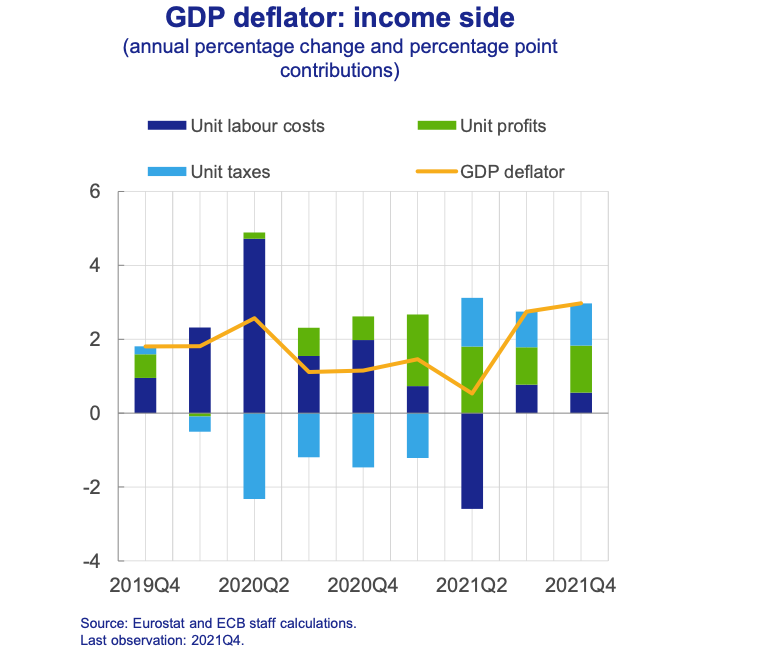

The graph below has been constructed by economists of the European Central Bank. It’s based on national accounts data. It shows that present day inflation is profit driven, not wage driven. Money flows to profits, not wages. What does this mean for monetary, fiscal and income policy, taking some other aspects of inflation into consideration? Quite a lot. High central bank interest rates have a dual purpose. First, they are intended to show that central banks are serious. Let’s call this Peacock rates: showing your feathers. This should somehow give people the idea that increasing prices is a bad, costly, unnecessary habit which, people being rational, leads people to stop raising prices. Second, they are meant to increase borrowing costs which should lead to lower investments

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The graph below has been constructed by economists of the European Central Bank. It’s based on national accounts data. It shows that present day inflation is profit driven, not wage driven. Money flows to profits, not wages. What does this mean for monetary, fiscal and income policy, taking some other aspects of inflation into consideration? Quite a lot.

High central bank interest rates have a dual purpose. First, they are intended to show that central banks are serious. Let’s call this Peacock rates: showing your feathers. This should somehow give people the idea that increasing prices is a bad, costly, unnecessary habit which, people being rational, leads people to stop raising prices. Second, they are meant to increase borrowing costs which should lead to lower investments (think: construction) and consumption (less consumer borrowing). Let’s call this: ‘taking away the soup bowl’ rates: demolishing livelihoods. For younger readers: intended pun. In the case of a wage-price spiral this should,after a considerable lag (18-36 months?) mitigate wage increases. But: there is no wage-price spiral. What’s staring us in the face is a profit-price spiral. Because of this profit-price spiral real wages are declining with, depending on the EU country, 5 to 10%. This decrease will already lead to a decline of purchases and a decline of prosperity of, especially, poor households. Considering the composition of present day inflation (high energy and food prices, high input prices for among other sectors construction) this will lead to less demand without any increase of interest rates. Inflation itself is, considering the composition of present day inflation, already . For central banks the silver lining is that profit margins are much more sensitive to changes in demand than wages – which means that business cycle related increases in profit margins will crash (if they haven’t already) and inflation will get lower on its own.

Let me be clear: I do think that present day negative rates are especially fortuitous. They have fueled asset price booms (houses!). Not good. Fiscal instead of monetary policies should have bore more of the business cycle brunt in the EU (which might include lower VAT rates (0%) on labor intensive services etc. etc.) while unemployed should be put to work and unsustainable debts should be written off. But this is not about the level of rates. It’s about the question if they have to be increased to mitigate inflation. The answer to this is clear no. A profit-prices spiral is highly sensitive to changes in demand and demand (consumption, investment, exports) is already coming down.

Meta: we know all this because of the absolutely fabulous national accounts, which measure the money economy. Just like Rosa Luxemburg did, just like Wesley Mitchell did and just like Steve Keen does, the money economy should be at the center of our analysis. And no, that’s not the entire economy, I know. But: ‘being poor’ is defined as ‘not having enough monetary income’ for a reason. Money matters. Credit matters. Money flows, like profits, matter. The total amount of money growth is not interesting. Following flows of money, however, is.