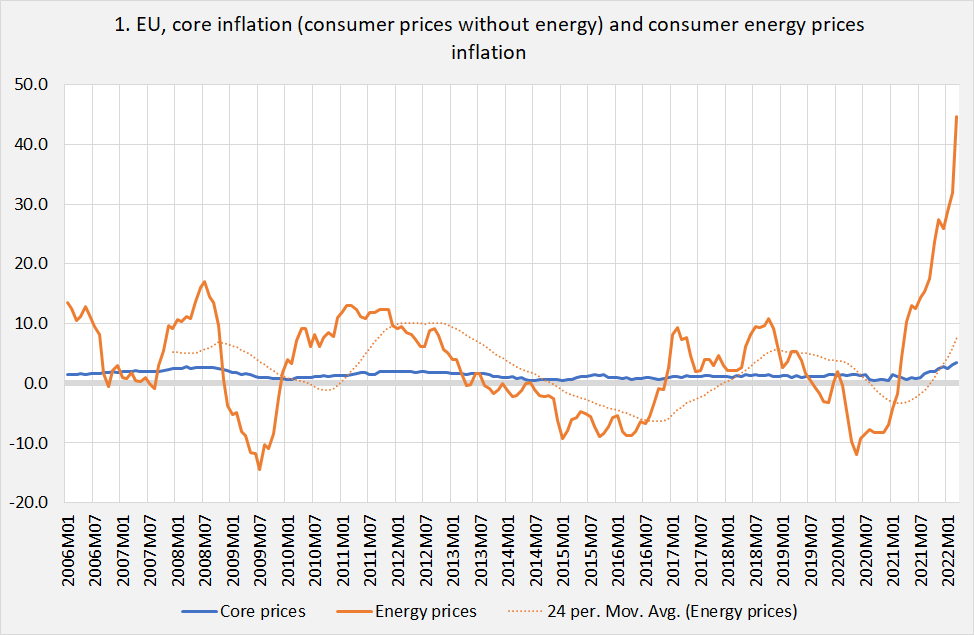

Inflation is up. A remarkable aspect of todays inflation is the relatively high increase of energy prices (graph), an international phenomenon. Rising prices are a bitch when nominal incomes stay behind, which at the moment is the case in Europe. This leads especially to problems for people with lower incomes who have less money to spare and who spent a relatively larger amount of their income on energy. So, what to do? Should we raise interest rates? Hmmm…. The relation between interest rates and inflation is week at best and even more so when inflation is not caused by domestic but by international events (see this blog by J.W. Mason). Also, the idea behind the policy of raising interest rate is that higher rates lead to lower investment and consumer spending, curbing demand

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Inflation is up. A remarkable aspect of todays inflation is the relatively high increase of energy prices (graph), an international phenomenon. Rising prices are a bitch when nominal incomes stay behind, which at the moment is the case in Europe. This leads especially to problems for people with lower incomes who have less money to spare and who spent a relatively larger amount of their income on energy. So, what to do? Should we raise interest rates? Hmmm….

The relation between interest rates and inflation is week at best and even more so when inflation is not caused by domestic but by international events (see this blog by J.W. Mason). Also, the idea behind the policy of raising interest rate is that higher rates lead to lower investment and consumer spending, curbing demand and hence price increases. This might make sense when nominal wages increase faster than other prices. But this isn’t the case today and increasing energy prices already ciurb demand for other items. Also, Energy prices won’t rise for ever meaning that headline inflation (including all prices) will come down, too, in the foreseeable future (say: 6 to 8 months). However – unlike the situation after, say, 1985 it might be that energy prices won’t go down again and will stay on a high level. What to do? In the short run, energy importing countries will just get poorer: their terms of trade deteriorated. Changes in for instance direct taxes can and should shift the pain – but the energy bill has to be paid. In the medium run – we’ll have to save on energy. Take a hike, take a bike, work from home if possible, increase the average number of people living in one house, insulate houses – there are a myriad of possibilities. And we should of course invest in the cheapest and most fungible source of power: solar electricity as well as in a change of the electricity grid, enabling a change from a system based on central production and decentral use to a system of decentral production, storage (think of all these electric cars) and use.