From David Ruccio Kevin Hassett and the other members of the president’s Council of Economic Advisers are just like the long-haired preachers Joe Hill sang about more than a century ago. They come out every night to tell us what’s wrong and what’s right. But when asked about something to eat, they answer in voices so sweet: You will eat, bye and bye In that glorious land above the sky Work and pray, live on hay You’ll get pie in the sky when you die. That’s a lie With one notable exception: according to the Council (pdf), that “glorious land above the sky” lies just on the other side of the Trump administration’s proposed tax reform. And workers, whose real wages have stagnated for decades now, won’t have to die to receive their pie in the sky. Reducing the statutory federal corporate

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Kevin Hassett and the other members of the president’s Council of Economic Advisers are just like the long-haired preachers Joe Hill sang about more than a century ago. They come out every night to tell us what’s wrong and what’s right. But when asked about something to eat, they answer in voices so sweet:

You will eat, bye and bye

In that glorious land above the sky

Work and pray, live on hay

You’ll get pie in the sky when you die.

That’s a lie

With one notable exception: according to the Council (pdf), that “glorious land above the sky” lies just on the other side of the Trump administration’s proposed tax reform. And workers, whose real wages have stagnated for decades now, won’t have to die to receive their pie in the sky.

Reducing the statutory federal corporate tax rate from 35 to 20 percent would. . .increase average household income in the United States by, very conservatively, $4,000 annually. The increases recur each year, and the estimated total value of corporate tax reform for the average U.S. household is therefore substantially higher than $4,000. Moreover, the broad range of results in the literature suggest that over a decade, this effect could be much larger.

There’s no other way to put it. That’s a lie.

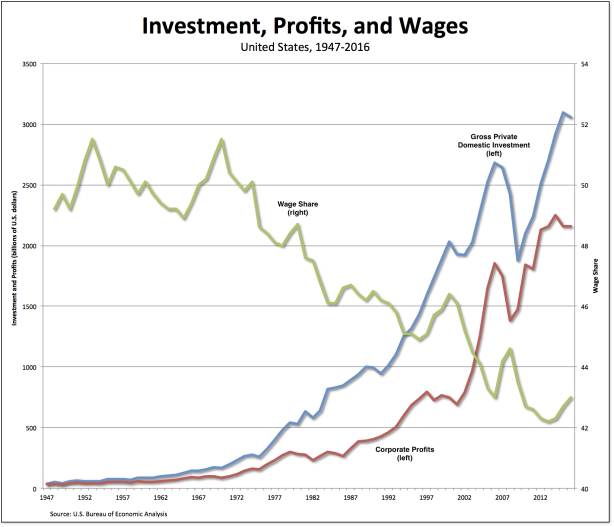

As is clear from this chart, both corporate profits (the red line) and investment (the blue line) have soared in recent decades. There’s simply been no shortage of investment or investment funds, either from retained earnings or in terms of money borrowed from financial institutions. At the same time, the wage share of national income (the green line in the chart) has fallen precipitously.

So, even if cutting corporate tax rates (and thus permitting higher retained earnings) did lead to more investment, there’s no guarantee workers’ wages would increase as a result. They haven’t for decades now. Why should that change in the future?

Moreover, there’s no guarantee higher retained earnings would lead to more investment. Just as likely (perhaps even more so), corporations would be able to use their profits for other purposes—including higher CEO salaries, increased dividends to stockholders, and more mergers and acquisitions—which have nothing to do with raising workers’ wages.

The only result would be more corporate power and more obscene levels of inequality in the United States.

And that’s no lie.