Thomas Palley, Louis-Philippe Rochon, Guillaume Vallet , Review of Keynesian Economics, April 2019. The Great Recession (2008/9) triggered by the financial crisis of 2008 has had considerable impact on the conduct of monetary policy. Before the recession, monetary policy was largely based on a New Consensus-type macroeconomic model and it targeted inflation via a Taylor […]

Read More »The sickening market-driven society

The sickening market-driven society The market was meant to emancipate us, offering autonomy and freedom. Instead it has delivered atomisation and loneliness. The workplace has been overwhelmed by a mad, Kafkaesque infrastructure of assessments, monitoring, measuring, surveillance and audits, centrally directed and rigidly planned, whose purpose is to reward the winners and punish the losers. It destroys autonomy, enterprise, innovation and loyalty, and...

Read More »Nobelpriset i ekonomi är nykolonialt!

Nobelpriset i ekonomi är nykolonialt! I år har priset tilldelats tre forskare verksamma vid universitet i USA, Esther Duflo, Abhijit Banerjee och Michael Kremer som har fått priset för sin forskningsmetod som kallas ”randomiserade kontrollförsök” … Men i det internationella vetenskapssamhället har det lagts fram en hel del kritik mot denna metod och årets pristagare. Exempelvis har man pekat på de etiska aspekterna när man experimenterar med människor,...

Read More »Microfoundations and economic policy choices

Microfoundations and economic policy choices Since there will generally be many micro foundations consistent with some given aggregate pattern, empirical support for an aggregate hypothesis does not constitute empirical support for any particular micro foundation … Lucas himself points out that short-term macroeconomic forecasting models work perfectly well without choice-theoretic foundations: “But if one wants to know how behaviour is likely to change...

Read More »The question no one dares to ask …

The question no one dares to ask … [embedded content] [h/t Danne Mikula]

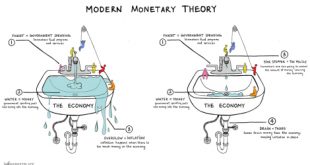

Read More »Can governments ever run out of money?

Can governments ever run out of money? Whether it’s more nurses, frozen tax promises, free broadband internet or more social housing in the UK; or tax cuts and green energy investments in America, public spending is set to surge. This sudden abandonment of fiscal rectitude comes amid the rise in prominence of a way of thinking about money, spending and the economy – Modern Monetary Theory (MMT). According to its key architect, US businessman Warren Mosler,...

Read More »Steuer auf Finanztransaktionen

[embedded content] If I may be allowed to appropriate the term speculation for the activity of forecasting the psychology of the market, and the term enterprise for the activity of forecasting the prospective yield of assets over their whole life, it is by no means always the case that speculation predominates over enterprise. As the organisation of investment markets improves, the risk of the predominance of speculation does, however, increase. Speculators may do no harm as...

Read More »IPA’s weekly links

Guest post by Jeff Mosenkis of Innovations for Poverty Action. There’s a new evaluation out of the Northern Ghana site of the famous expensive Millennium Villages project most associated with Jeff Sachs. I’m not an expert, but as I understand it, the theory is that an intensive big fix (building new institutions like hospitals and many other things at once) could fix the interdependent problems of poor areas.The thing is that Sachs insisted he knew it would work, and it didn’t need an...

Read More »Modell och verklighet i ekonomisk teori

Modell och verklighet i ekonomisk teori Ofta är tanken hos mainstreamekonomer att modeller och teorier genom »successiva approximationer« ska närma sig »sanningen« genom att inkorporera fler och fler faktorer och genom att släppa efter på de idealiserande antagandena. Detta användande av »isolering« och »successiva approximationer« som ett slags heuristisk metod är inte övertygande. För att metoden ska fungera väl krävs både att de faktorer man studerar i...

Read More »Analytical Marxism

Perhaps the most striking application of hyper-rationality occurs in Analytical Marxism, whose doctrines were outlined clearly and concisely by its leading philosopher Gerald Cohen … It is an anti-dialectical and anti-holistic attempt to ground Marxist notions in neoclassical methodology. It “believes that [neoclassical] economics is essentially sound” and consequently relies on rational choice theory, game theory, and associated neoclassical mathematical techniques to derive...

Read More » Heterodox

Heterodox