From Lars Syll So in what sense is this “dynamic stochastic general equilibrium” model firmly grounded in the principles of economic theory? I do not want to be misunderstood. Friends have reminded me that much of the effort of “modern macro” goes into the incorporation of important deviations from the Panglossian assumptions that underlie the simplistic application of the Ramsey model to positive macroeconomics. Research focuses on the implications of wage and price stickiness, gaps and asymmetries of information, long-term contracts, imperfect competition, search, bargaining and other forms of strategic behavior, and so on. That is indeed so, and it is how progress is made … There has always been a purist streak in economics that wants everything to follow neatly from greed,

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

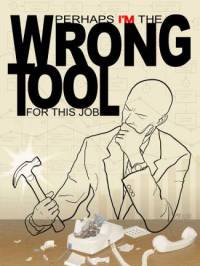

So in what sense is this “dynamic stochastic general equilibrium” model firmly grounded in the principles of economic theory? I do not want to be misunderstood. Friends have reminded me that much of the effort of “modern macro” goes into the incorporation of important deviations from the Panglossian assumptions that underlie the simplistic application of the Ramsey model to positive macroeconomics. Research focuses on the implications of wage and price stickiness, gaps and asymmetries of information, long-term contracts, imperfect competition, search, bargaining and other forms of strategic behavior, and so on. That is indeed so, and it is how progress is made …

There has always been a purist streak in economics that wants everything to follow neatly from greed, rationality, and equilibrium, with no ifs, ands, or buts. Most of us have felt that tug. Here is a theory that gives you just that, and this time “everything” means everything: macro, not micro. The theory is neat, learnable, not terribly difficult, but just technical enough to feel like “science.”

Yes, indeed, there is a “purist streak in economics that wants everything to follow neatly from greed, rationality, and equilibrium, with no ifs, ands, or buts.” That purist streak has given birth to a kind of ‘deductivist blindness’ of mainstream economics, something that also to a larger extent explains why it contributes to causing economic crises rather than to solving them. But where does this ‘deductivist blindness’ of mainstream economics come from? To answer that question we have to examine the methodology of mainstream economics.

The insistence on constructing models showing the certainty of logical entailment has been central in the development of mainstream economics. Insisting on formalistic (mathematical) modelling has more or less forced the economist to give up on realism and substitute axiomatics for real-world relevance. The price paid for the illusory rigour and precision has been monumentally high

This deductivist orientation is the main reason behind the difficulty that mainstream economics has in terms of understanding, explaining and predicting what takes place in our societies. But it has also given mainstream economics much of its discursive power – at least as long as no one starts asking tough questions on the veracity of – and justification for – the assumptions on which the deductivist foundation is erected. Asking these questions is an important ingredient in a sustained critical effort to show how nonsensical the embellishing of a smorgasbord of models founded on wanting (often hidden) methodological foundations is.

This deductivist orientation is the main reason behind the difficulty that mainstream economics has in terms of understanding, explaining and predicting what takes place in our societies. But it has also given mainstream economics much of its discursive power – at least as long as no one starts asking tough questions on the veracity of – and justification for – the assumptions on which the deductivist foundation is erected. Asking these questions is an important ingredient in a sustained critical effort to show how nonsensical the embellishing of a smorgasbord of models founded on wanting (often hidden) methodological foundations is.

The mathematical-deductivist straitjacket used in mainstream economics presupposes atomistic closed systems — i.e., something that we find very little of in the real world, a world significantly at odds with an (implicitly) assumed logic world where deductive entailment rules the roost. Ultimately then, the failings of modern mainstream economics have their roots in a deficient ontology. The kind of formal-analytical and axiomatic-deductive mathematical modelling that makes up the core of mainstream economics is hard to make compatible with a real-world ontology. It is also the reason why so many critics find mainstream economic analysis patently and utterly unrealistic and irrelevant. The empty formalism that Solow points out in his critique of ‘modern’ macroeconomics is still one of the main reasons behind the monumental failure of ‘modern’ macroeconomics.