From Lars Syll Not accounting for uncertainty may result in severe confusion about what we do indeed understand about the economy. In the financial crisis of 2007/2008 the demon has lashed out at this ignorance and challenged the credibility of the whole economic community by laying bare economists’ incapability to prevent the crisis … Economics itself cannot be regarded a purely analytical science. It has the amazing and exciting property of shaping the object of its own analysis. This feature clearly distinguishes it from physics, chemistry, archaeology and many other sciences. While biologists, chemists, engineers, physicists and many more are very able to transform whole societies by their discoveries and inventions — like Penicillin or the internet — the laws of nature they study

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

Not accounting for uncertainty may result in severe confusion about what we do indeed understand about the economy. In the financial crisis of 2007/2008 the demon has lashed out at this ignorance and challenged the credibility of the whole economic community by laying bare economists’ incapability to prevent the crisis …

Economics itself cannot be regarded a purely analytical science. It has the amazing and exciting property of shaping the object of its own analysis. This feature clearly distinguishes it from physics, chemistry, archaeology and many other sciences. While biologists, chemists, engineers, physicists and many more are very able to transform whole societies by their discoveries and inventions — like Penicillin or the internet — the laws of nature they study remain unaffected by these inventions. In economic, this constancy of the object under study just does not exist.

The financial crisis of 2007-2008 hit most laymen and economists with surprise. What was it that went wrong with our macroeconomic models, since they obviously did not foresee the collapse or even made it conceivable?

There are many who have ventured to answer that question. And they have come up with a variety of answers, ranging from the exaggerated mathematization of economics, to irrational and corrupt politicians.

But the root of our problem goes much deeper. It ultimately goes back to how we look upon the data we are handling. In ‘modern’ macroeconomics — Dynamic Stochastic General Equilibrium, New Synthesis, New Classical and New ‘Keynesian’ — variables are treated as if drawn from a known “data-generating process” that unfolds over time and on which we therefore have access to heaps of historical time-series. If we do not assume that we know the ‘data-generating process’ – if we do not have the ‘true’ model – the whole edifice collapses. And of course it has to. I mean, who honestly believes that we should have access to this mythical Holy Grail, the data-generating process?

But the root of our problem goes much deeper. It ultimately goes back to how we look upon the data we are handling. In ‘modern’ macroeconomics — Dynamic Stochastic General Equilibrium, New Synthesis, New Classical and New ‘Keynesian’ — variables are treated as if drawn from a known “data-generating process” that unfolds over time and on which we therefore have access to heaps of historical time-series. If we do not assume that we know the ‘data-generating process’ – if we do not have the ‘true’ model – the whole edifice collapses. And of course it has to. I mean, who honestly believes that we should have access to this mythical Holy Grail, the data-generating process?

‘Modern’ macroeconomics obviously did not anticipate the enormity of the problems that unregulated ‘efficient’ financial markets created. Why? Because it builds on the myth of us knowing the ‘data-generating process’ and that we can describe the variables of our evolving economies as drawn from an urn containing stochastic probability functions with known means and variances.

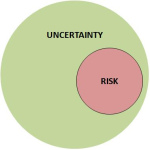

This is like saying that you are going on a holiday-trip and that you know that the chance the weather being sunny is at least 30%, and that this is enough for you to decide on bringing along your sunglasses or not. You are supposed to be able to calculate the expected utility based on the given probability of sunny weather and make a simple decision of either-or. Uncertainty is reduced to risk.

This is like saying that you are going on a holiday-trip and that you know that the chance the weather being sunny is at least 30%, and that this is enough for you to decide on bringing along your sunglasses or not. You are supposed to be able to calculate the expected utility based on the given probability of sunny weather and make a simple decision of either-or. Uncertainty is reduced to risk.

But as Keynes convincingly argued in his monumental Treatise on Probability (1921), this is not always possible. Often we simply do not know. According to one model the chance of sunny weather is perhaps somewhere around 10% and according to another – equally good – model the chance is perhaps somewhere around 40%. We cannot put exact numbers on these assessments. We cannot calculate means and variances. There are no given probability distributions that we can appeal to.

In the end this is what it all boils down to. We all know that many activities, relations, processes and events are of the Keynesian uncertainty-type. The data do not unequivocally single out one decision as the only ‘rational’ one. Neither the economist, nor the deciding individual, can fully pre-specify how people will decide when facing uncertainties and ambiguities that are ontological facts of the way the world works.

Some macroeconomists, however, still want to be able to use their hammer. So they decide to pretend that the world looks like a nail, and pretend that uncertainty can be reduced to risk. So they construct their mathematical models on that assumption. The result: financial crises and economic havoc.

Some macroeconomists, however, still want to be able to use their hammer. So they decide to pretend that the world looks like a nail, and pretend that uncertainty can be reduced to risk. So they construct their mathematical models on that assumption. The result: financial crises and economic havoc.

How much better — how much bigger chance that we do not lull us into the comforting thought that we know everything and that everything is measurable and we have everything under control — if instead we could just admit that we often simply do not know, and that we have to live with that uncertainty as well as it goes.

Fooling people into believing that one can cope with an unknown economic future in a way similar to playing at the roulette wheels, is a sure recipe for only one thing — economic disaster.