 1. Final domestic demand in Canada has been weakening for over a year, and was shrinking in the third quarter of 2022 (latest data). Were it not for the export sector (with the trade balance lifted by both growing exports and falling imports – the latter itself a sign of weakness not strength), GDP growth would have been

Topics:

Jim Stanford considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The Bank of Canada is widely expected to increase its policy interest rate again this week, for the eighth time in the last 10 months. Media and financial market commentary on its decision has made numerous throwaway references to how Canada’s economy is still “running hot,” and that i why a rate hike is needed.

This common claim is surprising, and not consistent with economic evidence. Canada’s economy is not “running hot” by any concrete measure. Here are six:

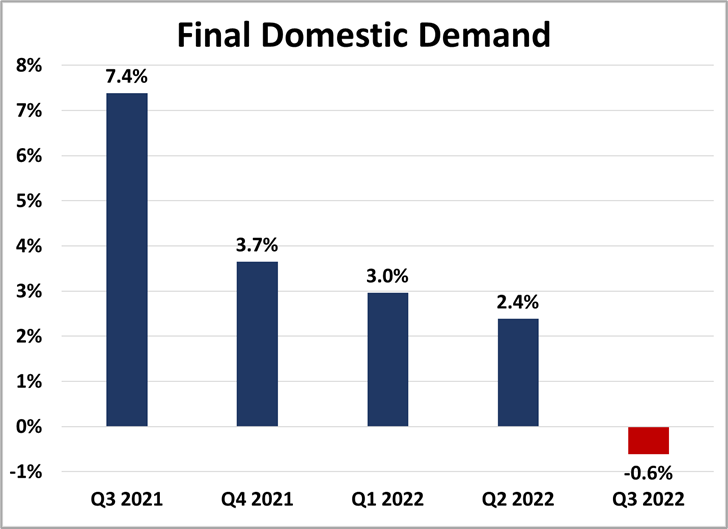

1. Final domestic demand in Canada has been weakening for over a year, and was shrinking in the third quarter of 2022 (latest data). Were it not for the export sector (with the trade balance lifted by both growing exports and falling imports – the latter itself a sign of weakness not strength), GDP growth would have been negative.

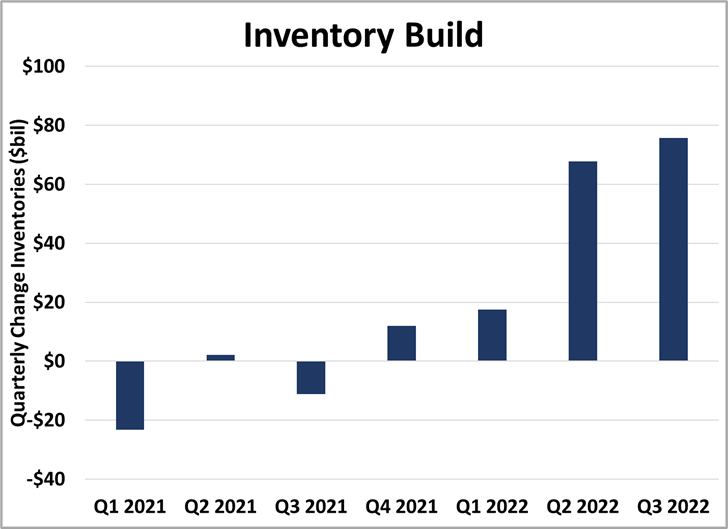

2. An enormous build-up of business inventories (the biggest in history by far) has also supplemented GDP growth over the last 2 quarters. Partly this reflects firms rebuilding stocks after the supply chain disruptions of the lockdowns. But partly it is also a sign that consumer sales are falling. This build will soon reverse as retailers reduce orders to draw down large stockpiles, and consumer spending slows further. The resulting contraction in inventories will exacerbate negative GDP results in coming quarters.

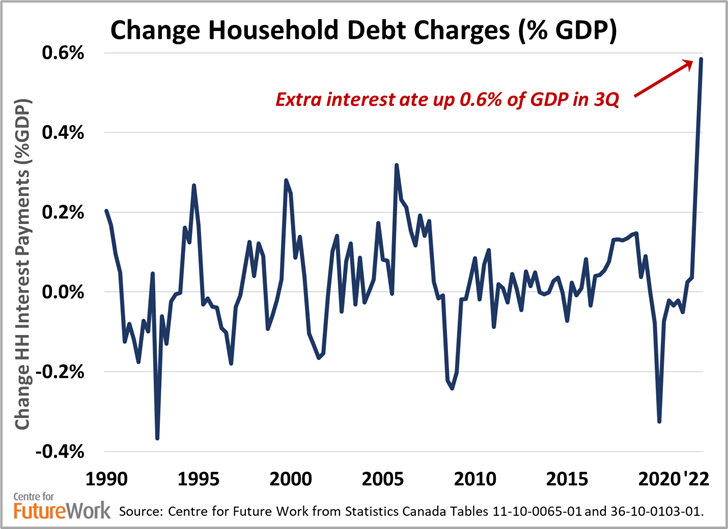

3. Real consumer spending contracted in the third quarter of 2022. The latest monthly retail sales data (for November) also confirms a decline in real retail sales. They will fall further as interest rate hikes bite into disposable income for mortgage holders and other borrowers. Indeed, extra debt charges paid by households ate up 0.6% of GDP in the third quarter (again, by far the biggest quarterly increase in history), and will take bigger chunks ahead.

4. Residential construction investment fell 15% in the third quarter of 2022, on top of a 32% fall in the second quarter. Construction has been the strongest engine of post-COVID recovery: in fact, as revealed in our recent Centre for Future Work report on weak business investment, 2021 was 1st time ever in Canada that residential investment exceeded all non-residential business investment (on structures, machinery, and intellectual property). Now it’s in freefall.

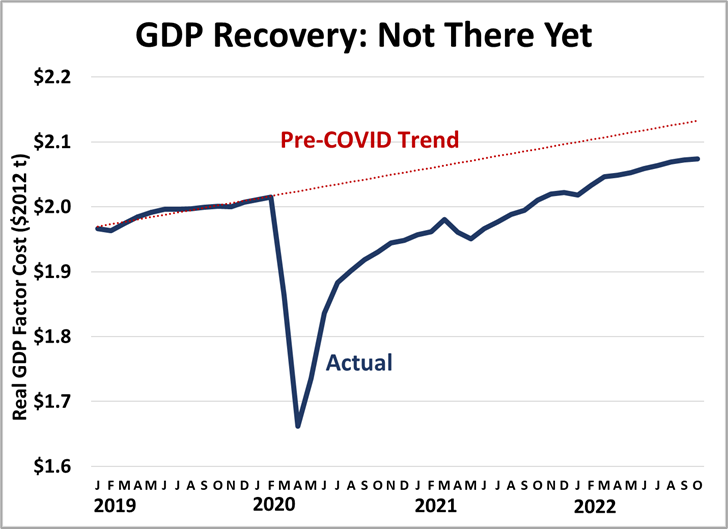

5. With all these headwinds, real GDP growth has slowed to a crawl in recent months (0.8% annualized in October, latest data). The gap between actual and trend GDP has been widening since rate hikes started. Canada’s economy is not “overheated”, operating above it’s potential. Rather, premature austerity (with interest rates rising and government spending falling) is locking in a condition of underutilization, with both aggregate demand and aggregate supply well below where it could (and should) be.

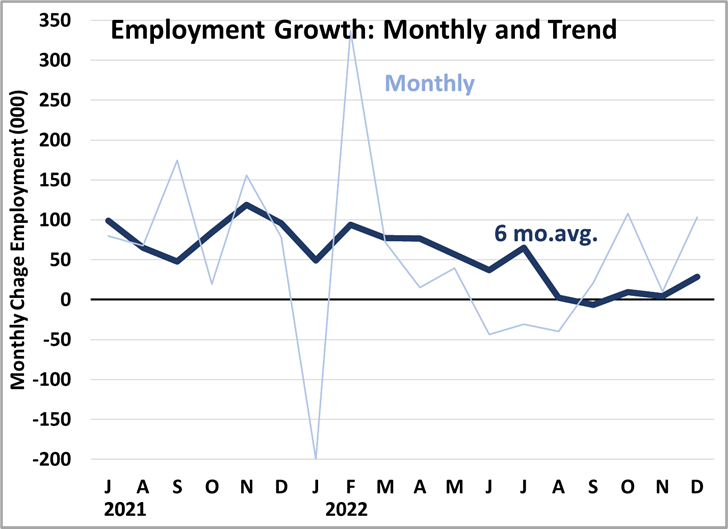

6. Even in the labour market, the evidence of an economy “running hot” is not conclusive at all. Job-creation has experienced two good months (October and December) out of the last nine. Remains to be seen whether those were blips, or whether real momentum has been reestablished after a very weak spring-summer (when employment declined).

The main data point invoked to support the “running hot” hypothesis is the unemployment rate, which at 5% is at a historic low. But the level of the unemployment rate only measures the current labour supply-demand balance. It does not indicate future economic trajectory: the economy can start with low unemployment, yet still experience a recession. And there are many factors (including demographic changes, and COVID disruptions to normal immigration patterns) which explain why the unemployment rate is relatively low, despite an economy that is actually lacking macroeconomic momentum.

An economy that was really “running hot” would have much stronger GDP growth (in the range of 4-5%, not under 1%), strong growth in leading indicators (like construction, business sentiment, and investment intentions), and rising real incomes. Canada has the opposite on all these measures. It is not credible to suggest the economy is “running hot”.

Despite this evidence, the Bank of Canada will almost certainly hike its interest rate again on Wednesday anyway. The Bank has been explicit that it targets inflation, not employment or GDP growth. Inflation is falling (for reasons unrelated to their interest rates), but nowhere near its 2% target. The Bank will keep hiking (even if economy enters recession) until its target is clearly in sight.

We can have an honest debate about whether this is the appropriate course of action. But we should be honest about the existing condition of Canada’s economy – which can be verified empirically. It isn’t “running hot.” It’s pretty cold already, and definitely getting colder.