Today, I bring you the sad tale of a crypto lender that promised safety and high returns to its depositors, but whose promises have proved to be as hollow as its name. Donut Inc., a self-proclaimed DeFi" lender, has a "Proof of Reserves" section on its website. This is supposed to reassure customers that their deposits are matched one for one by the platform's liquid assets. I am firmly of the opinion that "Proof of Reserves" statements prove nothing without a corresponding statement of liabilities, since deposits aren't the only form of liability, and encumbered assets can't back deposits. But in this case, the "Proof of Reserves" is worse than useless. It is actually fiction. And it conceals a truly dreadful situation for Donut's customers. As of today, this is what the "Proof of

Topics:

Frances Coppola considers the following as important: banks, crypto, default, deposits, lending

This could be interesting, too:

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

merijn knibbe writes The incredible cost of Bitcoin.

Angry Bear writes Crypto’s 5 million campaign finance operation filled airwaves with ads

Matias Vernengo writes Argentina on the verge

Today, I bring you the sad tale of a crypto lender that promised safety and high returns to its depositors, but whose promises have proved to be as hollow as its name.

Donut Inc., a self-proclaimed DeFi" lender, has a "Proof of Reserves" section on its website. This is supposed to reassure customers that their deposits are matched one for one by the platform's liquid assets. I am firmly of the opinion that "Proof of Reserves" statements prove nothing without a corresponding statement of liabilities, since deposits aren't the only form of liability, and encumbered assets can't back deposits. But in this case, the "Proof of Reserves" is worse than useless. It is actually fiction. And it conceals a truly dreadful situation for Donut's customers.

As of today, this is what the "Proof of Reserves" says:

By itself, this doesn't prove anything at all. It's just an unsupported statement of what the company calls "assets under management".* We need to know what these assets are and how they protect customer deposits.

Cash deposits are held by Donut's partner bank Evolve Bank & Trust, and banking services are provided by the Banking-As-a-Service company Synapse FI. FDIC-insured banks do not hold one dollar in reserve for every dollar on deposit. They are fractionally reserved, which means they do not hold sufficient actual dollars to enable all depositors to withdraw their funds simultaneously. When an FDIC-insured bank suffers a run, it must borrow cash to settle deposit withdrawals. Recently, runs on the crypto-related bank Silvergate have forced it to borrow large amounts from the Federal Home Loan Bank (FHLB).

This is why a liquidity problem at a lending partner forces Donut to suspend withdrawals. It does not hold anything like enough actual dollars to settle customer withdrawal requests, and it also does not have much in the way of assets it can pledge for dollars. In fact as we shall see, right now it has almost no liquidity. And that is because of the nature of its lending.

"Donut earns money on the margin between the variable rates we secure with partners and the fixed rates we provide to users"

This is the business model of a bank. So Donut is yet another unregulated, unsupervised and uninsured crypto bank that promises safety and high returns to its depositors while making money (or losing it) on opaque and highly risky lending.

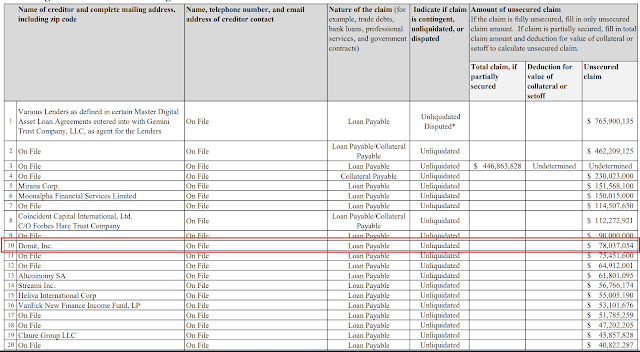

But as with FTX, Genesis's "liquidity issue" has turned out to be insolvency. On 20th January 2023, Genesis Global filed for Chapter 11 bankruptcy in the United States. The bankruptcy filing (pdf) reveals that it owes creditors over $5 bn. One of those creditors is Donut. In fact Donut is the 10th biggest creditor (click for larger image):

So Genesis owes Donut $78,037,054. Donut's Proof of Reserves says it has $78,384,987 AUM. Of those AUM, therefore, all but $347,933 consist of loans to Genesis. That is 99.55% of its total AUM.

"Defi lending is highly collateralized, typically over 125%. This makes it more likely that in the event of a borrower default, there may be sufficient collateral to protect your funds"

"Your current balance, after withdrawing the full value of your funds from other lending partners, is with Genesis in its entirety, who continues to prevent withdrawals. Donut is not holding any of your funds nor preventing withdrawals."

Nor is Donut in a position to make its customers good. It has hardly any liquidity and no means of obtaining any. So it is rationing the little it has. Build customers can withdraw 14.5% of their balances, but Save customers, who are the majority of Donut's customers (and, it would seem, more exposed to Genesis) can only withdraw 5%. That's a rubbish recovery rate.

I don't see any possibility of Donut's customers recovering all, or even much, of their money. Heaven help anyone who was paying their wages into this ghastly scheme, or who had put student loans or other debt on deposit here. Just like Voyager, Celsius and BlockFi, ordinary people will pay the price for Donut's mis-selling, mismanagement and dishonesty.