From David Ruccio I continue to maintain that Congressional Republicans will stick with President Donald Trump until they get their favorite policies enacted—or until Trump’s missteps and declining popularity stand in the way of their getting what they want. And one of the things they want is tax reform—specifically, a cut in corporate taxes. Here’s the problem: U.S. corporations aren’t taxed too heavily. They’re taxed too little. As is clear from the chart above, corporate profits (as a percentage of GDP) have risen dramatically since the mid-1980s—from 5.8 percent in 1985 to 11.8 percent in 2016. However, as I have shown before, even while individual taxes have remained relatively high (as a percentage of federal tax receipts), taxes on corporate income fell throughout the postwar

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

I continue to maintain that Congressional Republicans will stick with President Donald Trump until they get their favorite policies enacted—or until Trump’s missteps and declining popularity stand in the way of their getting what they want.

And one of the things they want is tax reform—specifically, a cut in corporate taxes.

Here’s the problem: U.S. corporations aren’t taxed too heavily. They’re taxed too little.

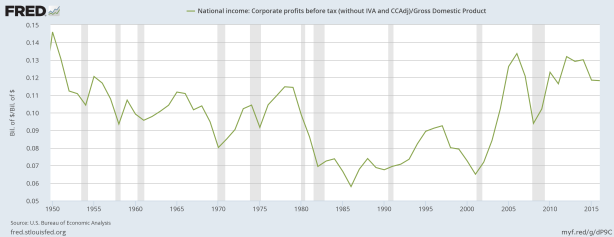

As is clear from the chart above, corporate profits (as a percentage of GDP) have risen dramatically since the mid-1980s—from 5.8 percent in 1985 to 11.8 percent in 2016.

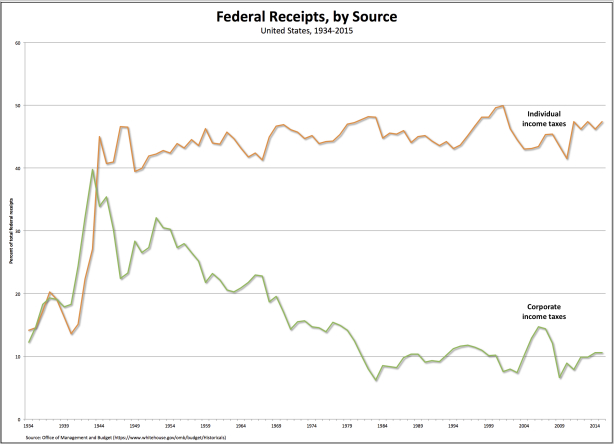

However, as I have shown before, even while individual taxes have remained relatively high (as a percentage of federal tax receipts), taxes on corporate income fell throughout the postwar period and have remained relatively low (at about 10 percent federal tax receipts) since the mid-1980s.

Here’s what the Economic Policy Institute recommends in a recent report:

If we wish to reform corporate tax policy to benefit the vast majority of Americans—and not just a wealthy few—we should not be talking about lowering corporate tax rates or offering other tax breaks to corporations; we should instead be focusing on closing loopholes in the system that have eroded the corporate income tax base, to ensure the corporate sector is paying its appropriate share of taxes.