I have been invited by the ISEPA’19 conference (organised by the Dicle University) to speak atheir conference. Since I could not make it due to other obligations I was asked for a video lecture. Its subject is ‘Economic Crisis and the crisis of Economics: Political Economy as a realistic and credible alternative’ Nikos Zappas did an excellent job in recording and editing the video. The link for watching the video is below: [embedded content] The abstract of the lecture is the following: INTERNATIONAL SYMPOSIUM ON ECONOMICS, POLITICS AND ADMINISTRATION ISEPA’19 ‘Rethinking the Economy and Politics: Current Solutions for New Problems’ 10-12 October 2019, Dicle University, Diyarbakir ‘Economic Crisis and the crisis of Economics: Political Economy as a realistic and credible

Topics:

Stavros Mavroudeas considers the following as important: crisis in Economics, economic crisis, Economics, keynesianism, Marxism, Neoclassicism, New Macroeconomic Consensus, Political Economy, profitability, Video από συνέδρια. τηλεοπτικές εκπομπές κλπ.- Videos from conferences, lectures, tv etc., Εισηγήσεις σε επιστημονικά συνέδρια - Papers in academic conferences

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

I have been invited by the ISEPA’19 conference (organised by the Dicle University) to speak atheir conference.

Since I could not make it due to other obligations I was asked for a video lecture.

Its subject is ‘Economic Crisis and the crisis of Economics: Political Economy as a realistic and credible alternative’

Nikos Zappas did an excellent job in recording and editing the video.

The link for watching the video is below:

-

The abstract of the lecture is the following:

INTERNATIONAL SYMPOSIUM ON ECONOMICS, POLITICS AND ADMINISTRATION

ISEPA’19

‘Rethinking the Economy and Politics: Current Solutions for New Problems’

10-12 October 2019, Dicle University, Diyarbakir

‘Economic Crisis and the crisis of Economics:

Political Economy as a realistic and credible alternative’

Stavros Mavroudeas

Professor of Political Economy

Panteion University

Dept. of Social Policy

e-mail: [email protected]

ABSTRACT

This video lecture focuses on the current crisis of Economics and the relevance of Political Economy as a realistic and credible alternative. The last global capitalist crisis of 2008 reopened discussions on the issue of economic crisis; an issue long forgotten by the dominant tradition within economic theory, Economics. Economics (that is the study of the economy in abstraction from social and political relations, as a ‘play’ between individuals and not between social classes) has failed, in both its Mainstream (Neoclassicism) and Heterodox (Keynesianism) versions to forecast, comprehend and confront the 2008 crisis. This is a repetition of Economics’ dismal record against almost all previous major economic crises. Its Mainstream version considers capitalism a perfect system where crises erupt only because of deformations of the ‘normal’ functioning of the market. Its Heterodox version maintains that capitalism – because of its anarchic nature – is prone to crises but the existence of an overseer (in the form of the state) can secure the avoidance of such sad episodes. Both versions have failed utterly as the crisis hit both deregulated and regulated economies. On the other hand, Political Economy – the other major tradition in economy theory – proposes a more realistic and credible understanding of the economy. The latter is not an ‘play’ between individuals but between antagonistic social classes. This class struggle within the economy has an inherent social nature and is necessarily linked with politics. Thus, Political Economy argues for a unified analysis of the economy, the society and politics. Within Political Economy the Marxist tradition argues that capitalism is a system that passes from periods of booms to periods of bust. This is the normal functioning of the system as it exhibits cyclical fluctuations (economic cycles). Thus, crises are not an aberration but a normal characteristic. Moreover, state intervention can affect the eruption and the evolution of crises but it cannot extinguish their existence. This analytical framework has greater explanatory power that Economics.

-

The main points of the talk are the following:

The subject of this video lecture is the current crisis of Economics and the relevance of Political Economy as a realistic and credible alternative to the former.

Historically, economic thought is divided between two main alternative approaches: Political Economy and Economics.

The following table summarises the fundamental differences between these approaches.

Table 1: Main alternative economic approaches

|

POLITICAL ECONOMY

|

ECONOMICS |

|

| Agents | social classes

the economy is a social ‘game’ |

individuals

the economy is a ‘game’ between individuals |

| Primary focus | production | circulation (and only that involved in market exchange |

| Analytical framework | Dual system:

(labour) values detn. prices |

Single system:

prices detn. prices |

| Analysis of the economy in relation to society and politics | in a unified framework | separately |

Economics is the study of the economy in abstraction from social and political relations, as a ‘play’ between individuals. There cannot be social groups as each individual is different from the other. However, these totally different individuals obey miraculously the same behavioural norm (minimize cost while maximizing utility).

On the contrary, Political Economy considers the economy as a social process; thus it is a ‘play’ between social classes. There is antagonisms between them (class struggle). And also they are different behavioural rules for different social classes.

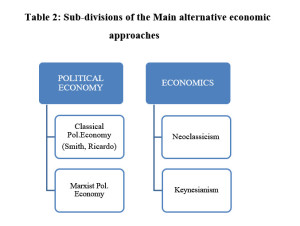

Each of the two main alternative economic approaches is sub-divided two currents, as shown in Table 2.

Table 2: Sub-divisions of the Main alternative economic approaches

Since the end of the 19th century, Economics have become the dominant approach. Thus, it constitutes the Orthodoxy or the Mainstream. Political Economy continues its existence (mainly in the form of Marxist and Radical Political Economy) but it is relegated to the ‘underworld’, excluded from the commanding heights of economic policy making.

However, because of it’s a-social nature and its unrealistic fundamental assumptions (perfect markets etc.), Economics has been scarred by internal strife. These problems are particularly evident during big and prolonged economic crises. Thus, there appears within Economics also a Heterodoxy. The latter is practically a heresy: it shares several articles of faith with the Orthodoxy but it disagrees in some others.

Since the mid-1980s economic thought and policy has been increasingly dominated by very dogmatic and conservative types of Neoclassical theory (usually branded as Neoliberalism). Rational Expectations, infatuation with mathematization without considering its realism, belief in the perfect functioning of markets are its main features. Keynesianism – the previous Orthodoxy – became a Heterodoxy.

However, Neoliberalism – because of its unrealistic assumptions – has serious problems in instructing economic policy. Thus, even before the 2008 global capitalist crisis, a new Orthodoxy was created. This is the New Macroeconomic Consensus, which is a hybrid between a mild Neoliberalism and the conservative New Keynesianism. In a nutshell, the New Macroeconomic Consensus Orthodoxy is Keynesian in the short-run (accepting the existence of frictions and disequilibria and thus the efficacy of economic policy) and Neoliberal in the long-run (believing in Rational Expectations and self-equilibrating markets).

Nevertheless, the 2008 global capitalist crisis and its aftermath tore apart the credibility of this Orthodoxy and show once again the blatant inability of Economics to understand, forecast and confront economic crises.

There is ample evidence of this failure:

New Classicals have pronounced the end of economic cycles.

On a more practical level, the IMF declared in October 2007 that “in advanced economies, economic recessions had virtually disappeared in the post-war period”.

And then there was astonishment:

Nobel Prize winner and top Chicago neoclassical economist Eugene Fama declared: “We don’t know what causes recessions. I’m not a macroeconomist, so I don’t feel bad about that. We’ve never known. Debates go on to this day about what caused the Great Depression. Economics is not very good at explaining swings in economic activity… If I could have predicted the crisis, I would have. I don’t see it. I’d love to know more what causes business cycles.”

The failure of Economics (both in their Orthodox and Heterodox versions) to comprehend the economic crisis stems from their very methodology.

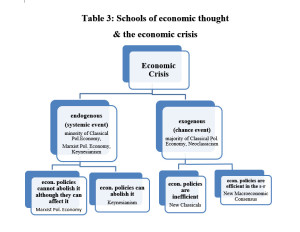

Table 3 summarises the way the main schools of economic thought approach the issue of economic crisis.

Table 3: Schools of economic thought

& the economic crisis

Essentially, Neoclassicism believes that capitalism is a perfect system (a Swiss clock) that never fails (and falls into crisis). Crises occur because some agent does not follow the normal market behaviour (hence it distorts the perfect functioning of the market). Capitalism is perfect and self-equilibrating.

Keynesianism believes that capitalism may fall into crisis (possibility theory of crisis) because its anarchic nature permits agents to function irregularly. However, a wise state supervision can either avoid crises or solve them. Capitalism is the best but it has to be saved from its own contradictions.

These approaches have failed not only in the last crisis but also in the previous ones. Their failure stems from their common foundations of Economics:

- Understanding of the economy is a ‘play’ between individuals fails to grasp its social dimension and particularly the role of class struggle. It fails also to link economic and social and political processes.

- Their belief that capitalism is the best socio-economic system leads to either ignore its fundamental deficiencies and contradictions or think that they can be rectified.

- Their emphasis on the sphere of circulation ignores that the basis of the economy is the sphere of production. Thus, both Neoclassicism and Keynesianism ignore the critical role of profitability (the rate and the mass of profit) in the capitalist economy. Consequently, they cannot discern how a falling profitability leads to economic crisis.

Contrary to both of them, Political economy proposes a more realistic and credible understanding of the economy. The latter is not an ‘play’ between individuals but between antagonistic social classes. This class struggle within the economy has an inherent social nature and is necessarily linked with politics. Thus, Political Economy argues for a unified analysis of the economy, the society and politics.

Within Political Economy the Marxist Political Economy tradition offers a very realistic, sophisticated and coherent theory of crisis. It argues that capitalism is a system that passes from periods of booms to periods of bust. This is the normal functioning of the system as it exhibits cyclical fluctuations (economic cycles). Thus, crises are not an aberration but a normal characteristic. Moreover, state intervention can affect the eruption and the evolution of crises but it cannot extinguish their existence.

The main points of the Marxian theory of crisis can be summarized as follows:

- Economic crises are part of the normal functioning of the capitalist system (that is, they have endogenous [systemic] causes).

- This implies that crises are a usual and frequent event (that is they are a systematic phenomenon).

- This does not imply that capitalism is in continuous crisis neither than that it is destined to collapse due to simply an economic Rather, that capitalism passes from periods of boom (growth) to periods of bust (recession). This succession causes the fluctuations of economic activity (economic cycles) and is expressed both in the short-run economic cycles and in the long-run ones.

- The systemic causes of crises derive from the dominant sphere of production (and are subsequently expressed in the others and not vice versus). They express the contradictions of capitalist accumulation and they operate even without the effects of class struggle (i.e. crises appear even without workers’ militancy).

- Τhe basic determinant (systemic cause) of both the shοrt-run and the long-run economic fluctuations is the profit rate (and the linked to it mass of profits). The profit motive is the aim and, hence the determining factor in the operation of the capitalist system. Therefore, its fluctuations determine both the short-run and the long-run fluctuations of the accumulation of capital (grossly expressed in the fluctuations of investment and the GDP).

- The basic rule that determines the movement of profit is the Law of the Tendency of the Rate of Profit to Fall (TRPF). It provides the central It co-exists in continuous struggle with a number of counter-acting tendencies. Their interplay causes both the long-run fluctuations (alteration between ‘golden eras’ of strong growth and deep structural crises) and the short-run fluctuations (alterations between growth and slump).

- Intra-capitalist competition takes place in view of rates of profit (each capitalist eyes his adversaries) and is crucially shaped by its firm’s technical Therefore, technical change is the main determinant of competitive advantage. This crucial role attributed to technical change differentiates Marx from both A.Smith (he considered technical change but not in relation to the rate of profit) and D.Ricardo (he did not considered technical change in relation to the rate of profit)

- The crisis is both an expression of the problems of the capitalist system and a rectification mechanism.

- Problems: the very success of the system (its overaccumulation of capital) causes its failure (the inability to continue to accumulate). Its overextension leads it to surpass its social and technical limits (in the given period).

- Rectification: a process of destruction and reconstruction. Part of the system must be destroyed (e.g. bankruptcies) in order to leave space for its

This analytical framework has greater explanatory power that Economics as the debate on the recent global crisis proved.