According to the Monetary Statistics of the European Central Bank, the credit impulse to the Euro Area economy is getting even weaker (graph 1, the yellow part of the bars). Which not only forbodes a recession but already is a recession. Graph 1. Monetary developments in the Euro Area. Source. This interpretation (the EA is in a recession) gains credibility when we realize that most of the remaining net credit is used to finance the purchase of existing houses and not to finance new investment or consumption. The blue part of the bars shows that households and companies are moving deposit money to savings accounts (with a higher interest rate), which are not included in M3 money. Net external assets are, at the moment, however increasing. What does this mean? First, we

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

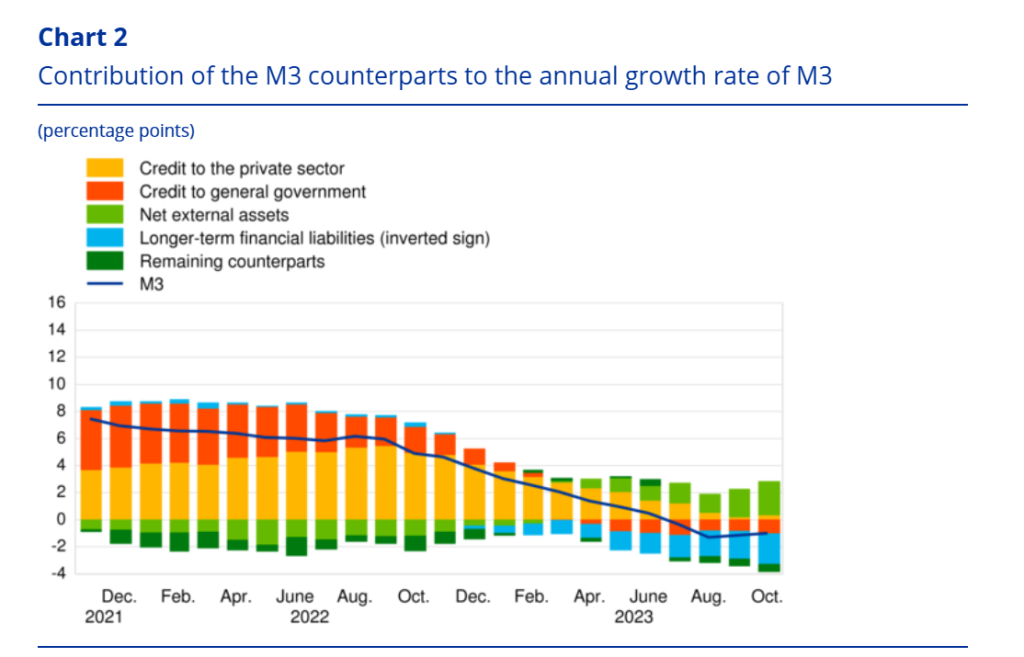

According to the Monetary Statistics of the European Central Bank, the credit impulse to the Euro Area economy is getting even weaker (graph 1, the yellow part of the bars). Which not only forbodes a recession but already is a recession.

Graph 1. Monetary developments in the Euro Area. Source.

This interpretation (the EA is in a recession) gains credibility when we realize that most of the remaining net credit is used to finance the purchase of existing houses and not to finance new investment or consumption.

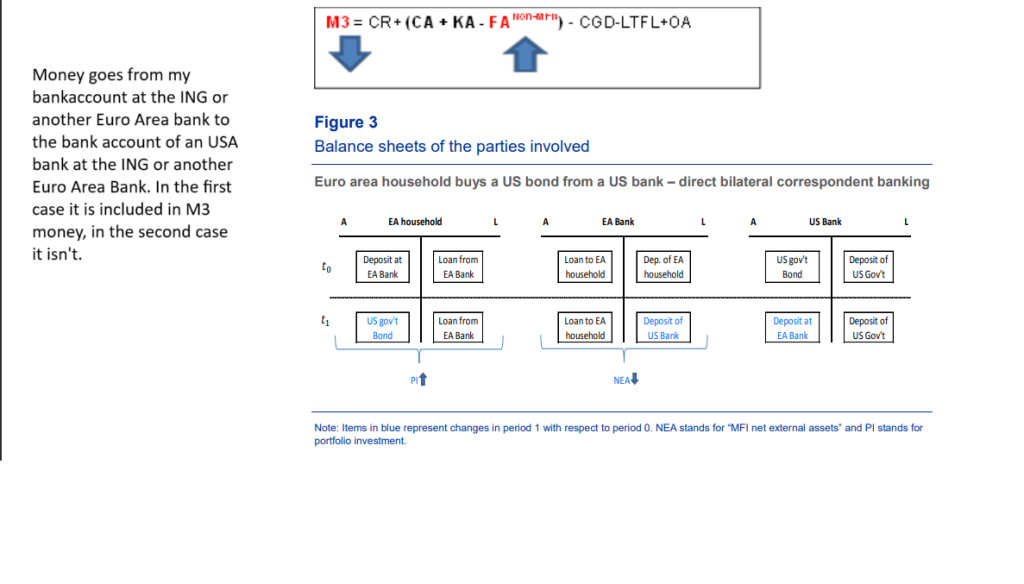

The blue part of the bars shows that households and companies are moving deposit money to savings accounts (with a higher interest rate), which are not included in M3 money. Net external assets are, at the moment, however increasing. What does this mean? First, we must answer the question: ‘What are ‘net external assets”. The answer to this question can be found in this ECB monograph which is also the source of graph 2. Net external assets are not items like UK pounds or USA dollars but items included in the M3 definition of Euro-money but owned by non-EU residents. The present increase might (!) be caused by EU residents selling US shares to US traders who pay using deposit money in their account at a European Bank. It might be caused by English tourists using a debit card to buy ice cream at an Italian beach (recommended). See graph 2.

Graph 2. ‘External assets’ are assets included in the M3 money definition but owned by non-EU companies or persons. A ‘Net external assets’ increase means that M3 items like deposit money are shifted from non-EU companies or persons to EU companies or persons (the literature uses the phrase ‘residents’ to denote both but this equates companies with persons. We’re not neoliberals so we should not do that).