Considering the present architecture of the Eurozone – there is according to Erwan Mahé no obvious way to solve the Italian Euro crisis… From: Erwan Mahé I sent this little collage on 25 May, via IB Bloomberg chat, as the BTP began to decline, since it seemed to sum up the best attitude to take towards the near hysteria afflicting the Italian debt market at the time. From a high of 132.88 on Monday 25 May, it plunged to as low as 120.10 the next day, reflecting a full one per cent rate shift on the eurozone on the 10-year maturity! Lucky for us, the trade we flagged on Tuesday 29 May on the 2-year Italian maturity, with a bloc of 14,000 2-year futures (i.e. 25% of usual BTP daily volume!), fell 1 point below market price in the wake of rumours about huge losses at some carry funds,

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Considering the present architecture of the Eurozone – there is according to Erwan Mahé no obvious way to solve the Italian Euro crisis…

From: Erwan Mahé

I sent this little collage on 25 May, via IB Bloomberg chat, as the BTP began to decline, since it seemed to sum up the best attitude to take towards the near hysteria afflicting the Italian debt market at the time.

From a high of 132.88 on Monday 25 May, it plunged to as low as 120.10 the next day, reflecting a full one per cent rate shift on the eurozone on the 10-year maturity! Lucky for us, the trade we flagged on Tuesday 29 May on the 2-year Italian maturity, with a bloc of 14,000 2-year futures (i.e. 25% of usual BTP daily volume!), fell 1 point below market price in the wake of rumours about huge losses at some carry funds, allowing us to identify a very useful inflexion (or capitulation) point, because the BTP began a continuous upward shift, reaching a high of 130 on 4 June. The point of this update is not to brag about our stroke of luck on a totally disjointed market but to emphasise that we have nothing against the Italian market; we just need to adapt to changing circumstances.

*Disclaimer: I have held Italian zero-coupons for years now, given their low nominal cost and they could be a real wild card in the event of restructuring, as the Greek situation taught us.

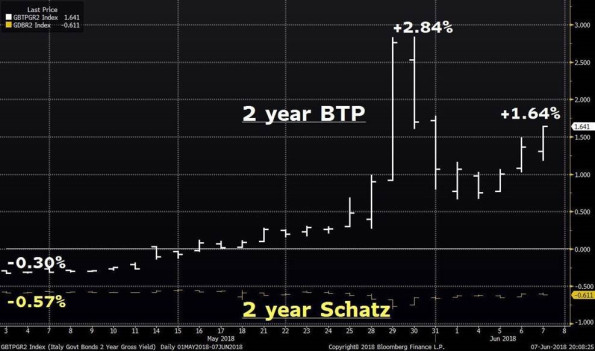

Truth be told, the problem with Italy is not the size of debt-to-GDP; the traders who harp on this point are the same ones who have hung themselves ten times over by shorting Japanese JGBs for the same reason. Anyone notice that S&P upgraded Japan’s country rating to A+ in April? What worries me is that, although its ratio is well below that of Japan, Italy (the eurozone) unfortunately does not benefit from the same fiscal-monetary architecture as Japan and remains under threat of the same self-fulfilling prophecies and “doom loop” that ravaged Europe in 2011-2012. The fact that the 2-year Italian maturity was able to rise 2.50% in two days on a market where it had become impossible for clients to find decent prices (the Italian bond market is the world’s third biggest in outstanding volume) is a flagrant demonstration of the ECB’s inability today to make its monetary transmission channel perform uniformly on the eurozone once markets begin to doubt a member state’s credit (which, in this case, mean the threat of re-denomination).

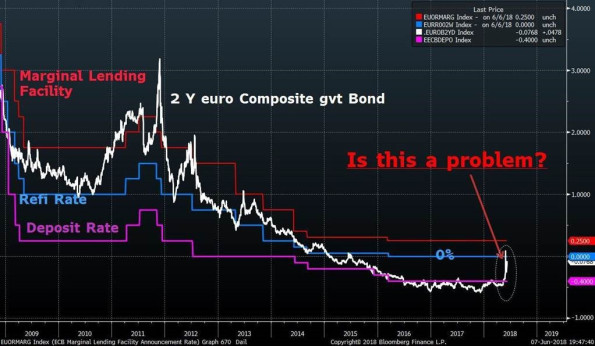

We had examined, at the time of the European debt crisis, the monetary transmission channel concept in several reports dedicated to the matter and by reconstructing a 2-year eurozone synthetic bond, which allowed us to monitor directly the efficiency of said transmission. I provide, below, an updated graph displaying the evolution of this synthetic 2-year euro bond, which still excludes Greece

Eurozone 2 Year synthetic «Sovereign»

Based on the graph, the rise in the 2-year maturity in recent days, although notable, does not seem so catastrophic. However, this synthetic illustration poorly reflects the reality of monetary policy transmission throughout the eurozone, because it masks the important country-by-country dispersion of said rates, i.e. the evolution of spreads between “sovereign” issuers. The governments of the eurozone do not benefit from tax transfers, unlike in the United States. Harmonised and pooled unemployment insurance alone would make it possible to soften the blow from domestic economic shocks whilst leaving room in the budget to carry out thorough-going structural reforms.

The current discussions between partners do not really seem to be going in this direction, with short-term political considerations always taking precedence over the longer-term solutions, given the electoral cycle of each country. Ideally, we could calibrate monetary policy, since it is the sole remaining leverage, in keeping with the macroeconomic situation of each eurozone country. Aside from the levels of inflation, the output gap (between unemployment and growth) should also be considered. Such an approach would lead to far more accommodative monetary policy in Italy where the latest HICP put May inflation at +1.1% and the unemployment rate at more than 11%, including 33% for those under 25.

It would be far more restrictive in Germany where inflation is 2.2% and unemployment 3.40%! Unfortunately, the recent movement of yield spreads between countries linked to this fear of re-denomination, or even restructuring, runs in exactly the opposite direction. I am also talking about restructuring risk and thus of partial default, because the promises of 2012 according to which there would never again be an organised default like in the Greece case don’t have any more credibility than those made in 2010-2011 (Trichet, Sarkozy) according to which Greece would never be allowed to default!

Ms Merkel’s comments in her FAZ interview this Sunday, relating to Mr Macron’s proposals for Europe, will hardly reassure us on this point. Check out the illustration of this phenomenon in the following graph

Italy & Germany 2 Year Yields

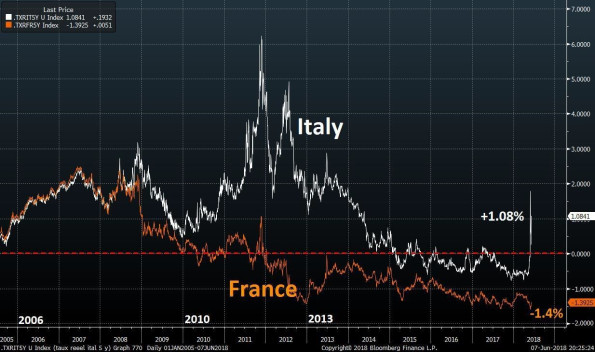

I am even going to give you another graph, which reflects even better this paradoxical dispersion phenomenon.

5 Years Real Yields, Italy & France

I could have created the same graph, displaying even greater divergence, with Italy and France, but this one underscores just how much France has pulled its chestnuts out of the fire. All in all, what is happening now seems very worrisome from a macroeconomic standpoint, and I do not see a top-down way out of this situation. I don’t think the ECB, focused on how to exit from the QE, can put into question its projected hardening of monetary policy just to please Italy without taking into consideration the nationality of its outgoing president. For that to happen, the 2-year synthetic bond would have to rise even more and, subsequent to tensions on credit markets and on the financial soundness of the eurozone’s lending institutions, financial conditions on the eurozone would have to worsen to such an extent that the ECB would feel the need to intervene.

But intervene how? By lowering its benchmark rate, which are already at the limits of what the financial system can bear? By re-launching the QE on a large scale whilst it must already contend with capacity constraints, in particular on German bonds? By recalibrating the QE to direct the spreads, like in the still murky OMT framework, which requires the recipient country to be put under trusteeship whilst Italy has just voted in a government adamantly opposed to trusteeship? I must admit that I don’t have satisfactory solutions at this point. We will again be surprised by the future. In the meantime, I look forward to hearing your feedback, including criticisms and suggestions!

As always, feel free to contact me about these matters.

The Macro Geeks’ Corner (MGC)

I have found time in recent weeks to assemble no small number of decent reads. Check them out!

Completing the Odyssean journey of the European monetary union

Vitor Constancio, 16 May 2017

NEGATIVE INTEREST RATE POLICY (NIRP) AND THE FALLACY OF THE NATURAL RATE OF INTE REST: WHY NIRP MAY WORSEN KEYNESIAN UNEMPLOYMENT

Thomas Palley, April 26, 2018

The persistence and signalling power of central bank asset programmes

Benoit Coeuré, 23 February 2018

Money, Power, and Monetary Regimes

Pavlina R. Tcherneva. Levy Economics Institute of Bard College March 2016

Federal Reserve Bank of Minneapolis Staff Report 528 May 2016

‘Communicating the complexity of unconventional monetary policy in EMU”

Peter Praet, 15 November 2017