On October 13, 2019, the Bank of International Settlements published a paper – Exiting low inflation traps by “consensus”: nominal wages and price stability – (which was based on a speech one of the authors was to make in late November at a conference in Colombia). The reason I cite this paper is because it talks about Modern Monetary Theory (MMT) – in pejorative terms, without really knowing what MMT is. But the most interesting aspect of it was the admission that the mainstream theory...

Read More »J. W. Mason — “On money, debt, trust and central banking”

Some of the most interesting of that new work is from, and about, central banks. As an example, here is a remarkable speech by BIS economist Claudio Borio. I am not sure when I last saw such a high density of insight-per-word in a discussion of money and finance, let alone in a speech by a central banker. I could just say, Go read it. But instead I’m going to go through it section by section, explaining what I find interesting in it and how it connects up to a larger heterodox vision of...

Read More »Bill Mitchell— The BIS should be defunded and then dissolved

On June 24, 2018, the Bank of International Settlements (BIS) released their – Annual Economic Report 2018 – which contains their latest analysis of the global economy including the risks they think the current growth process faces. It is full of myth and like previous statements from the BIS it only serves to perpetuate the policy mentalities that caused the global financial crisis. These multilateral organisations (including the BIS, IMF, World Bank, OECD etc) have become the harbingers...

Read More »Andreas Dombret — “Basel III – Are we done now?”

On finalizing Basel III. BISAndreas Dombret: "Basel III - Are we done now?" Statement by Dr Andreas Dombret, Member of the Executive Board of the Deutsche Bundesbank, at the Institute for Law and Finance Conference on Basel III, Frankfurt am Main, 29 January 2018.

Read More »Foreign Exchange Trading and the Dollar

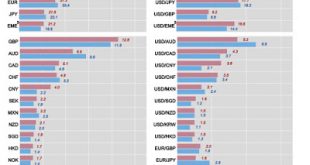

The new Bank for International Settlements (BIS) Triennial Central Bank Survey was published last month. The Foreign exchange turnover is down for the first time since they started in 1996. As the press release says: "Trading in FX markets averaged $5.1 trillion per day in April 2016. This is down from $5.4 trillion in April 2013." The figure below shows the main results. Not surprisingly the dollar remained the key vehicle currency, being on one side of around 88% of all trades, while...

Read More » Heterodox

Heterodox