[unable to retrieve full-text content]by Bill McBride Calculated Risk From housing economist Tom Lawler: Based on publicly-available local realtor/MLS reports released across the country through today . . . I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.97 million in October, up 3.4% from September’s […] The post Lawler: Early Read on Existing Home Sales in October appeared first on Angry Bear.

Read More »Watch Months-of-Supply! Housing

[unable to retrieve full-text content]Watch Months-of-Supply! by Bill McBride Calculated Risk Both inventory and sales are well below pre-pandemic levels, and I think we need to keep an eye on months-of-supply to forecast price changes. Historically nominal prices declined when months-of-supply approached 6 months – and that is unlikely any time soon – however, as expected, months-of-supply is above 2019 […] The post Watch Months-of-Supply! Housing appeared first on...

Read More »What Happened To Paying Off The National Debt?

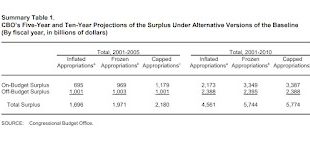

A week ago, this commentary by Bill McBride was up on Calculated Risk. A bit of history dating back to 2001. A very timely post and one which fits in with what was happening today with the National Debt. Take note of who was pushing less stringent regulation, tax cuts, etc. It will pay for itself! What Happened to “Paying off the National Debt”? (calculatedriskblog.com, Bill McBride At the turn of the millennium, the concern was that the US...

Read More »AAR: March Rail Carloads and Intermodal Decreased Year-over-year

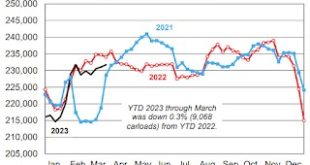

AAR: March Rail Carloads and Intermodal Decreased Year-over-year by Calculated Risk on 4/07/2023 03:25:00 PM From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission by AAR to Bill McBride. Rail volumes today are being negatively influenced by broader economic trends, including slowdowns in industrial output, high inventory levels at many retailers, lower port activity, and...

Read More »MBA: “Mortgage Delinquencies Increase in the Fourth Quarter of 2022”

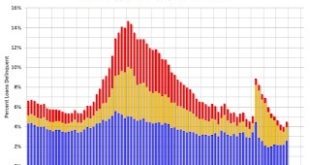

Calculated Risk: MBA: “Mortgage Delinquencies Increase in the Fourth Quarter of 2022” calculatedriskblog.com, Bill McBride by Calculated Risk on 2/16/2023 01:42:00 PM From the MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2022 The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.96 percent of all loans outstanding at the end of the fourth quarter of...

Read More » Heterodox

Heterodox