Will lower central bank interest rates at this moment lead to lower consumer rates? No, they won’t. The, at this moment, low rates on existing debt will continue to increase for years on end, cutting in household spending and hampering the possibility of households to pay down their debt. Figure 1. Interest rates for new mortgage contracts, the Netherlands. At this moment, Central Banks seem to take a break when it comes to increasing their interest rates. Maybe they will even lower rates. This, however, won’t stop consumer debt interest rates from increasing. Graph 1 shows interest rates for new mortgage contracts in the Netherlands. These are, thanks to the recent and feverish increase in central bank rates, up. However… looking at households and legacy debt, rates on

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Will lower central bank interest rates at this moment lead to lower consumer rates? No, they won’t. The, at this moment, low rates on existing debt will continue to increase for years on end, cutting in household spending and hampering the possibility of households to pay down their debt.

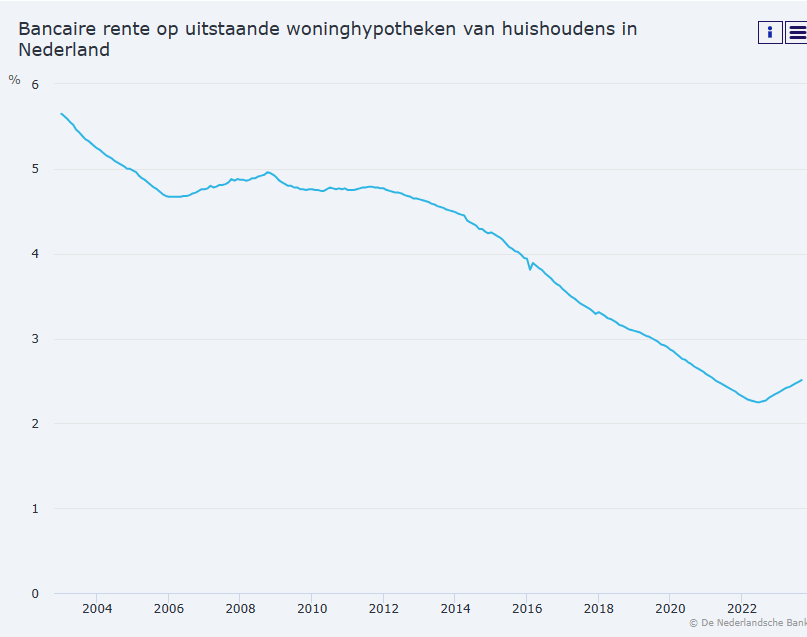

Figure 1. Interest rates for new mortgage contracts, the Netherlands.

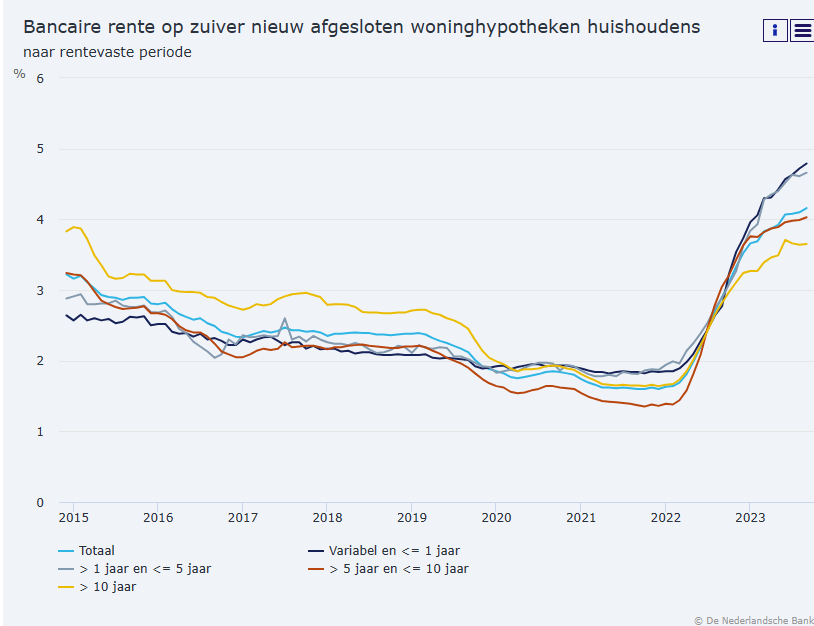

At this moment, Central Banks seem to take a break when it comes to increasing their interest rates. Maybe they will even lower rates. This, however, won’t stop consumer debt interest rates from increasing. Graph 1 shows interest rates for new mortgage contracts in the Netherlands. These are, thanks to the recent and feverish increase in central bank rates, up. However… looking at households and legacy debt, rates on existing debts are quite sticky (graph 2). Even then, average rates have started to increase and will continue to do so as long as rates for new contracts and refinancing contracts are higher than the rates on existing ones. The total mortgage debt of Dutch households is 800 billion Euro or, on average, 100.000 Euro per household or roughly 200.000 Euro per household with a mortgage) every %-point increase will mean an 8 billion drain from household income to banks. That’s around 1.000 Euro a year for the average household with a mortgage. A 3% increase is in the books. This will hamper the paying down of these debts (“Fisher dynamics“). Economic theory focuses on the relation between interest rates and new financing. It should, also, focus on the relation between interest rates and the costs of the liability side of household balance sheets. Caveat: other European households are not as indebted as Dutch ones. Also, increases and decreases in average interest rates paid should be included in the consumer price index.