Not good: Highlights Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the May 19 week, but refinancing applications rose 11 percent from the previous week to the highest level since March. The drop in purchase applications follows a 3 percent decrease in the prior week and takes the year-on-year purchase index gain down 6 percentage points to 3 percent. Lower rates during the week gave a big boost to refinancing, and the refinancing share of mortgage activity rose to 1.8 percentage points to 43.9 percent. The average interest rate on 30-year fixed-rate conforming mortgages (4,000 or less) fell to the lowest level since November 2016, down 6 basis points from the prior week to 4.17 percent. The second weekly decline in purchase

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Not good:

Highlights

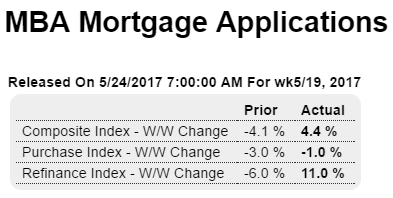

Purchase applications for home mortgages fell a seasonally adjusted 1 percent in the May 19 week, but refinancing applications rose 11 percent from the previous week to the highest level since March. The drop in purchase applications follows a 3 percent decrease in the prior week and takes the year-on-year purchase index gain down 6 percentage points to 3 percent. Lower rates during the week gave a big boost to refinancing, and the refinancing share of mortgage activity rose to 1.8 percentage points to 43.9 percent. The average interest rate on 30-year fixed-rate conforming mortgages ($424,000 or less) fell to the lowest level since November 2016, down 6 basis points from the prior week to 4.17 percent. The second weekly decline in purchase applications despite more attractive mortgage rates casts further doubts on the strength of the housing market, which opened the year strongly but may be slowing during the Spring selling season, as seen in the significant weakness shown yesterday’s new home sales report for April and housing starts reported last week.

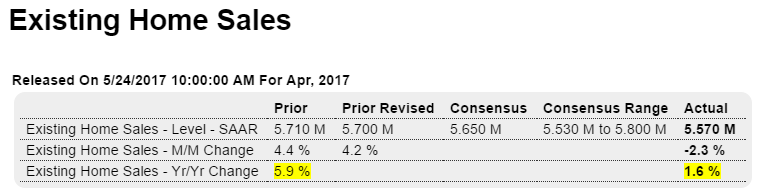

And this, all confirming the sharp deceleration in mortgage loans as previously discussed:

If the outcome is anywhere near revenue neutral, seems the tax cuts have far lower multiples than the spending cuts, so it looks to be contractionary overall. Nor do I think ‘mitigating risk for would-be entrepreneurs’ has any chance of overcoming the fiscal drag:

Trump releases budget that slashes government programs (The Hill) The Trump administration on Tuesday unveiled a budget seeking $1.5 trillion in nondefense discretionary cuts and $1.4 trillion in Medicaid cuts over the course of a decade, while adding nearly half a trillion dollars to defense spending. In 2018, Trump’s budget would shift $54 billion from nondefense discretionary spending to defense by enacting major cuts to government agencies. “We believe in the social safety net. We absolutely do,” Mulvaney said. A well-administered safety net, he continued, could boost economic activity by mitigating risk for would-be entrepreneurs.

At best a drop in the bucket and even then unlikely to ramp up for at least a year:

Trump lays out $1T infrastructure vision in budget request (The Hill) The rebuilding plan would inject $200 billion into transportation projects over 10 years, with the goal of creating $1 trillion worth of overall investment. The spending document says the administration would meet its $1 trillion target through a mix of new federal funding, incentives for private sector investment and expedited projects. The proposal will rely on four key approaches: leveraging private sector investment, ensuring federal dollars are targeted toward transformative projects, shifting more services and underused capital assets to the private sector and giving states and localities more flexibility.

Reads to me like they haven’t made any progress yet and don’t expect to any time soon:

Senate GOP focused on killing Medicaid expansion (The Hill) “There’s an interest among many of our members having a longer phaseout, a smoother glide path” after repealing the expansion, Sen. John Thune said Tuesday. Thune said the Senate is still likely to change the bill to provide more tax credits to better help low-income people afford health insurance, but acknowledged it’s still a “work in progress.” Thune expressed support for a last-minute provision in the House bill that would allow states to opt out of certain ObamaCare essential coverage requirements. Thune said senators want to have some sort of reinsurance program or high-risk pool to protect people with pre-existing conditions, but haven’t narrowed down their options.