From Dean Baker Word from the grapevine is that the risk of contagion may cause the Fed or the FDIC to engineer some sort of bailout of uninsured deposits, where they get paid back in full, instead of being forced to accept a partial loss on deposits over 0k. That would be unfortunate, since the people who run these companies that have large deposits are supposed to be brilliant whizzes, who should be able to understand things like FDIC deposit insurance limits. Their incessant whining, that losing 10-20 percent of their deposits, would shut down Silicon Valley and the country’s tech sector, made for good laughs. However, the risk of a nationwide series of bank runs is a high price to pay to teach these people about the limits on deposit insurance. We know that the view of most of

Topics:

Dean Baker considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Dean Baker

Word from the grapevine is that the risk of contagion may cause the Fed or the FDIC to engineer some sort of bailout of uninsured deposits, where they get paid back in full, instead of being forced to accept a partial loss on deposits over $250k. That would be unfortunate, since the people who run these companies that have large deposits are supposed to be brilliant whizzes, who should be able to understand things like FDIC deposit insurance limits.

Their incessant whining, that losing 10-20 percent of their deposits, would shut down Silicon Valley and the country’s tech sector, made for good laughs. However, the risk of a nationwide series of bank runs is a high price to pay to teach these people about the limits on deposit insurance.

We know that the view of most of our policy elites (the politicians who make policy, their staff, and the people who write about it in major news outlets) is that the purpose of government is to make the rich richer. But, there are alternative ways to structure the financial system for people who care about fairness and efficiency.

The most obvious solution would be to have the Federal Reserve Board give every person and corporation in the country a digital bank account. The idea is that this would be a largely costless way for people to carry on their normal transactions. They could have their paychecks deposited there every two weeks or month. They could have their mortgage or rent, electric bill, credit card bill, and other bills paid directly from their accounts.

This sort of system could be operated at minimal cost, with the overwhelming majority of transactions handled electronically, requiring no human intervention. There could be modest charge for overdrafts, that would be structured to cover the cost of actually dealing with the problem, not gouging people to make big profits.

Former Fed economist (now at Dartmouth), Andy Levin, has been etching the outlines of this sort of system for a number of years. The idea would be to effectively separate out the banking system we use for carrying on transactions from the system we use for saving and financing investment.

We would have the Fed run system to carry out the vast majority of normal financial transactions, replacing the banks that we use now. However, we would continue to have investment banks, like Goldman Sachs and Morgan Stanley, that would borrow on financial markets and lend money to businesses, as well as underwriting stock and bond issues. While investment banks still require regulation to prevent abuses, we don’t have to worry about their failure shutting down the financial system.

Not only would the shift to Fed banking radically reduce the risk the financial sector poses to the economy, it would also make it hugely more efficient. We waste tens of billions of dollars every year maintaining the structure of a financial system that technology has made obsolete.

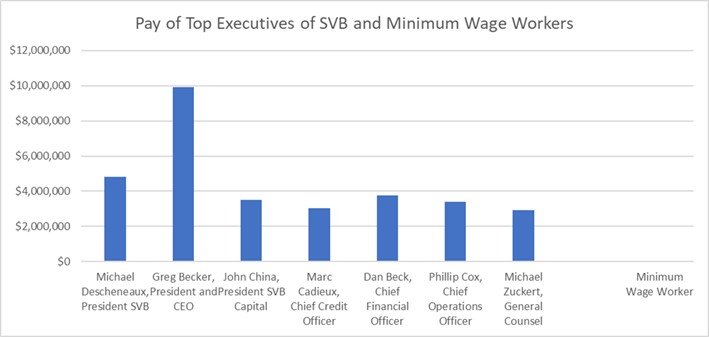

It is easy to see why this waste persists. The financial system as currently structured offers enormous rewards for people who get to the top. The Silicon Valley Bank (SVB) makes this case very clearly. The graph below shows the pay of the top seven executives at SVB alongside the pay of a minimum wage worker putting in 40 hours a week for 50 weeks. (It’s really there.)

Source: SVB and author’s calculations.

Greg Becker, the President and Chief Executive Officer, gets top pay among this group, pulling down 9,922,000 in SVB’s 2021 fiscal year (the most recent year for which I could find the data). That would be roughly 684 times what a minimum wage worker would earn for a full year’s work. (Top execs at the largest banks can earn three or four times this amount.) If we think that a worker has a 45-year working lifetime, then Mr. Becker pulls down more in a year than what a minimum wage worker would get in 15 working lifetimes. Yes, but we know the argument, how many minimum wage workers could threaten major financial upheaval, even in 15 working lifetimes?

We can go down the list, but the point should be clear. We maintain an enormously wasteful financial system because a relatively small number of people get very rich from it. And, these people use their money to lobby members of Congress to make sure no one talks about modernizing the system in a way that would take away the big bucks. (For those wondering about public sector comparisons, Fed Chair Jerome Powell gets $226,000 a year, just over 2.2 percent of Mr. Becker’s paycheck.)

And, our rich bankers have plenty of allies in the media and academic circles. Some of this is due to the fact that they can finance the voices of people who will tout their wisdom, but part of it is likely ideological bias. Plenty of neoliberal types, who will go on the warpath over a policy that helps workers or low-income people that they claim to be wasteful, can manage to completely ignore the massive waste in our financial system that is a major contributor to inequality.

Anyhow, we are not about to overturn the massive power of the rich in the financial system and the enormous network of elite opinion makers that supports them, but perhaps we can at least make the failure of SVB a teaching moment.

The rich are ripping us off big time. They are not lucky winners in a market competition due to their intelligence and hard work. They are people who have managed to rig the game to put big bucks in their pocket. That is the reality. We just have to find ways to change it. A key place to start is to stop pretending that their great wealth has anything to do with a free market.