[unable to retrieve full-text content]I’ve written a ‘top 10’ overview of the recent Alberta budget. My overview can be found here: https://monitormag.ca/articles/ten-things-to-know-about-the-recent-alberta-budget

Read More »The 2021 federal budget

I’ve written a ‘top 10’ overview of the recent federal budget. The link to the post is available here: https://nickfalvo.ca/ten-things-to-know-about-canadas-2021-federal-budget/ Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and is Section Editor of the Canadian Review of Social Policy/Revue canadienne de politique sociale. You can check out his...

Read More »The 2021 alberta budget

On 25 February 2021, Jason Kenney’s United Conservative Party government tabled its third budget, announcing very few major changes to either spending or taxation, while also projecting a deficit of $18.2 billion for the 2021-22 fiscal year. I’ve written an 900-word overview of the budget here. Nick Falvo is a Calgary-based research consultant with a PhD in Public Policy. He has academic affiliation at both Carleton University and Case Western Reserve University, and...

Read More »Ten considerations for the next Alberta budget

Over at the Behind The Numbers website, I’ve written a blog post titled “Ten considerations for the next Alberta budget.” The blog post is a summary of a recent workshop organized by the Alberta Alternative Budget Working Group. The link to the blog post is here. Enjoy and share:

Read More »An MMT View of the Twin Deficits Debate

Invited Presentation by L. Randall Wray at the UBS European Conference, London, Tuesday 13 November 2018 Q: These questions about deficits are usually cast as problems to be solved. You come from a different way of framing the issue, often referred to as MMT, which—at the risk of oversimplifying—says that we worry far too much about debt issuance. Can you help us understand where fears may be misplaced? Wray: First let me say that I think the twin deficits argument is based on flawed...

Read More »An Analysis of Financial Flows in the Canadian Economy

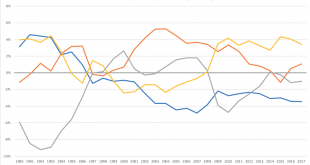

An essential but perhaps overlooked way of looking at the economy is a sector financial balance approach. Pioneered by the late UK economist Wynne Godley, this approach starts with National Accounts data (called Financial Flow Accounts) for four broad sectors of the economy: households, corporations, government and non-residents. Here’s how it works: in any given quarter or year each sector can be a net borrower or lender, but the sum of the four sectors’ borrowing/lending must equal to...

Read More »Ten things to know about the 2018 Saskatchewan budget

I’ve written a ‘top 10’ blog post about the recently-tabled Saskatchewan budget. Points raised in the blog post include the following: -This year’s budget was quite status quo. -Last year’s budget, by contrast, included a series of cuts to social spending. Last year’s budget also announced cuts to both personal and corporate income taxes that were subsequently reversed. -Saskatchewan has one of the lowest debt-to-GDP ratios in Canada. -This recent budget announced the phase out of a rent...

Read More »Alan Longbon — Good News: The CBO Reports The Federal Government Deficit Will Be Larger Than First Thought And Go On For Decades

SummaryContrary to mainstream opinion the CBO report is a positive result. The CBO finds that higher deficits will lead to higher and faster GDP growth and employment. The governement deficit is the private sector surplus and while the private sector balance remains positive and grows the likelihood of a stock market crash or recession is low. The purpose of this report is to show the finding of the latest CBO about the Federal deficit is a good thing and should be celebrated. To produce...

Read More »Five things to know about the 2018 Alberta budget

On March 22, the NDP government of Rachel Notley tabled the 2018 Alberta budget. I’ve written a blog post discussing some of the major ‘take aways’ from the standpoint of Calgary’s homeless-serving sector (where I work). Points made in the blog post include the following: this was very much a status quo budget; Alberta remains the lowest-taxed province in Canada (and still the only province without a sales tax); Alberta still has (by far) the lowest net debt-to-GDP ratio of any province;...

Read More »Ten proposals from the 2018 Alternative Federal Budget

I’ve written a blog post about this year’s Alternative Federal Budget (AFB). Points raised in the blog post include the following: -This year’s AFB would create 470,000 (full-time equivalent) jobs in its first year alone. By year 2 of the plan, 600,000 new (full-time equivalent) jobs will exist. -This year’s AFB will also bring in universal pharmacare, address involuntary part-time employment among women, eliminate tuition fees for all post-secondary students in Canada, speed up...

Read More » Heterodox

Heterodox