From Blair Fix To manage inflation, governments have a simple tool at their disposal: raise wages as fast as possible.— Milton Fryman For the last few months, I’ve been diving into the economics of inflation. In this post, I’m excited to review some forgotten history. Our journey starts with a basic question: what is the key policy tool for managing the rate of inflation? According to mainstream economics, the key tool is the rate of interest. Hike this rate, economists argue, and you will cool an overheated economy, solving the problem of inflation. As you probably know, I don’t think much of this idea. (Criticism here and here.) And so I’ve been looking for alternative theories of inflation management. After months spent in the library stacks, I’m happy to report that I’ve

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

To manage inflation, governments have a simple tool at their disposal:

raise wages as fast as possible.

— Milton Fryman

For the last few months, I’ve been diving into the economics of inflation. In this post, I’m excited to review some forgotten history.

Our journey starts with a basic question: what is the key policy tool for managing the rate of inflation?

According to mainstream economics, the key tool is the rate of interest. Hike this rate, economists argue, and you will cool an overheated economy, solving the problem of inflation. As you probably know, I don’t think much of this idea. (Criticism here and here.) And so I’ve been looking for alternative theories of inflation management.

After months spent in the library stacks, I’m happy to report that I’ve discovered some lost theory. During the mid-20th century, it seems that while most economists were jumping on the interest-rate bandwagon, a few researchers went in the opposite direction. They proposed that inflation could be treated with a dose of wage hikes.

Needless to say, this alternative theory remains virtually unknown. And on its face, it seems absurd. But as I’ll show, the wage-hike approach is strongly supported by evidence. Using standard economic tools, I find that rapid wage growth tends to be followed by a drop in inflation.

The message? Policy makers should reverse course. Instead of greeting inflation with a dose of interest-rate hikes, governments should reach for the wage-rate lever. Hike wages as fast as possible, and you will surely reduce inflation.

The Swisher effect

Our dive into inflation management starts with some well-known history. The standard approach to regulating inflation was set in motion by the economist Irving Fisher.

One of the early neoclassical economists, Fisher was fascinated by the natural laws which govern returns to capital. In 1907, he discovered a key mechanism. Interest rates, Fisher showed, fluctuate with the rate of inflation. The reason for this connection, he argued, is that markets gravitate towards a constant ‘natural rate of interest’. In other words, when markets work efficiently, they preserve the earning potential of creditors. Today, we call this natural law the ‘Fisher effect’. It is a basic fact which all economics students memorize.

What economics students are not told is that the same natural law exists for wages. It’s with this omission that our host history begins.

In 1909, a Danish economist named Donald Swisher discovered a corollary to the Fisher effect. Although unaware of Fisher’s work, Swisher had a similar passion for the natural laws determining income. But unlike Fisher, Swisher studied the wage rate. Looking at data from medieval Croatia, Swisher showed that the rate of wage growth tends to rise and fall with inflation. Swisher then argued that he had discovered a natural law. When markets function effectively, they preserve the earning potential of labor power. As a consequence, competitive markets gravitate towards a natural wage rate.

In honor of Donald Swisher, I propose that we call this natural law the ‘Swisher effect’.

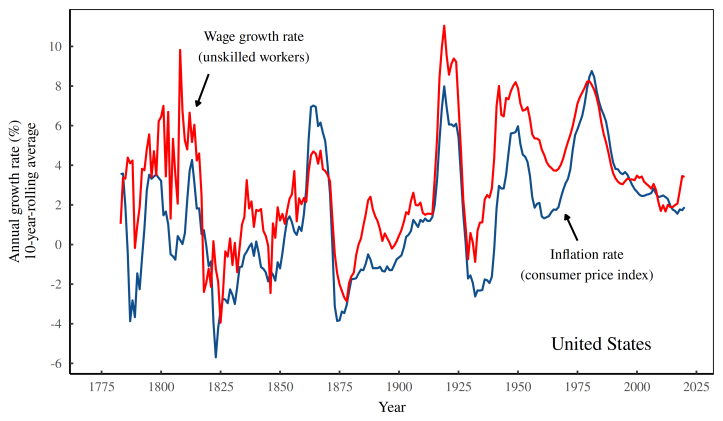

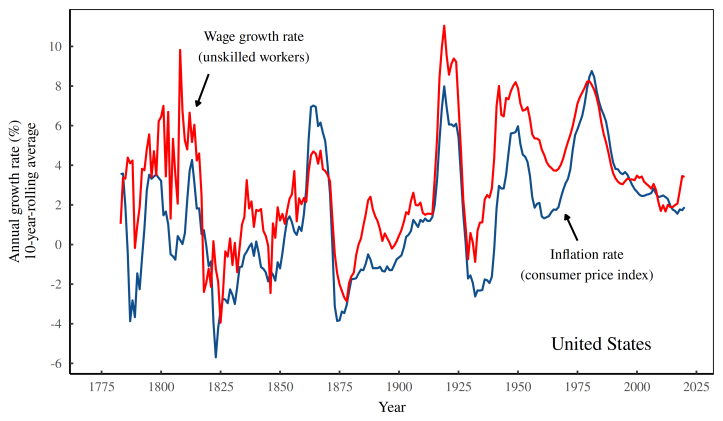

Although virtually unknown to modern economists, the Swisher effect is a remarkable regularity. Figure 1 shows the pattern in the United States. Across more than two centuries, the wage growth of unskilled workers remained tightly coupled to the rate of inflation. In short, the Swisher effect is as reliable as the laws of thermodynamics.

Considering this stunning evidence for the Swisher effect, the arc of history is perplexing. When Irving Fisher discovered the laws of capitalist income, he went on to fame and fortune. And yet when Donald Swisher discovered equivalent laws for labor income, his ideas were largely ignored. (Swisher was denied tenured and died in obscurity.)

And so we’re left to wonder … why did economists accept the idea of a ‘natural rate of interest’, while they ignored the concept of a ‘natural wage rate’?1 Although rarely discussed, it may be that economic science is not driven entirely by evidence.

The first Dr. Milton

Continuing our history, the plot thickens in the mid-20th century. It was then that Milton Friedman made waves by proclaiming that most of society’s problems could be solved by the strict regulation of the money supply. The trick was to administer the correct dose of interest-rate medicine.

Building on the work of Irving Fisher, Friedman argued that the interplay between the ‘nominal’ and ‘real’ rate of interest drove inflation expectations. Although his theoretical path was slightly torturous, Friedman concluded that central banks could regulate inflation by manipulating the rate of interest.

Now, the immediate problem for Friedman and his disciples was that evidence for monetarist theory was difficult to unearth. You see, the obvious pattern was that interest rates and inflation moved together — a sure sign of up-regulation. But the Friedmanite task was to transform the data until the correct effect revealed itself.

Undismayed by the obvious evidence, economists soon found a method that produced good results. The true effects of rate hikes revealed themselves only in the future. In other words, if you let inflation data lag interest-rate data by the appropriate amount, you observed the actual effect of monetary policy: interest rates down-regulate future inflation.

The second Dr. Milton

Now to the ‘other’ Dr. Milton. While Milton Friedman was busy creating monetarist theory, an economists named Milton Fryman was deriving an incendiary alternative.

One of the few students of Donald Swisher, Fryman was interested in the natural laws that govern wages. He wanted to know how these laws might be used to regulate inflation. Superficially, Fryman’s research was similar to Friedman’s, in the sense that he focused on the supply of money. However, Fryman took a more rigorous approach by basing his theory on the laws of thermodynamics. He called his model the ‘shoebox theory of monetary management’.

It worked as follows.

After years of field research, Fryman concluded that workers behaved differently than capitalists. In short, workers had a greater ‘marginal propensity to stash’. Capitalists, Fryman observed, put their money in ‘investments’. Crucially, these investments were then recorded on abstract accounting ledgers which were safe from the entropic decay. But workers tended to put their savings in physical containers — proverbial ‘shoeboxes’. There the forces of entropy wreaked havoc.

Each year, a significant portion of workers’ savings were misplaced, lost or destroyed. This entropic destruction, Fryman proposed, was the key to monetary management. If you wanted to reduce the money supply, you should hike wages.

Let’s lay out the reasoning. As you gave workers more cash, they would store more money in shoeboxes. There, entropy would do its work, resulting in a net destruction of money. The market would then equilibrate to the new monetary regime, causing inflation to fall. Of course, Fryman was careful to point out that the entropic delay would be ‘long and variable’. However, he was confident that the shoebox effect was real.

Fast-forward to the present. For reasons that are sadly ironic, Fryman’s theory remains virtually unknown. That’s because Fryman died while formalizing his theory. And in a testament to the effect he described, his manuscript box was lost and his path-breaking work was never published.

Fortunately, Fryman’s manuscripts were rediscovered in 2022. And so we’re now in a position to test his theory of inflation regulation.

Searching for Fryman’s shoebox effect

According to Fryman, a rise in wages should be followed by a reduction in inflation. Now, like his more conventional colleagues, Fryman had no idea what the wage-inflation lag would be. As such, Fryman recommended a proactive approach to testing his theory; simply lag the inflation data until the desired effect appears.

Following Fryman’s recommendation, I’ve adopted this robust method and applied it to the United States. I’ve determined that when we lag the inflation one year after the wage-growth data, the shoebox effect reveals itself.

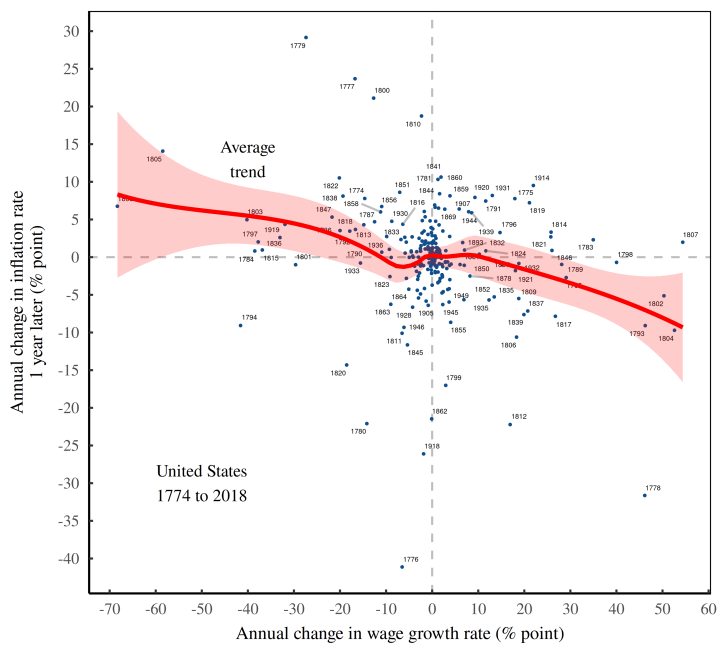

Figure 2 shows the pattern. Here, I plot the annual change in wage growth (horizontal axis) against next-year’s change in inflation (vertical axis). The resulting trend is strongly negative. When wage growth increases, inflation falls in the following year. And when wage growth declines, higher inflation soon follows. So it seems that Fryman was correct: the key to regulating inflation is the judicious dosage of wage hikes.

A puzzle

We’re now at the end of our forgotten history. Let’s summarize the story. While most economists focused on interest rates as a tool for regulating inflation, a small group of researchers studied an alternative hypothesis. To down-regulate inflation, they argued that governments should raise wages. Having rediscovered this lost theory and subjected it to a rigorous test, I find that it is strongly supported by evidence.

And yet I remain puzzled.

You see, when I show Figure 2 to my economist colleagues, they laugh in my face. ‘Wage hikes couldn’t possibly lower inflation,’ they say.

Confused by this reaction., I decided to run a little experiment. Leaving the data unchanged, I took my chart and altered the labels, substituting ‘interest rates’ for the ‘wage rate’. When I showed the revised chart to my economist friends, they leapt with excitement. The same data (which they had previously ridiculed) was now ‘stunning confirmation’ that interest rates down-regulate inflation.

Is it just me, or is this dichotomy odd? I’m beginning to suspect that economists might not weigh all types of evidence with equal rigor.

![]()

A satire unravelled

I hope you enjoyed this little satire. As you can guess, there is no Donald Swisher, nor is there a Milton Fryman. And there is certainly no ‘shoebox theory of monetary management’. These ideas were designed to be obvious bullshit. The point was to prime you into confusion; I took ideas that are absurd and then used the tools of economics to find supporting ‘evidence’.

Perhaps you recognize the trick. It’s the same sleight-of-hand used by mainstream economists when they argue that interest rates down-regulate inflation. The joke is that we can use the same trick to find ‘evidence’ for an idea that many economists would find appalling — the notion that wage hikes reduce inflation.

The reason the trick works is because it is based on a subtle (but severe) methodical flaw. Yes, faster wage growth correlates with lower inflation next year. But the key is that this correlation is not evidence for down-regulation. It’s actually a statistical artifact — a consequence of cyclical data. Let’s break it down.

Tit-for-tat cycles

To understand how the statistical trick works, let’s return to the original evidence — the tight coupling between inflation and wage growth. Figure 3 shows the data, this time without the satirical title.

The coupling of wage growth and inflation is caused by a tit-for-tat dynamic. The ‘tit’ is a jump in the rate of inflation.

On that front, don’t let language confuse you. Many people equate ‘inflation’ with a decrease in the potency of money. Forget this thinking, as it is misguided. In reality, ‘inflation’ is about prices. To calculate inflation, we take a group of commodities and measure their average change in price. Notice that prices are just the per-unit (gross) income that flows to a firms. So when inflation rises, it’s because firms are hiking their per-unit income. This is the ‘tit’. Workers respond by hiking their own ‘per-unit’ income — otherwise know as a wage. This is the ‘tat’.

Of course, it’s possible that cause and effect might be reversed, meaning wage hikes are the ‘tit’ and the rise of commodity prices is the ‘tat’. But either way, the tit-for-tat relation has all the hallmarks of up-regulation. (There is no hint of down-regulation.)

Looking at the wage-inflation coupling, let’s debunk a main theme in my economic satire. There are no ‘natural laws’ which ensure that wages remain coupled to inflation. To the extent that wages keep pace with price change, it’s because workers have the power to make it happen. The same goes for all forms of income. When inflation rears its head, everyone tries to get a raise. And so we get a generalized coupling between the rate of price change and the rate of income growth. The relation is neither surprising nor interesting.

What is interesting is that the struggle to raise prices creates winners and losers. In other words, some groups manage to raise prices faster than others. It’s here that we get to the core of economists’ trick.

When workers raise their wages in the face of price hikes, economists see blatant self interest And especially if the workers are unionized, economists argue that this self interest makes inflation worse. Economists are not wrong, But their focus is lopsided.

When economists look at capitalist income, the same reasoning gets thrown out the door. Thus, a 1961 OEEC panel concluded that when it comes to inflation, “there can be a wage-price spiral but not a profit-price spiral” (emphasis added). It’s an odd statement, given the fact that it is firms (not workers) who are directly responsible for raising prices. And never mind the fact that inflation tends to correlate with boosts to corporate income (relative to workers). These facts are inconvenient, and so best ignored.

Turning to the income of creditors, the story gets turned on its head. Sure, when workers get a rise, that makes inflation ‘worse’. But when creditors get a raise (via an interest rate hike), they’re somehow making inflation ‘better’.

Here’s where the fun begins. To drum up evidence for their claim, economists often look at lagged effects. They take interest rate changes and measure how inflation responds in the future. If they find a negative relation, it’s taken as ‘proof’ that interest rates down-regulate inflation. The joke is that we can use the same method to ‘show’ that wage growth down-regulates inflation. The economic gods must be crazy!

Clearly, economist don’t think to take their method in this direction. I wonder why? (Hint: it’s about class bias.) But before we get to the sociology of economics, let’s break down the problems with lagged analysis.

Cyclical circularity

The trick to the lagged wage-inflation effect is quite simple: you can likely find a similar effect for all types of income. The reason is as follows:

- All forms of income are coupled to inflation. Why? Because everyone struggles to preserve their earning capacity in the face of rising prices.

- Inflation is overwhelmingly cyclical. It rises, then it falls. Income growth comes along for the ride.

- Because inflation is cyclical, its past state predicts its future state.

- Owing to these cycles, income growth also predicts the future state of inflation. But that’s because income covaries with inflation (and inflation is cyclical). So the apparent prediction is actually a statistical artifact.

To make sense of this flaw in lagged analysis (as applied by economists), it helps to use a hyperbolic example. So here’s a whopper. Suppose I told you that when I go to sleep, I can predict that the dawn will come 8 hours later. Suppose I also claim that because of this prediction, it’s clear that my sleep pattern causes the dawn.

Would you believe me? I hope not. The obvious truth is that the Earth has a regular rotation, and my sleep patterns are a reaction to the resulting cycles of day and night.

In statistical terms, the issue is this: we cannot consider the ‘sleep-dawn’ effect on its own. As you know, the dawn happens to be highly cyclical. And so anything that coincides with daylight cycles will appear to ‘predict’ the dawn. But that’s because the dawn predicts itself. So if we want to test the hypothesis that sleeping causes the dawn, we need to compare the ‘sleep-dawn’ effect to the ‘dawn-dawn’ effect. Obviously the latter will win. The cycles of daylight predict themselves far better than my cycles of sleep.

The same principle holds for inflation. Because inflation is highly cyclical, its present state predicts its future state. So if we’re going to test the hypothesis that wage growth down-regulates inflation, we need to account for this self-prediction. And here we get to the fatal flaw lurking beneath my satire. Inflation has an enormous self-correlation.

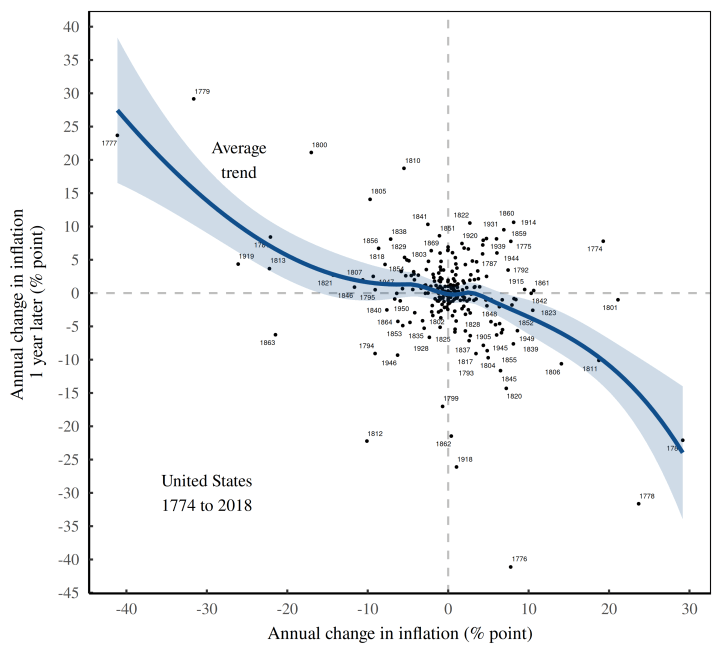

Figure 4 shows the pattern in the United States, measured over the last two centuries. Here, the horizontal axis shows the annual change in inflation. The vertical axis shows the change in inflation in the following year. The resulting trend is obvious. If inflation rises today, it tends to fall next year. And if inflation falls today, it tends to rise next year. Is this pattern magic? No. It is what happens when data is cyclical.

An effect falls apart

With self correlation in mind, let’s return to the idea that wage growth down-regulates inflation. When we account for the cyclical nature of inflation, the apparent effect falls apart.

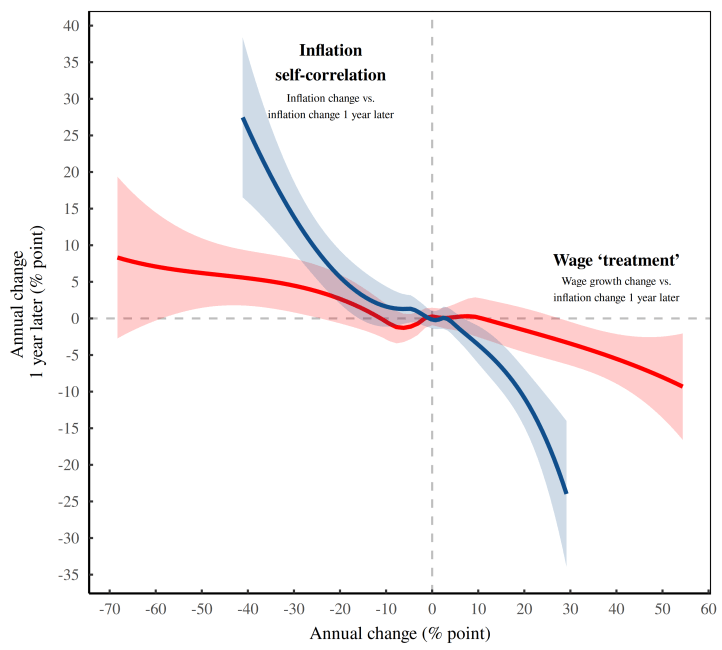

Figure 5 tells the story. Here, the red curve is the pattern between wage growth and the change in next-year’s inflation. This curve is what happens when we ‘treat’ inflation with a dose of wage hikes. Viewed in isolation, the ‘treatment’ seems to work. But that’s because we are fooling ourselves. The truth is that inflation treats itself, as shown by the blue curve. Regardless of the intervention, a rise in inflation today is proceeded by a drop next year. Importantly, this cyclical effect is far stronger than the wage effect. In other words, there is no evidence that wages down-regulate inflation.

The real joke

Back to mainstream economics and its story of inflation management. The trick to supporting dubious theory is to study lagged effects in isolation. Pick any form of income you want, and you’ll likely find that it predicts next-year’s inflation. But be sure not to mention that the apparent effect pales in comparison to inflation’s lagged effect on itself.

In this light, the question is not whether we can find a lagged effect, but why economist focused on the (apparent) effect of raising interest rates. Why not apply the same method to wages?

If you’re familiar with the history of economic thought, you’ll know the answer. The development of neoclassical economics can be read as one long apology for why capitalists deserve their income. And so when ‘well-trained’ economists apply their methods, they practice science with fine-tuned asymmetry.

See those labor unions using their bargaining power to raise wages? That’s a ‘distortion’ which makes inflation worse. But do you see those creditors doing the same thing — leveraging their power to bolster their income? That’s a ‘natural law’.

Like all good satire, the story is funny in hindsight but tragic to those who must endure it.